A)

B)

C)

D)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Recognition of depreciation expense is an asset use transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During Bruce Company's first year of operations,the company purchased $2,300 of supplies.At year-end,a physical count of the supplies on hand revealed that $825 of unused supplies were available for future use.How will the related adjusting entry affect the company's financial statements?

A) Expenses will increase and assets will decrease by $1,475.

B) Assets and expenses will both increase by $825.

C) Expenses and assets will both increase by $1,475.

D) The related adjusting entry has no effect on net income or the accounting equation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The carrying value of an asset is the expected selling price of an asset at the end of its useful life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the purpose of the accrual basis of accounting?

A) Recognize revenue when it is collected from customers.

B) Match assets with liabilities during the proper accounting period.

C) Recognize expenses when cash disbursements are made.

D) Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Prepaid insurance is a liability reported on the balance sheet.

B) Prepaid insurance indicates that a company has already paid cash for insurance coverage that protects the company for some future time period.

C) Prepaid insurance is a deferred expense.

D) Prepaid insurance represents a future economic benefit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A deferral

A) exists when a company pays cash at the same time the associated expense is recognized.

B) exists when a company pays cash after recognizing the associated expense.

C) exists when a company pays cash before recognizing the associated expense.

E) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider how each of the transactions listed below affect net income reported on the income statement and the net cash flows from operating activities reported on the statement of cash flows.Which transaction(s) would affect the income statement in a different period from the statement of cash flows?

A) Recognized depreciation expense on equipment

B) Incurred operating expenses on account

C) Paid interest that was accrued in a prior year

D) All of these answer choices would affect the income statement in a different period from the statement of cash flows

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies.

![[The following information applies to the questions displayed below.] At the end of Year 1, the following information is available for Grumpy, Happy, and Doc Companies. -Which company is the most profitable from the stockholders' perspective? A) Grumpy B) Happy C) Doc D) Cannot be determined](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f74_4050_ace2_2ba1b131d15b_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which company is the most profitable from the stockholders' perspective?

-Which company is the most profitable from the stockholders' perspective?

A) Grumpy

B) Happy

C) Doc

D) Cannot be determined

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

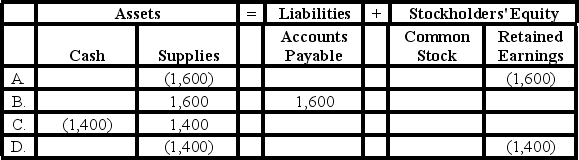

Chester Company started Year 2 with a $2,000 balance in its Cash account,a $500 balance in its Supplies account,and a $2,500 balance in its Common Stock account.During Year 2,the company experienced the following events:

(1) Paid $1,400 cash to purchase supplies.

(2) Physical count revealed $300 of supplies on hand at the end of Year 2.

Based on this information,which of the following shows how the year-end adjusting entry required to recognize supplies expense would affect Chester's account balances?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events would require a year-end adjusting entry?

A) Purchasing supplies for cash during the year

B) Purchasing land for cash during the year

C) Providing services on account during the year

D) Each of these events would require a year-end adjusting entry.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an asset use transaction?

A) Purchased land for cash

B) Recorded rent expense at the end of the period

C) Borrowed cash from the bank

D) Accrued salary expense at the end of the period

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Recognition of depreciation expense on equipment decreases the equipment account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shows how the event "collected cash for services to be rendered in the future" affects a company's financial statements?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

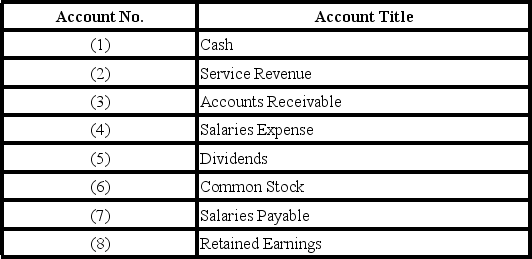

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement.)

Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement.)

A) Account numbers 2, 4, and 5 will appear on the income statement.

B) Account numbers 1, 3, and 8 will appear on the balance sheet.

C) Account numbers 2, 5, and 8 will appear on the statement of cash flows.

D) Account numbers 4, 5, and 6 will appear on the statement of changes in stockholders' equity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to recognize depreciation expense incurred on equipment involves which of the following?

A) A decrease in assets

B) An increase in liabilities

C) An increase in assets

D) A decrease in liabilities

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1,Year 1,Falloch,Inc.paid $3,600 cash for a contract allowing the company to use office space for one year.The company's fiscal closing date is December 31.Based on this information,the amount of cash flow from operating activities appearing on the Year 1 statement of cash flows would be

A) $2,100

B) $3,000

C) $3,300

D) $3,600

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a revenue or an expense event is recognized after cash has been exchanged it is referred to as

A) an accrual

B) a deferral

C) either an accrual or deferral

D) neither of these terms describe this event

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Matching

On November 1,Year 1,Danny Company paid $12,000 cash to rent an office for a year starting immediately.Indicate whether each of the following statements about this transaction is true or false.

Correct Answer

Multiple Choice

When a company purchases supplies on account

A) Cash flow from financing activities decreases

B) Total assets decrease

C) Expenses increase

D) Liabilities increase

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 91

Related Exams