A) $1,400

B) $800

C) $1,000

D) $1,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accrual accounting usually fails to match expenses with revenues.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary difference between notes payable and accounts payable is that notes payable generally have longer terms and usually require interest charges.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

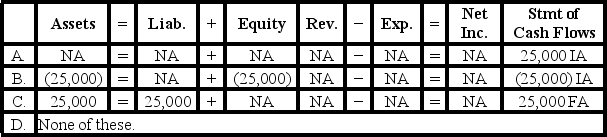

Zimmerman Company sold land for $25,000 cash.The original cost of the land was $25,000.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements regarding preparing financial statements is true or false.

Correct Answer

Multiple Choice

During Year 3,Fancy Foods Incorporated earned $54,000 of revenue on account.The beginning balance in accounts receivable was $5,000,and the ending balance was $10,000.Also,Fancy Foods Incorporated started the year with a beginning balance in accounts payable of $5,000.Fancy Foods' ending balance in account payable was $4,000.The company incurred $12,000 of operating expenses on account.Determine the amount of cash paid to settle accounts payable.

A) $13,000

B) $24,000

C) $96,000

D) $156,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chester Company began Year 2 with a note payable of $20,000 and interest payable of $800.During the year,the company accrued an additional $400 of interest expense,and paid off the note with interest.On the company's Year 2 statement of cash flows,cash flows for financing activities related to the note would be:

A) $1,200 outflow

B) $20,000 outflow

C) $20,400 outflow

D) $21,200 outflow

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe the policies and procedures that are designed to reduce the opportunities for fraud?

A) Internal controls

B) Asset source transactions

C) Accounting standards

D) Financial systems

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Some claims exchange transactions increase liabilities and decrease stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -The amount of Carolina's retained earnings on December 31,Year 1 was: A) $5,900 B) $7,200 C) $3,900 D) $4,900](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -The amount of Carolina's retained earnings on December 31,Year 1 was:

-The amount of Carolina's retained earnings on December 31,Year 1 was:

A) $5,900

B) $7,200

C) $3,900

D) $4,900

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

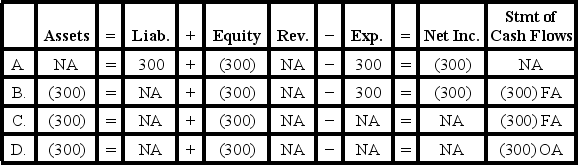

Perez Company paid a $300 cash dividend.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

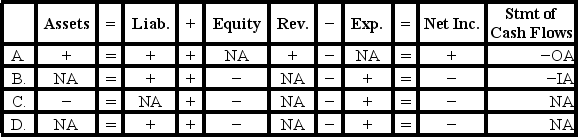

Multiple Choice

Janzen Company recorded employee salaries earned but not yet paid.Which of the following represents the effect of this transaction on the horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Issuing a note is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rushmore Company provided services for $45,000 cash during Year 1.Rushmore incurred $36,000 of operating expenses on account during Year 1,and by the end of the year,$9,000 of that amount had been paid with cash.If these are the only accounting events that affected Rushmore during Year 1,which of the following statements is true?

A) The amount of net loss shown on the income statement is $9,000.

B) The amount of net income shown on the income statement is $27,000.

C) The amount of net income shown on the income statement is $9,000.

D) The amount of net cash flow from operating activities shown on the statement of cash flows is $18,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in the "cash flow from operating activities" section of the statement of cash flows?

A) Accrual of salary expense at year-end.

B) Purchase of land for cash.

C) Payments of cash dividends to the owners of the business.

D) Cash paid for interest on a note payable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Companies that use accrual accounting recognize revenues and expenses at the time that cash is received or paid,respectively.

B) False

Correct Answer

verified

Correct Answer

verified

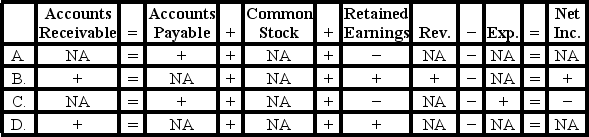

Multiple Choice

The Merry Maids provided cleaning services to Orange Company on account.Which of the following would describe the transaction's effect on Orange Company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The ethical standards for certified public accountants only require that such accountants comply with applicable laws and regulations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following financial statements is impacted most significantly by the matching concept?

A) Balance sheet

B) Income statement

C) Statement of changes in stockholders' equity

D) Statement of cash flows

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Sales on account decrease the balance in accounts receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 84

Related Exams