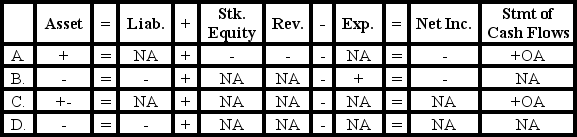

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

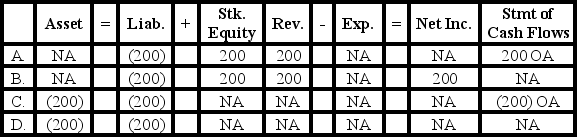

Foote Company was granted a purchase discount of $200 on merchandise the company had purchased a few days ago.Foote uses the perpetual inventory system.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which factor has removed most of the practical limitations associated with use of the perpetual inventory system?

A) A more honest work force

B) Recent changes in GAAP

C) Recent changes in federal and state laws

D) Advancements in technology

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following retailers would be expected to have the highest gross margin percentage?

A) Kmart

B) Neiman Marcus

C) Walmart

D) A supermarket chain such as Safeway

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following account titles is normally used in a periodic inventory system?

A) Transportation-in.

B) Purchases.

C) Purchase Returns and Allowances.

D) All of these answer choices are normally used.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

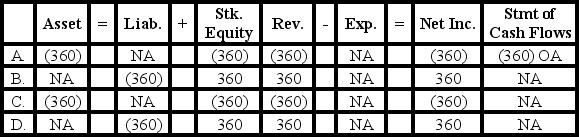

Howell Company granted a sales allowance of $360 to a customer who was not totally satisfied with the quality of goods received.The customer did not return the goods and had not yet paid for them.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is not a product cost?

A) Freight cost on goods delivered FOB destination to customers

B) Cost of merchandise purchased for resale

C) Transportation cost on merchandise purchased from suppliers

D) All of these answer choices are product costs

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glen Company uses the perpetual inventory system. The company entered into the following events: 1) Purchased merchandise inventory that cost $10,000 under terms of 2/10, n/30. 2) Made payment to the supplier within the discount period. 3) Sold all of the goods to customers on account for $22,000. What is Glen's cost of goods sold as a result of these three transactions?

A) $9,000

B) $9,800

C) $10,000

D) $21,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

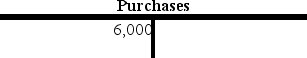

The following T-accounts are from the ledger of Hill Company.Hill uses the periodic inventory system.

Which of the following is true about Hill Company?

Which of the following is true about Hill Company?

A) When merchandise is sold,the Purchases account will be credited for cost of goods sold.

B) The accounts indicate that Hill returned $6,000 of merchandise to a supplier.

C) The balance in the purchases account will appear on the balance sheet at year end.

D) The T-accounts indicate that Hill purchased inventory on account.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the net income percentage calculated?

A) Net Sales divided by net Income

B) Net Income divided by net Sales

C) Total stockholders' equity divided by net sales

D) Net Income divided by Gross Margin

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

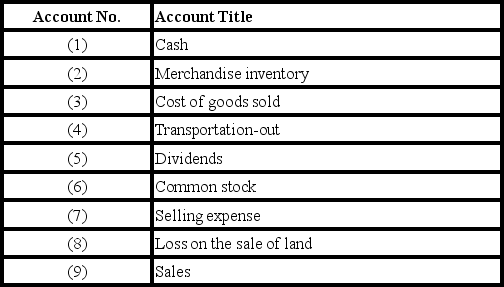

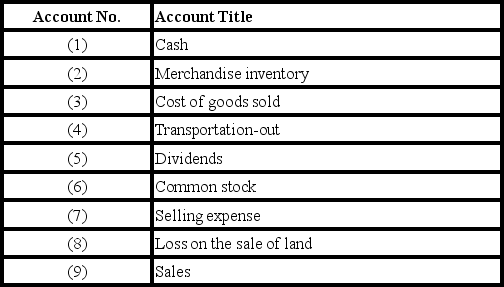

A company's chart of accounts includes,in part,the following account numbers and corresponding account titles:

-Which accounts would affect gross margin?

-Which accounts would affect gross margin?

A) Account numbers 2 and 9

B) Account numbers 3 and 9

C) Account numbers 3,4,7,and 9

D) Account numbers 3,7,8,and 9

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

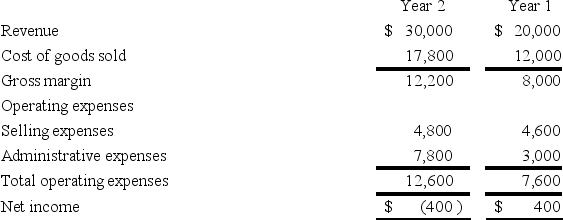

The following are the income statements of the Hancock Company for two consecutive years.Increases in which of the expenses contributed to the net loss in Year 2?

A) Cost of goods sold and selling expenses

B) Selling expenses and administrative expenses

C) Cost of goods sold and administrative expenses

D) Administrative expenses

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jake Co.purchased on account merchandise with a list price of $90,000.Payment terms were 1/15,n/45.If collection occurs within 18 days,what discount will Jake Co.recognize on the merchandise?

A) $13,500

B) $900

C) $500

D) $0

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A common size income statement is prepared by dividing all amounts on the statement by net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company recognizes cost of goods sold,how does that event impact the elements of the financial statements? (Ignore the effects of recognizing sales revenue. )

A) Assets increase.

B) Liabilities increase.

C) Stockholder's equity decreases.

D) Dividends decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's chart of accounts includes,in part,the following account numbers and corresponding account titles:

-Which accounts would appear on the income statement?

-Which accounts would appear on the income statement?

A) Account numbers 3,4,7,8,and 9

B) Account numbers 3,4,5,7,and 9

C) Account numbers 2,3,7,8,and 9

D) Account numbers 3,5,7,and 8

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system. 1) The company purchased $12,500 of merchandise on account under terms 2/10, n/30. 2) The company returned $1,200 of merchandise to the supplier before payment was made. 3) The liability was paid within the discount period. 4) All of the merchandise purchased was sold for $18,800 cash. -What is the gross margin that results from these four transactions?

A) $5,100

B) $7,726

C) $6,550

D) $11,074

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the purpose of a common size financial statement?

A) Compare the amount of common stock to other types of stock

B) Make comparisons between firms of different sizes

C) Make comparisons between different time periods

D) Make comparisons between firms of different sizes and between different time periods

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do the credit terms,2/15,n/30 mean?

A) A fifteen percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) A two percent discount can be deducted for a period up to thirty days following the date of sale.

C) A two percent discount can be deducted if the invoice is paid before the fifteenth day following the date of the sale.

D) A two percent discount can be deducted if the invoice is paid after the fifteenth day following the sale,but before the thirtieth day.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

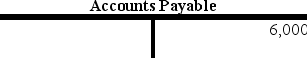

Ramirez Company returns merchandise previously purchased on account.It had not yet been paid for.Ramirez uses the perpetual inventory system.Which of the following reflects the effects on the financial statements of only the purchase return?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 114

Related Exams