A) Overstatement of cost of goods sold

B) Overstatement of total assets

C) Understatement of net income

D) Understatement of retained earnings

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Co.had beginning inventory of $400 and ending inventory of $600.Taylor Co.had cost of goods sold amounting to $1,800.What is the amount of inventory that was purchased during the period?

A) $1,600

B) $2,800

C) $2,000

D) $2,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when a company is operating in an inflationary environment?

A) The company's net income will be higher if it uses LIFO than if it uses FIFO.

B) The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C) The company's net income will be the same regardless of whether LIFO or FIFO is used.

D) The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zinke Company understated its ending inventory at the end of Year 1.Which of the following correctly states the effect of the error on the amounts shown on the Year 1 financial statements?

A) Overstatement of total assets and cost of goods sold.

B) Overstatement of cost of goods sold and retained earnings.

C) Understatement of liabilities and retained earnings.

D) Understatement of total assets and gross margin.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

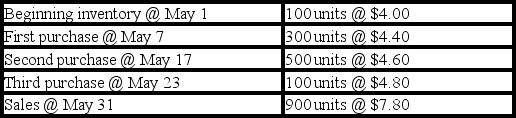

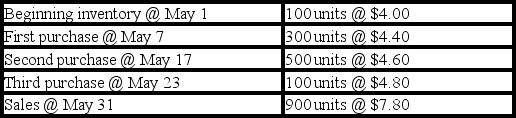

The inventory records for Radford Co.reflected the following:

-What is the amount of cost of goods sold assuming the LIFO cost flow method?

-What is the amount of cost of goods sold assuming the LIFO cost flow method?

A) $4,100

B) $4,320

C) $2,360

D) $3,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inventory records for Radford Co.reflected the following:

-What is the amount of ending inventory assuming the FIFO cost flow method?

-What is the amount of ending inventory assuming the FIFO cost flow method?

A) $480

B) $440

C) $400

D) $940

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The last-in,first-out cost flow method assigns the cost of the items purchased first to ending inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles do not allow the cost flow pattern for merchandise inventory to differ from the physical flow of merchandise within the business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

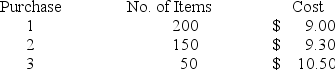

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each.During the period,the company purchased inventory items as follows:

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under weighted-average (rounded) ?

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under weighted-average (rounded) ?

A) $2,361

B) $2,340

C) $1,980

D) $1,998

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phipps Corporation overstated its ending inventory on December 31,Year 1.Which of the following correctly identifies the effect of the error on Year 2 financial statements?

A) Cost of goods sold is overstated.

B) Gross margin overstated.

C) Ending inventory is understated.

D) Net income is overstated.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is meant by "market" in the lower-of-cost-or-market rule?

A) The amount of gross margin earned by selling merchandise.

B) The amount the goods were sold for during the period.

C) The amount that would have to be paid to replace the merchandise.

D) The amount originally paid for the merchandise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barker Company paid cash to purchase two identical inventory items.The first purchase cost $18.00 cash and the second cost $20.00 cash.Barker sold one inventory item for $30.00 cash.Based on this information alone,without considering the effect of income taxes,which of the following statements is correct?

A) Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B) Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C) Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D) The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the replacement cost of inventory is greater than its historical cost,the increase in value does not affect the company's financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost flow method chosen by a company will impact its inventory turnover ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods of applying the lower-of-cost-or-market rule will result in the fewest number of inventory write-downs?

A) Each individual inventory item

B) Average of cost of goods sold for the past three years

C) Major classes or categories of inventory

D) The entire stock of inventory in the aggregate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that longer inventory holding periods act to increase expenses,which of the three companies would be expected to have the lowest inventory holding costs?

A) All three companies have equal holding costs

B) Company X

C) Company Y

D) Company Z

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct regarding the importance of inventory turnover to a company's profitability?

A) Companies will prefer to have a low inventory turnover rather than a high inventory turnover.

B) It is sometimes more desirable to sell a large amount of merchandise with a small amount of gross margin than a small amount of merchandise with a large amount of gross margin.

C) A company's profitability is affected by how rapidly inventory sells.

D) A company's profitability is affected by the spread between cost and selling price.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which inventory costing method will produce an amount for cost of goods sold that is closest to current market value?

A) Weighted average

B) Specific identification

C) LIFO

D) FIFO

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a time of declining prices,which inventory cost flow method will result in the highest ending inventory?

A) Weighted-average

B) FIFO

C) LIFO

D) Either weighted-average or FIFO

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 86

Related Exams