A) Recording interest that has been earned but will not be collected until the next accounting period.

B) Recording operating expenses that have been incurred but not paid as of the end of the accounting period.

C) Recording salary expense that has been incurred but not paid as of the end of the accounting period.

D) Recording insurance expense relating to insurance premiums that were paid in advance.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in an expense may be accompanied by a decrease in a liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recognition of revenue may be accompanied by which of the following?

A) A decrease in a liability

B) An increase in a liability

C) An increase in an asset

D) An increase in an asset or a decrease in a liability

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company provides services to clients but has not yet collected any cash,how should that transaction be classified?

A) Claims exchange transaction

B) Asset use transaction

C) Asset source transaction

D) Asset exchange transaction

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Accounts that are closed include expenses,dividends,and unearned revenues.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue on account amounted to $9,000.Cash collections of accounts receivable amounted to $8,100.Cash paid for operating expenses was $7,500.The amount of employee salaries accrued at the end of the year was $900.What was the net cash flow from operating activities?

A) $900

B) $600

C) $1,500

D) $8,700

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If retained earnings decreased during the year,and no dividends were paid,which of the following statements must be true?

A) Expenses for the year exceeded revenues.

B) The company did not have enough cash to pay its expenses.

C) Total equity decreased.

D) Liabilities increased during the year.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

After the closing process,all income statement accounts have balances that carry forward into the next accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After closing,what is the balance of the Retained Earnings account on December 31,Year 1?

A) $5,900

B) $7,200

C) $3,900

D) $4,900

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duluth Co.collected a $6,000 cash advance from a customer on November 1,Year 1 for services to be provided over a six-month period beginning on that date.If the year-end adjustment is properly recorded,what will be the effect of the adjusting entry on Duluth's Year 1 financial statements?

A) Increase assets and decrease liabilities

B) Increase assets and increase revenues

C) Decrease liabilities and increase revenues

D) No effect

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1,Year 1,Jason Company paid $7,200 to lease office space for one year beginning immediately.What is the amount of rent expense that will be reported on the Year 1 income statement and what is the cash outflow for rent that would be reported on the Year 1 statement of cash flows?

A) $7,200;$7,200

B) $1,800;$1,800

C) $1,800;$7,200

D) $1,200;$7,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

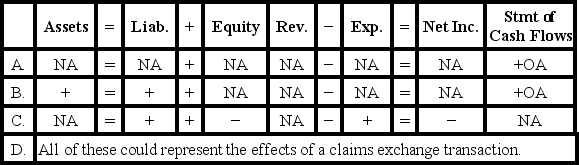

Multiple Choice

Which of the following describes the effects of a claims exchange transaction on a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The term "recognition" means to report an economic event in the financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Nelson Company experienced the following transactions during Year 1, its first year in operation. Acquired $12,000 cash by issuing common stock Provided $4,600 of services on account Paid $3,200 cash for operating expenses Collected $3,800 of cash from customers in partial settlement of its accounts receivable Paid a $200 cash dividend to stockholders -What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,400

B) $12,600

C) $13,400

D) $13,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a principle of the AICPA Code of Professional Conduct?

A) Due Care

B) Objectivity and Independence

C) Integrity

D) Internal Controls

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correctly states the proper order of the steps in the accounting cycle?

A) Record transactions,adjust accounts,close temporary accounts,prepare statements.

B) Adjust accounts,record transactions,close temporary accounts,prepare statements.

C) Record transactions,adjust accounts,prepare statements,close temporary accounts.

D) Adjust accounts,prepare statements,record transactions,close temporary accounts.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Companies that use accrual accounting recognize revenues and expenses at the time that cash is received or paid,respectively.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe the policies and procedures that are designed to reduce the opportunities for fraud?

A) Internal controls

B) Asset source transactions

C) Accounting standards

D) Financial systems

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider how each of the transactions listed below affect net income reported on the income statement and the net cash flows from operating activities reported on the statement of cash flows.Which transaction(s) would affect the income statement in a different period from the statement of cash flows?

A) Recognized depreciation expense on equipment.

B) Incurred operating expenses on account.

C) Paid interest that was accrued in a prior year.

D) All of these answer choices would affect the income statement in a different period from the statement of cash flows.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue on account amounted to $5,000.Cash collections of accounts receivable amounted to $2,300.Expenses for the period were $2,100.The company paid dividends of $450.What was net income for the period?

A) $1,200

B) $2,900

C) $2,850

D) $2,450

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 92

Related Exams