A) Accrual of salary expense at year-end.

B) Purchase of equipment for cash.

C) Payments of cash dividends to the owners of the business.

D) Cash paid for interest on a note payable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An adjusting entry that decreases unearned revenue and increases service revenue is a claims exchange transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

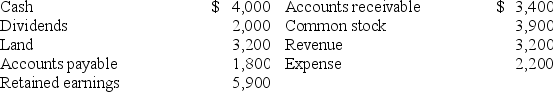

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31,Year 1:

-What is the amount of net income that will be reported on the Year 1 income statement?

-What is the amount of net income that will be reported on the Year 1 income statement?

A) $2,200

B) $3,200

C) $1,000

D) $200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the adjusting entry to recognize the portion of the unearned revenue that a company earned during the accounting period affect the elements of the financial statements?

A) An increase in assets and a decrease in liabilities.

B) An increase in liabilities and a decrease in equity.

C) A decrease in liabilities and an increase in equity.

D) A decrease in assets and a decrease in liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to recognize depreciation expense incurred on equipment involves which of the following?

A) A decrease in assets

B) An increase in liabilities

C) An increase in assets

D) A decrease in liabilities

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recognizing an expense may be accompanied by which of the following?

A) An increase in liabilities

B) A decrease in liabilities

C) A decrease in revenue

D) An increase in assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events involves a deferral?

A) Recording interest that has been earned but not received.

B) Recording revenue that has been earned but not yet collected in cash.

C) Recording supplies that have been purchased with cash but not yet used.

D) Recording salaries owed to employees at the end of the year that will be paid during the following year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Alabama Company purchased a machine for $26,000.The machine has an estimated useful life of 4 years and an estimated salvage value of $6,000.What is the book value of the machine reported on Alabama's balance sheet as of December 31,Year 1?

A) $26,000

B) $19,500

C) $21,000

D) $15,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Two of the steps in the accounting cycle are adjusting the accounts and closing the accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an element of the fraud triangle?

A) Reliance

B) Rationalization

C) Opportunity

D) Pressure

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Recognition of depreciation expense on equipment decreases the equipment account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Enterprises began operations during Year 1.The company had the following events during Year 1: The business issued $40,000 of common stock to its stockholders. The business purchased land for $24,000 cash. Services were provided to customers for $32,000 cash. Services were provided to customers for $10,000 on account. The company borrowed $32,000 from the bank. Operating expenses of $24,000 were incurred and paid in cash. Salary expense of $1,600 was accrued. A dividend of $8,000 was paid to the stockholders of Warren Enterprises. After closing,what is the balance of the Retained Earnings account as of December 31,Year 1?

A) $10,000

B) $8,400

C) $16,400

D) $42,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

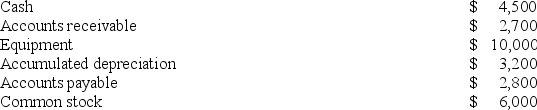

The following accounts and balances were drawn from the records of Barnes Company:

Based on this information alone the amount of Barnes's retained earnings is:

Based on this information alone the amount of Barnes's retained earnings is:

A) $11,600.

B) $17,200.

C) $5,200.

D) None of these answers is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A payment to an employee in settlement of salaries payable decreases an asset and decreases equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an asset use transaction?

A) Purchased machine for cash.

B) Recorded insurance expense at the end of the period.

C) Invested cash in an interest earning account.

D) Accrued salary expense at the end of the period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a claims exchange transaction?

A) Recognized revenue earned on a contract where the cash had been collected at an earlier date.

B) Issued common stock.

C) Invested cash in an interest earning account.

D) Purchased machine for cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the common elements that are typically present when fraud occurs?

A) The capacity to rationalize

B) The existence of pressure leading to an incentive

C) The assistance of others

D) The presence of an opportunity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Sarbanes-Oxley Act includes several significant reforms that affect the auditing profession,but it did not reduce an audit firm's ability to provide non-audit services to its audit clients.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accrual accounting usually fails to match expenses with revenues.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What action did the U.S.Congress take because of the audit failures at Enron,WorldCom and other companies?

A) Required publicly-traded companies to be audited by a government agency

B) Passed the Sarbanes-Oxley Act

C) Required companies to begin preparing an additional financial statement

D) Passed an amendment to the Securities and Exchange Act

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 92

Related Exams