A) Total assets and total stockholders' equity decrease by $900.

B) Total assets decrease by $2,600 and total stockholders' equity decreases by $1,700.

C) Total assets and total stockholders' equity decrease by $2,600.

D) Total assets and total stockholders' equity increase by $900.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

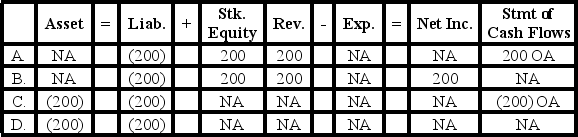

Foote Company was granted a purchase discount of $200 on merchandise the company had purchased a few days ago.Foote uses the perpetual inventory system.Which of the following reflects the effects of this event on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following account titles is normally used in a periodic inventory system?

A) Transportation-in.

B) Purchases.

C) Purchase Returns and Allowances.

D) All of these answer choices are normally used.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

![[The following information applies to the questions displayed below.] -Three of the companies are upscale stores and one is a discount store.Which company is most likely to be the discount store? A) Company A B) Company B C) Company C D) Company D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f69_6baf_ace2_ad66e87c4fd6_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Three of the companies are upscale stores and one is a discount store.Which company is most likely to be the discount store?

-Three of the companies are upscale stores and one is a discount store.Which company is most likely to be the discount store?

A) Company A

B) Company B

C) Company C

D) Company D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the chief advantage of the periodic system?

A) Efficiency and ease of recording

B) Immediate feedback on the inventory on hand at any time during the period

C) Timely discovery of losses due to theft

D) Better control over inventory

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when merchandise is delivered FOB shipping point?

A) The buyer pays the freight cost.

B) The seller pays the freight cost.

C) The buyer records transportation cost as an expense.

D) The seller records transportation-out expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Sanchez Company engaged in the following transactions during Year 1: 1) Started the business by issuing $42,000 of common stock for cash. 2) The company paid cash to purchase $26,400 of inventory. 3) The company sold inventory that cost $16,000 for $30,600 cash. "4) Operating expenses incurred and paid during the year, $14,000. Sanchez Company engaged in the following transactions during Year 2:" 1) The company paid cash to purchase $35,200 of inventory. 2) The company sold inventory that cost $32,800 for $57,000 cash. "3) Operating expenses incurred and paid during the year, $18,000. Note: Sanchez uses the perpetual inventory system." -What is Sanchez's gross margin for Year 2?

A) $6,200

B) $24,200

C) $21,800

D) $32,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

![[The following information applies to the questions displayed below.] -Based on common-sized income statements,which of the companies spent the least on operating expenses in relationship to its sales? A) Company A B) Company B C) Company C D) Company D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f69_6baf_ace2_ad66e87c4fd6_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Based on common-sized income statements,which of the companies spent the least on operating expenses in relationship to its sales?

-Based on common-sized income statements,which of the companies spent the least on operating expenses in relationship to its sales?

A) Company A

B) Company B

C) Company C

D) Company D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

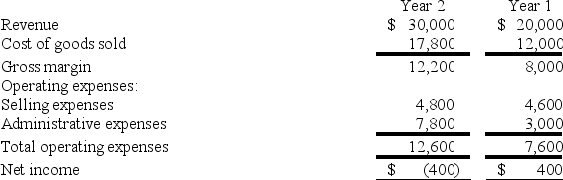

The following are the income statements of the Hancock Company for two consecutive years.Increases in which of the expenses contributed to the net loss in Year 2?

A) Cost of goods sold and selling expenses

B) Selling expenses and administrative expenses

C) Cost of goods sold and administrative expenses

D) Administrative expenses

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

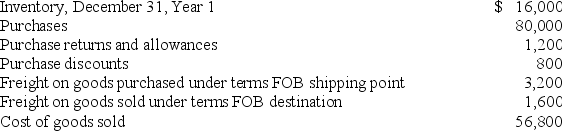

The following information for Year 2 is taken from the accounts of Tuttle Company.The company uses the periodic inventory system.

Based on this information,what is the inventory at December 31,Year 2?

Based on this information,what is the inventory at December 31,Year 2?

A) $55,200

B) $24,400

C) $38,800

D) $40,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jake Co.purchased on account merchandise with a list price of $90,000.Payment terms were 1/15,n/45.If collection occurs within 18 days,what discount will Jake Co.recognize on the merchandise?

