A) Revenue and Expense

B) Cash and Revenue

C) Cash and Expense

D) Cash and Dividends

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Santa Fe Company was started on January 1,Year 1,when it acquired $9,000 cash by issuing common stock.During Year 1,the company earned cash revenues of $4,500,paid cash expenses of $3,750,and paid a cash dividend of $250.Which of the following is true based on this information?

A) The December 31,Year 1 balance sheet would show total equity of $8,750.

B) The Year 1 income statement would show net income of $500.

C) The Year 1 statement of cash flows would show net cash inflow from operating activities of $4,500.

D) The Year 1 statement of cash flows would show a net cash inflow from financing activities of $8,750.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities are obligations of a business to relinquish assets,provide services,or accept other obligations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

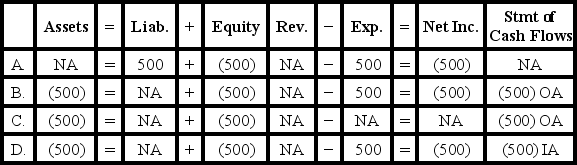

Jackson Company paid $500 cash for salary expenses.Which of the following accurately reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hazeltine Company issued common stock for $200,000 cash.What happened as a result of this event?

A) Assets increased.

B) Equity increased.

C) Claims increased.

D) Assets,claims,and equity all increased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Li Company paid cash to purchase land.What happened as a result of this business event?

A) Total assets decreased.

B) Total assets were unaffected.

C) Total equity decreased.

D) Both assets and total equity decreased.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An asset source transaction increases a business's assets and the claims to assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below. Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $40,000 2) borrowed $25,000 from its bank 3) provided consulting services for $39,000 4) paid back $15,000 of the bank loan 5) paid rent expense for $9,000 6) purchased equipment costing $12,000 7) paid $3,000 dividends to stockholders 8) paid employees' salaries, $21,000 -What is Yowell's ending notes payable balance?

A) $0

B) $25,000

C) ($15,000)

D) $10,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of Year 2,retained earnings for the Baker Company was $3,500.Revenue earned by the company in Year 2 was $1,500,expenses paid during the period were $800,and dividends paid during the period were $500.Based on this information alone,what was the amount of retained earnings at the beginning of Year 2?

A) $3,300

B) $3,700

C) $2,800

D) $3,800

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

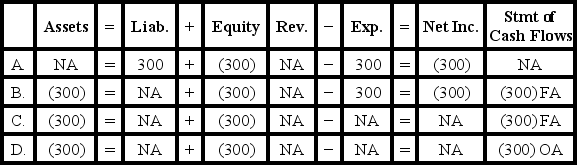

Perez Company paid a $300 cash dividend.Which of the following accurately reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The value created by a business is created by its assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Algonquin Company reported assets of $50,000,liabilities of $22,000 and common stock of $15,000.Based on this information only,what is the amount of the company's retained earnings?

A) $7,000.

B) $57,000.

C) $13,000.

D) $87,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following financial statements provides information about a company as of a specific point in time?

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Statement of changes in stockholders' equity

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below. Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $40,000 2) borrowed $25,000 from its bank 3) provided consulting services for $39,000 4) paid back $15,000 of the bank loan 5) paid rent expense for $9,000 6) purchased equipment costing $12,000 7) paid $3,000 dividends to stockholders 8) paid employees' salaries, $21,000 -What is Yowell's net income?

A) $9,000

B) $30,000

C) $18,000

D) $6,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

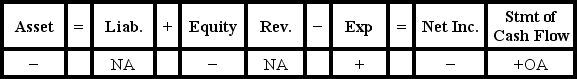

Delta Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

A) Paid a cash dividend

B) Incurred a cash expense

C) Borrowed money from a bank

D) Earned cash revenue

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of revenue?

A) Cash received as a result of a bank loan

B) Cash received from investors from the sale of common stock

C) Cash received from customers at the time services were provided

D) Cash received from the sale of land for its original selling price

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mayberry Company paid $30,000 cash to purchase land.What happened as a result of this business event?

A) Total equity was not affected.

B) The net cash flow from investing activities decreased.

C) Total assets were not affected.

D) Total assets and total equity were not affected,and net cash flow from investing activities decreased.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a (are) permanent account(s) ?

A) The Retained Earnings account

B) All income statement accounts

C) The Dividend account

D) All balance sheet accounts and the Dividends account

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which financial statement matches asset increases from operating a business with asset decreases from operating the business?

A) Balance sheet

B) Statement of changes in equity

C) Income statement

D) Statement of cash flows

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Turner Company reported assets of $20,000 (including cash of $9,000) ,liabilities of $8,000,common stock of $7,000,and retained earnings of $5,000.Based on this information,what can be concluded?

A) 25% of Turner's assets are the result of prior earnings.

B) $5,000 is the maximum dividend that can be paid to shareholders.

C) 40% of Turner's assets are the result of borrowing from creditors.

D) 25% of Turner's assets are from prior earnings,$5,000 is the maximum possible dividend,and 40% of assets are the result of borrowed resources.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 94

Related Exams