B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Nelson Company experienced the following transactions during Year 1, its first year in operation. 1) Acquired $12,000 cash by issuing common stock 2) Provided $4,600 of services on account 3) Paid $3,200 cash for operating expenses 4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable 5) Paid a $200 cash dividend to stockholders -What is the balance of the retained earnings that will be reported on the balance sheet as of December 31,Year 1?

A) $1,200

B) $1,000

C) $1,400

D) $13,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

Matching

On January 1,Year 1,Wilson Company borrowed $70,000 from State Bank.The note stipulates a 3-year term with a 3 percent interest rate.On December 31,Year 1,Wilson recorded an adjusting entry to accrue interest expense.Based solely on these events,indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

[The following information applies to the questions displayed below.] Nelson Company experienced the following transactions during Year 1, its first year in operation. 1) Acquired $12,000 cash by issuing common stock 2) Provided $4,600 of services on account 3) Paid $3,200 cash for operating expenses 4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable 5) Paid a $200 cash dividend to stockholders -What is the amount of net cash flows from operating activities that will be reported on the Year 1 statement of cash flows?

A) $400

B) $600

C) $1,400

D) $1,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

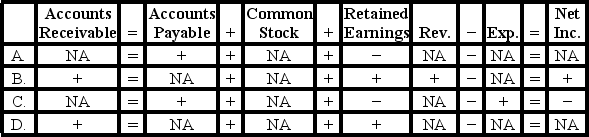

The Merry Maids provided cleaning services to Orange Company on account.Which of the following would describe the transaction's effect on the Merry Maids' financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an element of the fraud triangle?

A) Reliance

B) Rationalization

C) Opportunity

D) Pressure

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If retained earnings decreased during the year,and no dividends were paid,which of the following statements must be true?

A) Expenses for the year exceeded revenues.

B) The company did not have enough cash to pay its expenses.

C) Total equity decreased.

D) Liabilities increased during the year.

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Matching

Wyatt Company paid $57,000 in January,Year 2 for salaries that had been earned by employees in December,Year 1.Indicate whether each of the following statements about financial statement effects of the January,Year 2 event is true or false.

Correct Answer

Multiple Choice

During Year 2,Fancy Foods Incorporated earned $104,000 of revenue on account.The beginning balance in accounts receivable was $26,000,and the ending balance was $4,000.Based solely on this information,what was the amount of cash collected from accounts receivable?

A) $74,000

B) $82,000

C) $126,000

D) $134,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1? A) $12,600 B) $13,800 C) $7,200 D) $10,600](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,600

B) $13,800

C) $7,200

D) $10,600

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an asset use transaction?

A) Purchased land for cash

B) Paid cash for salary expense

C) Invested cash in an interest earning account

D) Accrued salary expense at the end of the period

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

The bankruptcies of Enron and WorldCom both indicated the occurrence of major audit failures.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The term "accrual" describes an earnings event that is recognized before cash is received or paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are "matched" under the matching concept?

A) Expenses and revenues

B) Expenses and liabilities

C) Assets and equity

D) Assets and liabilities

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following is an asset exchange transaction?

A) Issued common stock

B) Accrued salary expense at the end of the accounting period

C) Collected cash on accounts receivable

D) Earned cash revenue for services provided

F) A) and B)

Correct Answer

verified

Correct Answer

verified

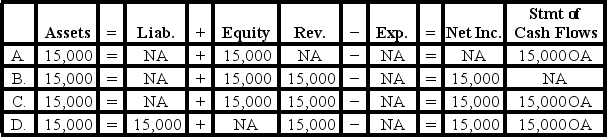

Multiple Choice

Frank Company earned $15,000 of cash revenue.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Accounts receivable is an asset account on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The internal controls of a business are designed to reduce the probability of occurrence of fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements regarding the four types of accounting events is true or false.

Correct Answer

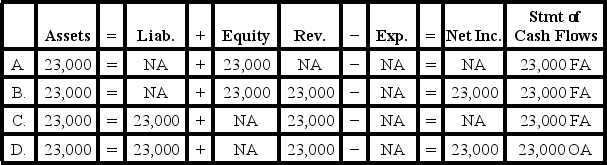

Multiple Choice

Garrison Company acquired $23,000 by issuing common stock.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option C

B) Option A

C) Option D

D) Option B

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 84

Related Exams