A) Attributes of the users

B) Purpose for which the information will be used

C) Process by which the information is analyzed

D) All of these answers are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio measures the percentage of a company's assets that are financed by debt?

A) Debt to assets ratio

B) Asset turnover

C) Debt to equity

D) Return on investment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2 Gant paid $3,600 on accounts payable.Which of the following statements is not true?

A) Gant's quick ratio will increase and its current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will remain the same.

D) Gant's current ratio will increase.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In vertical analysis,each item is expressed as a percentage of:

A) Total expenses on the income statement.

B) Net income on the income statement.

C) Sales on the income statement.

D) None of these answers is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

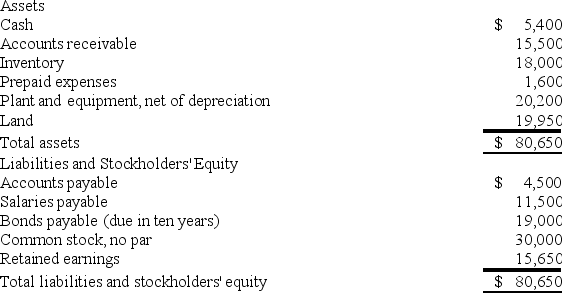

The following balance sheet information is provided for Apex Company for Year 2:

What is the company's working capital?

What is the company's working capital?

A) $24,500

B) $20,300

C) $4,900

D) $22,900

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2,Gant paid $250 for transportation-in cost on merchandise it had received.Which of the following statements is not true?

A) Gant's current ratio will remain the same.

B) Gant's quick ratio will increase.

C) Gant's working capital will remain the same.

D) Gant's quick ratio will decrease and its current ratio will remain the same.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two ratios that provide insight on the relationship between credit sales and receivables are:

A) Current ratio and inventory turnover ratio.

B) Accounts receivable turnover and average days to collect receivables.

C) Average days to collect receivables and asset turnover.

D) Accounts receivable turnover and current ratio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The drawback of studying absolute amounts reported in financial statements is the problem of differing materiality levels.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An analysis procedure that uses percentages to compare each of the parts of an individual statement to a key dollar amount from the financial statements is:

A) Ratio analysis.

B) Contribution analysis.

C) Horizontal analysis.

D) Vertical analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A vertical analysis uses percentages to compare each of the parts of an individual statement to a key statement figure.For example,on an income statement each item would be shown as a percentage of net sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in the computation of the quick ratio?

A) Cash

B) Prepaid expenses

C) Accounts receivable

D) Marketable securities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The quick ratio although similar to the current ratio is more conservative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long-term creditors are usually most interested in evaluating:

A) Liquidity.

B) Managerial effectiveness.

C) Solvency.

D) Profitability.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common methods of financial statement analysis include all of the following except:

A) Incremental analysis.

B) Horizontal analysis.

C) Vertical analysis.

D) Ratio analysis.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crestar Company reported net income of $112,000 on 20,000 average outstanding common shares.Preferred dividends total $12,000.On the most recent trading day,the preferred shares sold at $50 and the common shares sold at $95.What is this company's current price-earnings ratio?

A) 19

B) 17

C) 20

D) None of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study of an individual item or account over several periods in the same financial year or over many years is known as:

A) Liquidity analysis

B) Ratio analysis

C) Vertical analysis

D) Horizontal analysis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial statements is not true?

A) The net margin ratio is a profitability ratio.

B) The current ratio is a liquidity ratio.

C) The debt-to-assets ratio is a liquidity ratio.

D) The dividend yield is a stock market ratio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

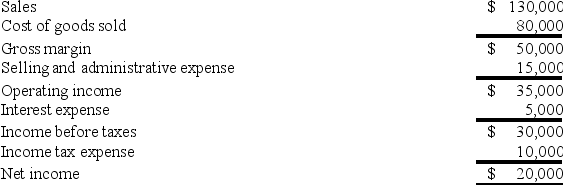

The Fortune Company reported the following income for Year 2:

What is the company's number of times interest is earned ratio?

What is the company's number of times interest is earned ratio?

A) 7 times

B) 6 times

C) 4 times

D) None of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the analysis of absolute amounts of various accounts reported on the financial statements is not true?

A) Financial statement users with expertise in particular industries can look at absolute amounts and assess a company's performance in a certain area.

B) To correctly evaluate an absolute amount,the analyst must consider its relative importance.

C) Economic statistics such as the gross national product are built upon totals of absolute amounts reported by businesses.

D) Using absolute amounts eliminates the problem of varying materiality levels.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 1,Gant Corporation had a current ratio of 1.29,quick ratio of 1.05,and working capital of $18,000.The company uses a perpetual inventory system and sells merchandise for more than it cost.On January 1,Year 2,Gant purchased merchandise on account for $4,000.Which of the following statements is true?

A) Gant's current ratio will decrease.

B) Gant's quick ratio will increase.

C) Gant's working capital will increase.

D) Gant's quick ratio will increase and its current ratio will decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 108

Related Exams