A) 3.32 times

B) 1.67 times

C) 1.66 times

D) 1.70 times

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The drawback of studying absolute amounts reported in financial statements is the problem of differing materiality levels.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Factor(s) involved in communicating useful information is (are) :

A) Attributes of the users.

B) Purpose for which the information will be used.

C) Process by which the information is analyzed.

D) All of these answers are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Financial ratio analysis is a form of horizontal analysis in that comparisons are made between different accounts in the same set of financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In vertical analysis, each item is expressed as a percentage of:

A) Total expenses on the income statement.

B) Net income on the income statement.

C) Sales on the income statement.

D) None of these answers is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in IBM stock and wish to assess the firm's long-term debt-paying ability and its use of debt financing. All of the following ratios can be used to assess solvency except:

A) Number of times interest is earned.

B) Debt to assets ratio.

C) Debt to equity ratio.

D) Net margin.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding horizontal analysis is incorrect?

A) Percentage analysis involves establishing the relationship of one amount to another.

B) A horizontal analysis of cost of goods sold on the income statement includes dividing net income by total revenue.

C) Percentage analysis attempts to eliminate the materiality problem of comparing firms of different sizes.

D) In doing horizontal analysis, an account is expressed as a percentage of the previous balance of the same account.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two ratios that provide insight on the relationship between credit sales and receivables are:

A) Current ratio and inventory turnover ratio.

B) Accounts receivable turnover and average days to collect receivables.

C) Average days to collect receivables and asset turnover.

D) Accounts receivable turnover and current ratio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

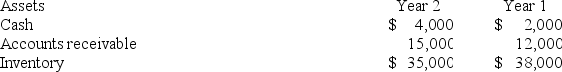

The following balance sheet information was provided by Western Company:  Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 net credit sales totaled $270,000, what were the company's average days to collect receivables? (Use 365 days in a year. Do not round intermediate calculations.)

A) 18.25 days

B) 47.31 days

C) 16.22 days

D) 20.28 days

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

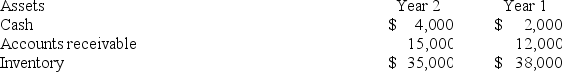

The following balance sheet information is provided for Patton Company:  Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)

Assuming Year 2 cost of goods sold is $730,000, what are the company's average days to sell inventory? (Use 365 days in a year. Do not round intermediate calculations.)

A) 17.5 days

B) 18.25 days

C) 19 days

D) 20.86 days

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the return on equity (ROE) measure is incorrect?

A) ROE is used to measure the profitability of the firm in relation to the amount invested by stockholders.

B) ROE equals net income divided by average total stockholders' equity.

C) ROE is affected by a company's use of leverage.

D) A company's ROE is lower than its return on investment because ROE does not consider that part of the business that is financed by debt.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are considered to be measures of a company's short-term debt-paying ability except:

A) Current ratio.

B) Earnings per share.

C) Inventory turnover.

D) Average collection period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income divided by sales is the formula for which of these analytical measures?

A) Return on assets

B) Return on equity

C) Earnings per share

D) Net margin

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is one of the most common measures of solvency.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis is also known as:

A) Liquidity analysis.

B) Trend analysis.

C) Revenue analysis.

D) Variance analysis.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Darden Company has cash of $40,000, accounts receivable of $60,000, inventory of $32,000, and equipment of $100,000. Assuming current liabilities of $48,000, this company's working capital is:

A) $12,000.

B) $52,000.

C) $144,000.

D) $84,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

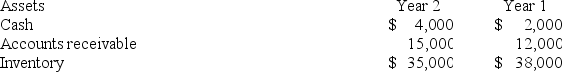

The following balance sheet information is provided for Gaynor Company:  Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

Assuming Year 2 cost of goods sold is $153,300, what is the company's inventory turnover?

A) 4.0 times

B) 4.4 times

C) 4.2 times

D) None of these answers is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in Apple stock and wish to assess the firm's short-term debt-paying ability. All of the following ratios are used to assess liquidity except:

A) Debt to equity ratio.

B) Inventory turnover.

C) Quick ratio.

D) Accounts receivable turnover.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant paid $250 for transportation cost on merchandise it had received. Which of the following statements is incorrect?

A) Grove's current ratio will remain the same

B) Grove's quick ratio will increase

C) Grove's working capital will remain the same

D) Grove's quick ratio will increase and its current ratio will remain the same.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31, Year 1, Gant Corporation had a current ratio of 1.29, quick ratio of 1.05, and working capital of $18,000. The company uses a perpetual inventory system and sells merchandise for more than it cost. On January 1, Year 2, Gant collected $5,200 of accounts receivable. As a result of this transaction, Gant's working capital will:

A) Increase.

B) Decrease.

C) Remain the same.

D) Cannot be determined.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 108

Related Exams