A) Item numbers 2 and 4

B) Item numbers 2, 4, and 5

C) Item numbers 1 and 4

D) Item numbers 1, 2, 4, and 5

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A business learns about customers' NSF checks through debit memos that are included with the bank statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A savings account or certificate of deposit that imposes a substantial penalty for early withdrawals should not be classified as Cash on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasper Company accepted a check from Harp Company as payment for services rendered.Jasper's bank statement revealed that the Harp check was an NSF check.What effect will recording the NSF check have on the accounting equation of Jasper Company?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the materiality concept is not true?

A) Materiality is different for each company.

B) A material error would change the opinion of the average prudent investor.

C) Any error greater than $5,000 is considered material in a financial statement audit.

D) Material misstatements should not exist in order for a company to receive an unqualified audit opinion.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true with regards to financial statement audits?

A) The auditors guarantee that the financial statements are accurate and correct.

B) Financial audits are directed toward the discovery of fraud.

C) Auditors provide reasonable assurance that statements are free from material misstatements, whether caused by errors or fraud.

D) Auditors will not disclose information that they have acquired as a result of their accountant-client relationship.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Segregation of duties in an organization should be required to reduce the likelihood of theft.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when a company replenishes its petty cash fund?

A) Cash decreases

B) Petty cash decreases

C) Expenses decrease

D) Cash increases

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The primary focus of financial statement audits is the discovery of fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

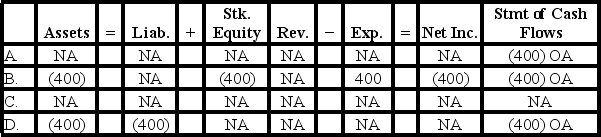

The owner of Barnes Company established a petty cash fund amounting to $400.What is the effect on the financial statements of recording this transaction?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

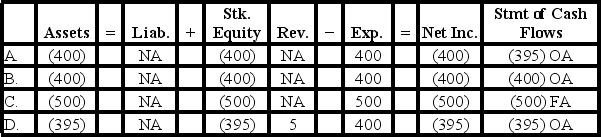

Multiple Choice

Peterson Company's petty cash fund was established on January 1 with $500.On January 31,a count of the fund revealed: $105 in cash remaining and vouchers for miscellaneous expenses totaling $400.If the company records both the disbursements and the replenishments to the fund,what is the overall effect on Peterson's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is a customer's NSF check reflected on a bank reconciliation?

A) Subtracted from the unadjusted book balance to get the true cash balance

B) Added to the unadjusted bank balance to get the true cash balance

C) Subtracted from the unadjusted bank balance to get the true cash balance

D) Added to the unadjusted book balance to get the true cash balance

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a petty cash fund to be most useful to a business,one of the employees of the business should be designated as responsible for the fund.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

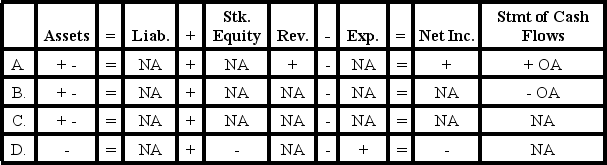

Keatts Company's bank statement included an NSF check written by one of its customers.What effect will recognizing the NSF check have on the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes an activity that reduces a company's bank account balance?

A) A deposit in transit

B) A debit memo

C) A credit memo

D) A reconciling entry

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] The bank statement for Tetra Company contained the following items: a bank service charge of $10; a credit memo for interest earned, $15; and a $50 NSF check from a customer. The company had outstanding checks of $100 and a deposit in transit of $300. -Which of the following will be caused by recording the customer's NSF check?

A) Accounts receivable increases.

B) Cash decreases.

C) stockholders' equity decreases.

D) Accounts receivable increases and cash decreases.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Establishment of a petty cash fund is an asset exchange transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The April 30 bank statement for Trimble Corporation shows an ending balance of $34,351.The unadjusted cash account balance was $28,250.The accountant for Trimble gathered the following information: (1) There was a deposit in transit for $4,240. (2) The bank statement reports a service charge of $39. (3) A credit memo included in the bank statement shows interest earned of $95. (4) Outstanding checks totaled $10,935. (5) The bank statement included a $650 NSF check deposited in April. What is the true cash balance as of April 30?

A) $27,656

B) $27,006

C) $31,801

D) $31,896

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which internal control procedure is a deterrent to corruption?

A) Segregation of duties

B) Physical controls

C) Fidelity bonding

D) Use of prenumbered documents

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Owen Company's unadjusted book balance at June 30 is $9,700.The company's bank statement reveals bank service charges of $45.Two credit memos are included in the bank statement: one for $900,which represents a collection that the bank made for Owen,and one for $50,which represents the amount of interest that Owen had earned on its interest-bearing account in June.What is the true cash balance?

A) $9,700

B) $10,695

C) $10,550

D) $10,605

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 76

Related Exams