A) $13,500

B) $900

C) $500

D) $0

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Assume the perpetual inventory system is used. 1) Green Company purchased merchandise inventory that cost $64,000 under terms of 2/10, n/30 and FOB shipping point. 2) Green Company paid freight cost of $2,400 to have the merchandise delivered. 3) Payment was made to the supplier on the inventory within 10 days. 4) All of the merchandise was sold to customers for $94,000 cash and delivered under terms FOB destination with freight cost amounting to $1,600. -What is the net cash flow from operating activities that results from these transactions?

A) $94,000 inflow

B) $27,280 inflow

C) $66,720 outflow

D) $31,280 inflow

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olly Company is a merchandising business that sells dog food.Based on the following information,what is the gross margin for Olly Company?

A) $135,000

B) $160,000

C) $200,000

D) $285,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do the credit terms,2/15,n/30 mean?

A) A fifteen percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) A two percent discount can be deducted for a period up to thirty days following the date of sale.

C) A two percent discount can be deducted if the invoice is paid before the fifteenth day following the date of the sale.

D) A two percent discount can be deducted if the invoice is paid after the fifteenth day following the sale, but before the thirtieth day.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Melbourne Company sold merchandise that it had purchased with a list price of $3,300.The credit terms were of 2/10,n/30.Assuming that Melbourne paid for the merchandise during the discount period,the cost of goods sold for this transaction would be $2,970.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:

![[The following information applies to the questions displayed below.] A company's chart of accounts includes, in part, the following account numbers and corresponding account titles: -Which accounts would appear on the income statement? A) Account numbers 3, 4, 7, 8, and 9 B) Account numbers 3, 4, 5, 7, and 9 C) Account numbers 2, 3, 7, 8, and 9 D) Account numbers 3, 5, 7, and 8](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f65_e936_ace2_1d414f84598a_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which accounts would appear on the income statement?

-Which accounts would appear on the income statement?

A) Account numbers 3, 4, 7, 8, and 9

B) Account numbers 3, 4, 5, 7, and 9

C) Account numbers 2, 3, 7, 8, and 9

D) Account numbers 3, 5, 7, and 8

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:

![[The following information applies to the questions displayed below.] A company's chart of accounts includes, in part, the following account numbers and corresponding account titles: -Which accounts would affect operating income? A) Account numbers 2, 4, and 9 B) Account numbers 3, 5, 7, and 9 C) Account numbers 3, 4, 7, and 9 D) Account numbers 3, 4, 7, 8, and 9](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f65_e936_ace2_1d414f84598a_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which accounts would affect operating income?

-Which accounts would affect operating income?

A) Account numbers 2, 4, and 9

B) Account numbers 3, 5, 7, and 9

C) Account numbers 3, 4, 7, and 9

D) Account numbers 3, 4, 7, 8, and 9

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

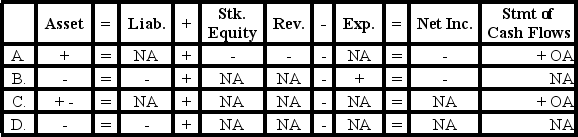

Ramirez Company returns merchandise previously purchased on account.It had not yet been paid for.Ramirez uses the perpetual inventory system.Which of the following reflects the effects on the financial statements of only the purchase return?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glen Company uses the perpetual inventory system.The company entered into the following events: 1) Purchased merchandise inventory that cost $10,000 under terms of 2/10,n/30. 2) Made payment to the supplier within the discount period. "3) Sold all of the goods to customers on account for $22,000. What is Glen's cost of goods sold as a result of these three transactions?"

A) $9,000

B) $9,800

C) $10,000

D) $21,800

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Sanchez Company engaged in the following transactions during Year 1: 1) Started the business by issuing $42,000 of common stock for cash. 2) The company paid cash to purchase $26,400 of inventory. 3) The company sold inventory that cost $16,000 for $30,600 cash. "4) Operating expenses incurred and paid during the year, $14,000. Sanchez Company engaged in the following transactions during Year 2:" 1) The company paid cash to purchase $35,200 of inventory. 2) The company sold inventory that cost $32,800 for $57,000 cash. "3) Operating expenses incurred and paid during the year, $18,000. Note: Sanchez uses the perpetual inventory system." -What is the amount of inventory that will be shown on the balance sheet at December 31,Year 2?

A) $2,400

B) $12,800

C) $61,600

D) $28,800

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 106

Related Exams