A) Net income for the period

B) The change in the cash account balance between the beginning and ending of the period

C) The ending cash balance

D) The amount of cash inflow for the period

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,Laredo Company purchased equipment making a down payment of $15,500 cash and signing a one-year note payable on the $22,500 balance.The note carried an interest rate of 6%,and all interest was to be paid on the maturity date.Which of the following correctly shows the combined effect of the purchase as well as the accrual of interest on December 31,Year 1? Cash Flows Net Income Operating Investing Financing

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Companies report significant noncash investing and financing activities on a schedule that accompanies the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The final or bottom line on the statement of cash flows is the net increase or decrease in cash for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items would be classified as a cash flow from investing activities? 1) Issue common stock for cash 2) Payment on principal of note payable 3) Payment of dividends 4) Sale of equipment for cash

A) 1 and 4

B) 4 only

C) 3 only

D) 1,2,3,and 4

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How are cash receipts from interest on a note receivable classified on a statement of cash flows prepared using the direct method?

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash financing and investing activity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of revenue a company recognizes on the income statement normally differs from the amount of cash collected from customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Colgate Corporation decided to switch from the direct method to the indirect method of preparing the statement of cash flows.Assuming a positive net income figure but a decrease in the cash balance,what can be said about the change in method of preparing the statement?

A) The direct method will yield a larger amount for cash flows from operating activities.

B) The only difference will be in the cash flows from financing activities section.

C) The indirect method will yield a larger amount for cash flows from operating activities.

D) There will be no difference in the totals on the statement of cash flows.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which section of the statement of cash flows is prepared using either the direct or indirect method?

A) Operating activities

B) Investing activities

C) Financing activities

D) All of these answer choices are correct

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On the statement of cash flows,cash receipts from interest and dividends are classified as investing activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an incorrect statement of one of the rules for converting net income to the cash flow from operating activities using the indirect method?

A) Increases in current assets are subtracted from net income.

B) Decreases in current assets are added to net income.

C) Gains are added to net income.

D) Increases in current liabilities are added to net income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Rapid growth of a company can cause it to be short of cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be presented in the financing section of the statement of cash flows?

A) Purchased a new office building by issuing a note payable

B) Purchased treasury stock

C) Repayment of long-term bonds payable

D) Issuing of preferred stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On August 1, Year 1, Jackson Company issued a one-year $80,000 face value interest-bearing note with a stated interest rate of 9% to Galaxy Bank. Jackson accrues interest expense on December 31, Year 1, its calendar year-end. -What is the cash flow from financing activities that will be reported during the year ending December 31,Year 1?

A) $0

B) $80,000 inflow

C) $83,000 inflow

D) ($87,200) outflow

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be a cash flow from financing activities?

A) Borrowing on a long-term note payable

B) Repayment of principal on bonds payable

C) Payment of interest on bonds payable

D) Payment of a cash dividend

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

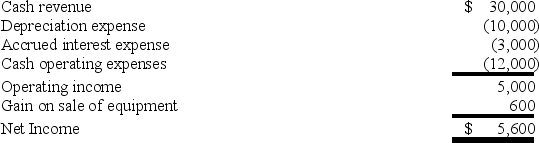

The following income statement was drawn from the annual report of Newtown Company:

What is the net cash flow from operating activities?

What is the net cash flow from operating activities?

A) $18,000

B) $18,600

C) $13,000

D) $14,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Gregg Co.reported wages expense of $160,000 during Year 2,wages payable of $16,000 at the end of Year 1,and wages payable of $22,000 at the end of Year 2.What amount of cash was paid for wages during Year 2?

A) $176,000

B) $160,000

C) $154,000

D) $144,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions affects cash flows?

A) Accrual of interest receivable

B) Issuance of a stock dividend

C) Recognition of depreciation expense

D) Payment of dividends declared in a previous year

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If cash from operating activities was $48,000,cash used for investing activities was ($88,000) and the net change in cash was $96,000,what was cash from/used for financing activities?

A) ($144,000)

B) $48,000

C) $136,000

D) $96,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the indirect method,which of the following items would be added to net income to determine the cash flow from operating activities?

A) Gain on the sale of equipment

B) Depreciation expense

C) Accrued interest receivable

D) Decrease in the balance of accounts payable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 88

Related Exams