A) $26,000

B) $19,500

C) $21,000

D) $15,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Knoll Company started Year 2 with a $1,000 balance in its Cash account,a $200 balance in its Supplies account and a $1,200 balance in its common stock account.During Year 2,the company experienced the following events: (1) Paid $600 cash to purchase supplies. (2) Physical count revealed $50 of supplies on hand at the end of Year 2. Based on this information the amount of supplies expense reported on the Year 2 income statement is

A) $600

B) $750

C) $800

D) $850

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shows how paying cash to purchase supplies will affect a company's financial statements?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would not appear on a balance sheet?

A) Service Revenue

B) Supplies

C) Unearned Revenue

D) Prepaid Rent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies.

![[The following information applies to the questions displayed below.] At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies. -Which company has the highest return-on-assets ratio? A) Grumpy B) Happy C) Doc D) They all have equal return-on-assets ratios.](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f74_4050_ace2_2ba1b131d15b_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which company has the highest return-on-assets ratio?

-Which company has the highest return-on-assets ratio?

A) Grumpy

B) Happy

C) Doc

D) They all have equal return-on-assets ratios.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1,Year 1,Jack's Snow Removal Company received $6,000 of cash in advance from a customer and promised to provide services for that customer during the months of December,January,and February.How will the Year 1 year-end adjustment to recognize the partial expiration of the contract impact the elements of the financial statements model?

A) Total assets will increase by $2,000.

B) Equity will increase by $2,000.

C) Total liabilities will increase by $2,000.

D) Total assets will increase by $2,000 and equity will increase by $2,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

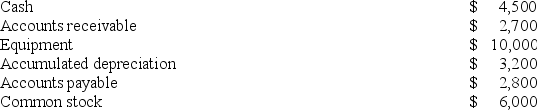

The following accounts and balances were drawn from the records of Barnes Company:

Based on this information alone the amount of Barnes's retained earnings is:

Based on this information alone the amount of Barnes's retained earnings is:

A) $11,600.

B) $17,200.

C) $5,200.

D) None of these answers is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Companies that use accrual accounting recognize revenues and expenses at the time that cash is received or paid,respectively.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Melon Moving Company paid $60,000 to purchase a truck.The truck was expected to have a five-year useful life and a $5,000 salvage value.If Melon uses the straight-line method,the amount of book value shown on the Year 4 balance sheet is

A) $27,000

B) $16,000

C) $5,000

D) zero

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

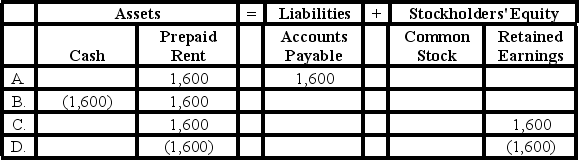

Bates Company paid $1,600 cash for the right to use office space during the coming year.Which of the following shows how this event would affect Bates' ledger accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1,Year 1,Wilson Company paid cash for an insurance policy that would provide protection for a one-year term.Which of the following shows how the required adjusting entry on December 31,Year 1 will affect Wilson's financial statements?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recognition of revenue may be accompanied by which of the following?

A) A decrease in a liability

B) An increase in a liability

C) An increase in an asset

D) An increase in an asset or a decrease in a liability

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 1,Year 2,Cole Company paid $12,000 cash for supplies.The Year 2 adjusting entry to recognize the amount of supplies used during Year 2

A) increases the amount of supplies expense recognized in Year 2

B) decreases the amount of liabilities shown on the Year 2 balance sheet

C) increases the amount of liabilities shown on the Year 2 balance sheet

D) decreases the amount of supplies expense recognized in Year 2

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company may recognize a revenue or expense without a corresponding cash collection or payment in the same accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies.

![[The following information applies to the questions displayed below.] At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies. -Which of the following ratios would be most useful in evaluating a company's performance from the owners' perspective? A) Return-on-assets ratio B) Debt-to-assets ratio C) Return-on-equity ratio D) Either the debt-to-assets ratio or the return-on-equity ratio](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f74_4050_ace2_2ba1b131d15b_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which of the following ratios would be most useful in evaluating a company's performance from the owners' perspective?

-Which of the following ratios would be most useful in evaluating a company's performance from the owners' perspective?

A) Return-on-assets ratio

B) Debt-to-assets ratio

C) Return-on-equity ratio

D) Either the debt-to-assets ratio or the return-on-equity ratio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

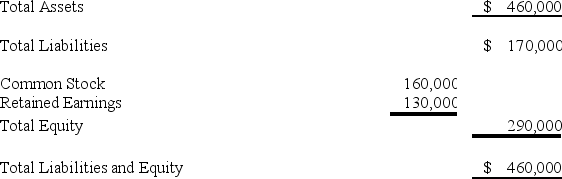

Chestnut,Inc.reported the following balances on its balance sheet at December 31,Year 1:

On January 1,Year 2,Chestnut purchased equipment for $40,000 on account.What is the company's debt-to-assets ratio immediately after the purchase of the equipment?

On January 1,Year 2,Chestnut purchased equipment for $40,000 on account.What is the company's debt-to-assets ratio immediately after the purchase of the equipment?

A) 0.42

B) 0.46

C) 0.37

D) 0.34

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Dixon Company collected cash in Year 1 from a customer for services to be performed beginning January,Year 2.Indicate whether each of the following statements about this transaction is true or false.

Correct Answer

Multiple Choice

Which of the following statements is true regarding accrual accounting?

A) Revenue is recorded only when cash is collected.

B) Expenses are recorded when they are incurred.

C) Revenue is recorded in the period when it is earned.

D) Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies.

![[The following information applies to the questions displayed below.] At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies. -Which company has the highest level of debt risk? A) Grumpy B) Happy C) Doc D) They all have equal debt risk.](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f74_4050_ace2_2ba1b131d15b_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which company has the highest level of debt risk?

-Which company has the highest level of debt risk?

A) Grumpy

B) Happy

C) Doc

D) They all have equal debt risk.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 2,the Supplies account of Sheldon Company had a balance of $1,200.During the year,the company purchased $3,400 of supplies on account and made partial payments totaling $3,000 on those accounts.On December 31,Year 2,Sheldon determined that there were $1,400 of supplies on hand.Which of the following would be reported on Sheldon's Year 2 financial statements?

A) $1,600 of supplies; $200 of supplies expense

B) $1,400 of supplies; $2,000 of supplies expense

C) $1,400 of supplies; $3,200 of supplies expense

D) $1,600 of supplies; $3,400 of supplies expense

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 91

Related Exams