A) Occur before expense recognition.

B) Occur after revenue or expense recognition.

C) Are uncertain.

D) May be substituted for goods or services.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incurring an expense for advertising on account would be recorded by:

A) Debiting liabilities.

B) Crediting assets.

C) Debiting an expense.

D) Debiting assets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When converting an income statement from a cash basis to an accrual basis, cash received for services:

A) Exceed service revenue.

B) May exceed or be less than service revenue.

C) Is less than service revenue.

D) Equals service revenue.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Examples of internal transactions include all of the following except:

A) Writing off an uncollectible account.

B) Recording the expiration of prepaid insurance.

C) Recording unpaid wages.

D) Paying wages to company employees.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

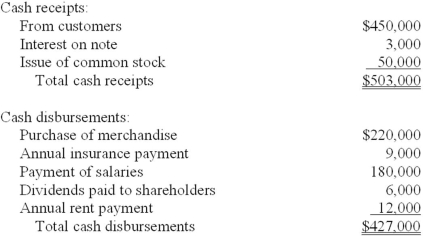

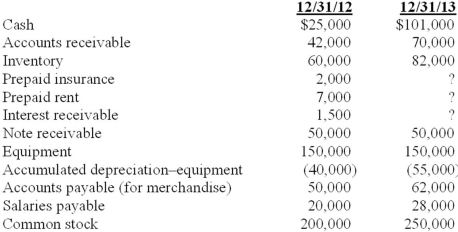

Raintree Corporation maintains its records on a cash basis. At the end of each year the company's accountant obtains the necessary information to prepare accrual basis financial statements. The following cash flows occurred during the year ended December 31, 2013:  Selected balance sheet information:

Selected balance sheet information:  Additional information:

1. On June 30, 2012, Raintree lent a customer $50,000. Interest at 6% is payable annually on each June 30. Principal is due in 2016.

2. The annual insurance payment is made in advance on March 31.

3. Annual rent on the company's facilities is paid in advance on September 30.

Required:

1. Prepare an accrual basis income statement for 2013 (ignore income taxes).

2. Determine the following balance sheet amounts on December 31, 2013:

a. Interest receivable

b. Prepaid insurance

c. Prepaid rent

Additional information:

1. On June 30, 2012, Raintree lent a customer $50,000. Interest at 6% is payable annually on each June 30. Principal is due in 2016.

2. The annual insurance payment is made in advance on March 31.

3. Annual rent on the company's facilities is paid in advance on September 30.

Required:

1. Prepare an accrual basis income statement for 2013 (ignore income taxes).

2. Determine the following balance sheet amounts on December 31, 2013:

a. Interest receivable

b. Prepaid insurance

c. Prepaid rent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Permanent accounts would not include:

A) Cost of goods sold.

B) Inventory.

C) Current liabilities.

D) Accumulated depreciation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

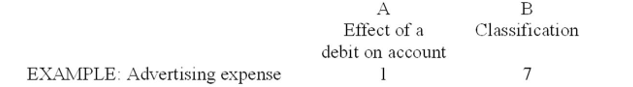

Below is a list of accounts in no particular order. Assume that all accounts have normal balances.

Required:

In column A, indicate whether a debit will:

1. Increase the account balance, or

2. Decrease the account balance.

In column B, classify each account according to the following scheme. For contra accounts, indicate the classification of the account to which it relates.

1. A current asset in the balance sheet.

2. A noncurrent asset in the balance sheet.

3. A current liability in the balance sheet.

4. A long-term liability in the balance sheet.

5. A permanent equity account in the balance sheet.

6. A revenue account in the income statement.

7. An expense account shown in the income statement.

8. Account does not appear in either the balance sheet or the income statement.

-Retained earnings

-Retained earnings

Correct Answer

verified

Correct Answer

verified

True/False

The statement of shareholders' equity discloses the changes in the temporary shareholders' equity accounts.

B) False

Correct Answer

verified

Correct Answer

verified

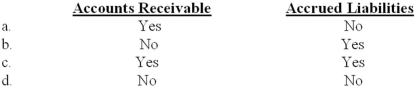

Essay

Purchased inventory on account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compared to the accrual basis of accounting, the cash basis of accounting produces a higher amount of income by the net decrease during the accounting period of:

A) Option a

B) Option b

C) Option c

D) Option d

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Sold inventory for cash.

Correct Answer

verified

Correct Answer

verified

Essay

Prepare journal entries to record the following transactions of Daisy King Ice Cream Company. If an entry is not required, state "No Entry." 1. Started business by issuing 10,000 shares of capital stock for $20,000. 2. Signed a franchise agreement to pay royalties of 5% of sales. 3. Leased a building for three years at $500 per month and paid six months' rent in advance. 4. Purchased equipment for $5,400, paying $1,000 down and signing a two-year, 10% note for the balance. 5. Purchased $1,800 of supplies on account. 6. Recorded cash sales of $800 for the first week. 7. Paid weekly wages, $320. 8. Paid for supplies purchased in item (5). 9. Paid royalties due on first week's sales. 10. Recorded depreciation on equipment, $50.

Correct Answer

verified

Correct Answer

verified

Essay

Closed the income summary account, assuming there was a net income for the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a contra account is:

A) Depreciation expense.

B) Accounts receivable.

C) Sales revenue.

D) Accumulated depreciation.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Paid rent for the next three months.

Correct Answer

verified

Correct Answer

verified

Essay

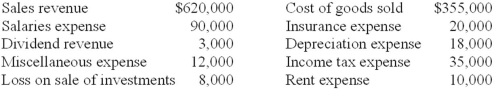

Presented below is income statement information of the Nebraska Corporation for the year ended December 31, 2013.  Required:

Prepare the necessary closing entries at December 31, 2013.

Required:

Prepare the necessary closing entries at December 31, 2013.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In its first year of operations Acme Corp. had income before tax of $400,000. Acme made income tax payments totaling $150,000 during the year and has an income tax rate of 40%. What is the balance in income tax payable at the end of the year?

A) $160,000 credit.

B) $150,000 credit.

C) $10,000 credit.

D) $10,000 debit.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The income statement summarizes the operating activity of a firm at a particular point in time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Hamada Company sales for 2013 totaled $150,000 and purchases totaled $95,000. Selected January 1, 2013, balances were: accounts receivable, $18,000; inventory, $14,000; and accounts payable, $12,000. December 31, 2013, balances were: accounts receivable, $16,000; inventory, $15,000; and accounts payable, $13,000. Net cash flows from these activities were:

A) $45,000.

B) $55,000.

C) $58,000.

D) $74,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a classified balance sheet for China Tea Company as of December 31, 2013.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 126

Related Exams