B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

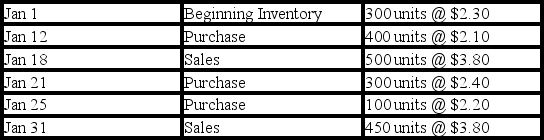

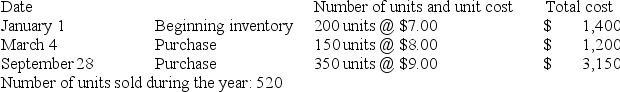

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a FIFO cost flow method,what is the cost of goods sold for the sales transaction on January 31?

-Assuming Chase uses a FIFO cost flow method,what is the cost of goods sold for the sales transaction on January 31?

A) $1,020

B) $1,005

C) $1,045

D) $340

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the gross margin method to estimate inventory,which of the following is a step in the computation?

A) Add the amount goods available for sale to estimated cost of goods sold

B) Add estimated gross margin to sales

C) Subtract estimated goods available for sale from beginning inventory

D) Subtract estimated cost of goods sold from the amount of goods available for sale

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

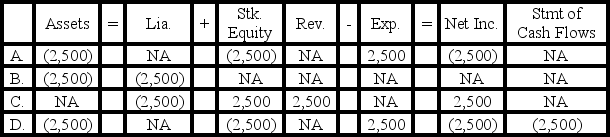

Nelson Corporation is required to record an inventory write-down of $2,500 as a result of using the lower-of-cost-or-market rule.Which of the following shows how this entry would affect the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

West Corporation's Year 1 ending inventory was overstated by $20,000;however,ending inventory for Year 2 was correct.Which of the following statements is correct?

A) Net income for Year 1 is understated.

B) Retained earnings at the end of Year 2 is overstated.

C) Cost of goods sold for Year 1 is overstated.

D) Cost of goods sold for Year 2 is overstated.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vargas Company uses the perpetual inventory system and the FIFO cost flow method.During the current year,Vargas purchased 400 units of inventory that cost $15.00 each.At a later date during the year,the company purchased an additional 800 units of inventory that cost $18.00 each.Vargas sold 500 units of inventory for $27.00.What is the amount of cost of goods sold that will appear on the current year's income statement?

A) $7,800

B) $6,000

C) $4,500

D) $5,700

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The gross margin method of estimating inventory is not useful in detecting inventory fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Misty Mountain Outfitters is a merchandiser of specialized fly fishing gear.Its cost of goods sold for Year 2 was $295,000,and sales were $690,000.The amount of merchandise on hand was $50,000,and total assets amounted to $585,000.What is the average number of days to sell inventory? (Round to the nearest day. )

A) 26 days

B) 62 days

C) 31 days

D) 40 days

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

International Financial Reporting Standards (IFRS)do not permit the use of the LIFO inventory cost flow method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During a period of rising inventory prices,a company's cost of goods sold would be higher using the LIFO cost flow method than with FIFO.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

During a period of rising inventory prices the LIFO cost flow method will result in higher total assets than FIFO.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Warner Company purchased two units of a product for $36 and later purchased one more for $40.If the company uses the weighted average cost flow method,and it sold one unit of the product for $60,its gross margin would be $22.00.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a period of rising inventory prices,use of the FIFO cost flow method would cause a company to pay more income taxes than would use of LIFO.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

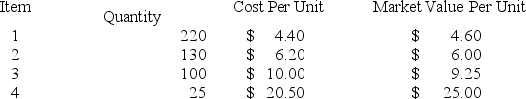

Rowan Company has four different categories of inventory.The quantity,cost,and market value for each of the inventory categories are as follows:

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

A) Increase total assets and stockholders' equity by $55.50.

B) Decrease total assets and stockholders' equity by $101.00.

C) Decrease total assets and stockholders' equity by $79.00.

D) Have no effect on total assets or stockholders' equity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

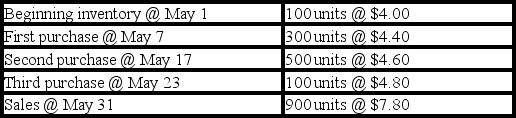

The inventory records for Radford Co.reflected the following:

-If the company uses the weighted-average inventory cost flow method,what is the average cost per unit (rounded) for May?

-If the company uses the weighted-average inventory cost flow method,what is the average cost per unit (rounded) for May?

A) $4.45

B) $4.50

C) $5.12

D) $6.34

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles restrict or limit a company's freedom to change inventory cost flow methods from one year to the next.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When prices are rising,which method of inventory,if any,will result in the lowest relative net cash outflow (including the effects of taxes,if any) ?

A) LIFO

B) FIFO

C) Weighted average

D) None of these;the choice of inventory methods does not affect cash flows.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Singleton Company's perpetual inventory records included the following information:

-If Singleton uses the LIFO cost flow method,its ending inventory would be $1,260.

-If Singleton uses the LIFO cost flow method,its ending inventory would be $1,260.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A discount merchandiser is likely to have a higher inventory turnover than more upscale stores with higher merchandise prices.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poole Company purchased two identical inventory items.One of the items,purchased in January,cost $4.50.The other,purchased in February,cost $4.75.One of the items was sold in March at a selling price of $7.50.Poole uses LIFO.Which of the following statements is true?

A) The balance in ending inventory would be $4.75.

B) The amount of gross margin would be $2.75.

C) The amount of ending inventory would be $4.625.

D) The amount of cost of goods sold would be $4.50.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 86

Related Exams