A) Amortization

B) Depreciation

C) Depletion

D) Revision

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. -Assume that Harding uses the units-of-production method when depreciating its equipment.Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has a salvage value of $34,000.Harding produced 265,000 units with the equipment by the end of the first year of purchase.Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A) $193,450

B) $125,200

C) $157,145

D) $165,890

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is used to describe long-term assets that have no physical substance and provide rights,privileges and special opportunities to businesses?

A) Tangible assets

B) Intangible assets

C) Natural resources

D) Property,plant and equipment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Ballard company purchased a machine for $52,000.On January 1,Year 2,the company spent $12,000 to improve its quality.The machine had a $4,000 salvage value and a 6-year life,which are unchanged.Ballard uses the straight-line method.What is the book value of the machine on December 31,Year 4?

A) $24,800

B) $20,800

C) $10,400

D) $24,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be classified as property,plant and equipment?

A) Computers

B) Buildings

C) Land

D) Office furniture

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On January 1, Year 1, Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years.

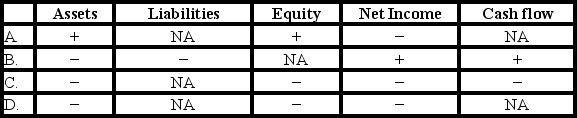

-Which of the following correctly shows the effect of the first year's amortization of Vanguard's copyright?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. -Which of the following correctly shows the effect of the first year's amortization of Vanguard's copyright? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d71_5869_a2a1_27bb85f5cdda_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Goodwill is the value attributable to good employee morale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chubb Company paid cash to purchase equipment on January 1,Year 1.Select the answer that shows how the recognition of depreciation expense in Year 2 would affect assets,liabilities,equity,net income,and cash flows.

A) option A

B) option B

C) option C

D) option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dinkins Company purchased a truck that cost $46,000.The company expected to drive the truck 100,000 miles over its 5-year useful life,and the truck had an estimated salvage value of $8,000.If the truck is driven 26,000 miles in the current accounting period,what would be the amount of depreciation expense for the year?

A) $11,960

B) $9,880

C) $9,200

D) $7,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jing Company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. -Assuming the company uses the double-declining-balance depreciation method,what are the amounts of depreciation expense and accumulated depreciation,respectively,that would be reported in the financial statements prepared as of December 31,Year 3?

A) $0 and $24,000

B) $960 and $12,000

C) $8,640 and $23,040

D) $5,184 and $28,224

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The depreciable cost of a long-term asset is the difference between the amount paid for the asset and its salvage value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anchor Company purchased a manufacturing machine with a list price of $160,000 and received a 2% cash discount on the purchase.The machine was delivered under terms FOB shipping point,and transportation costs amounted to $2,400.Anchor paid $3,000 to have the machine installed and tested.Insurance costs to protect the asset from fire and theft amounted to $3,600 for the first year of operations.What is the cost of the machine?

A) $156,800

B) $159,200

C) $165,800

D) $162,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For Year 1,the Oscar Company records depreciation expense of $12,000 on its income statement and $9,000 of MACRS depreciation on its tax return.Which of the following answers is correct regarding the difference between the two figures?

A) Net income is understated by $3,000 on the Year 1 income statement.

B) Deferred taxes of $3,000 are subtracted from taxable income of Year 1.

C) The difference in depreciation expense is caused by differences between GAAP and the tax code.

D) The amount of depreciation recorded on the income tax return must be incorrect.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Title search and transfer document costs incurred to purchase a building are expensed in the period the building is acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would most likely not be expensed using the straight-line method?

A) A copyright

B) A building

C) A timber reserve

D) A patent

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets include patents,copyrights,and franchises.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardwick Company purchased a truck that cost $53,000.The company expected to drive the truck 200,000 miles over its 5-year useful life,and the truck had an estimated salvage value of $3,000.If the truck is driven 30,000 miles in the current accounting period,what would be the amount of depreciation expense for the year?

A) $7,500

B) $10,000

C) $10,600

D) $12,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Stiller Company paid $80,000 to obtain a patent.Stiller expected to use the patent for 5 years before it became technologically obsolete.The remaining legal life of the patent was 8 years.Based on this information,what is the amount of amortization expense during Year 3 and the book value of the patent as of December 31,Year 3,respectively?

A) $10,000 and $30,000

B) $16,000 and $48,000

C) $10,000 and $50,000

D) $16,000 and $32,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When depreciation is recorded on equipment,Depreciation Expense is debited and Equipment is credited.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be the main determinant for selection of the allocation method for long-term operational assets?

A) The method that is most convenient to compute.

B) The method that best matches the pattern of asset use.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 110

Related Exams