A) Those who are experts in the interpretation of financial information.

B) Those who have a reasonable understanding of business and economic activities.

C) Financial analysts.

D) CPAs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Enhancing qualitative characteristics of accounting information include each of the following except:

A) Timeliness.

B) Materiality.

C) Comparability.

D) Verifiability.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

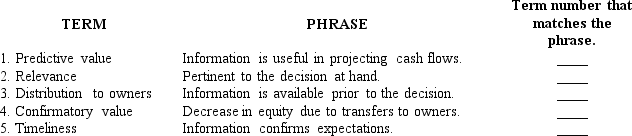

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms.Match each phrase with the correct number code for the term.

Correct Answer

verified

Correct Answer

verified

Essay

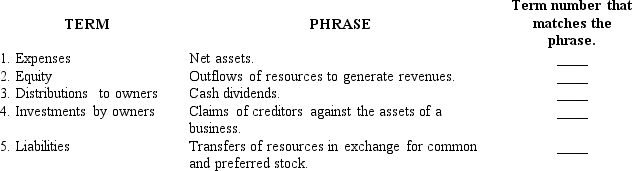

Listed below are five terms followed by a list of phrases that describe or characterize each of the terms.Match each phrase with the correct number code for the term.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Porite Company recognizes revenue in the period in which it records an asset for the related account receivable,rather than in the period in which the account receivable is collected in cash.Porite's practice is an example of:

A) Cash basis accounting.

B) Accrual accounting.

C) The matching principle.

D) Economic entity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under IFRS,the role of the conceptual framework:

A) Primarily involves guiding standard setters to make sure that standards are consistent with each other.

B) Includes serving as a guide for practitioners when a specific standard does not apply.

C) Is less important than in U.S.GAAP.

D) Has resulted primarily from a convergence with U.S.GAAP.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most recent example of the political process at work in standard-setting is the heated debate that occurred on the issue of:

A) Pension plan accounting.

B) Accounting for postretirement benefits other than pensions.

C) Accounting for business combinations.

D) Accounting for stock-based compensation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Land was acquired in 2016 for a future building site at a cost of $40,000.The assessed valuation for tax purposes is $27,000,a qualified appraiser placed its value at $48,000,and a recent firm offer for the land was for a cash payment of $46,000.The land should be reported in the financial statements at:

A) $40,000.

B) $27,000.

C) $46,000.

D) $48,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The FASB is currently the public-sector organization responsible for setting accounting standards in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gains or losses result,respectively,from the disposition of business assets for greater than,or less than,their book values.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Compute net income for the first year for Tri Fecta.

Correct Answer

verified

Correct Answer

verified

True/False

Revenues are inflows or other enhancements of assets or settlements of liabilities from activities that constitute the entity's ongoing operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Public Reform and Investor Protection Act of 2002 (Sarbanes-Oxley)changed the entity responsible for setting auditing standards in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Equity is a residual amount representing the owner's interest in the assets of the business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The FASB issues accounting standards in the form of:

A) Accounting Research Bulletins.

B) Accounting Standards Updates.

C) Financial Accounting Standards.

D) Financial Technical Bulletins.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an identified valuation technique in GAAP regarding fair value measurement?

A) Cost approach.

B) Market approach.

C) Cost-benefit approach.

D) Income approach.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Change in equity from nonowner sources is:

A) Comprehensive income.

B) Revenues.

C) Expenses.

D) Gains and losses.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue should not be recognized until:

A) The seller has transferred goods or services to a customer.

B) Contracts have been signed and payment has been received.

C) Work has been performed and customer has been billed.

D) Collection has been made and warrantees have expired.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Determining fair value by calculating the present value of future cash flows is a level 1 type of input.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Surefeet Corporation changed its inventory valuation method.Which characteristic is jeopardized by this change?

A) Comparability.

B) Representational faithfulness.

C) Consistency.

D) Feedback value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 144

Related Exams