A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the term commonly used to describe the practice of reporting the net realizable value of receivables in the financial statements?

A) Cash flow method.

B) Allowance method.

C) Direct write-off method.

D) Accrual method.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Collecting a credit card receivable is an asset source transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2?

![[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f4e_b792_ace2_eb0a910295f4_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

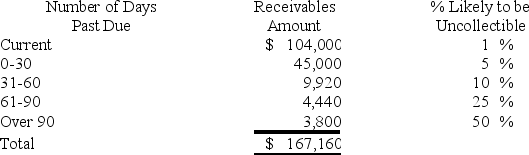

Domino Company ages its accounts receivable to estimate uncollectible accounts expense.Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $76,500 and $5,800,respectively.During Year 2,the company wrote off $4,640 in uncollectible accounts.In preparation for the company's estimate of uncollectible accounts expense for Year 2,Domino prepared the following aging schedule:

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A) $6,132

B) $1,512

C) $7,292

D) $4,640

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe the amount of accounts receivable that is actually expected to be collected?

A) Allowance for doubtful accounts

B) Uncollectible accounts expense

C) The present value of accounts receivable

D) Net realizable value

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account. -What is the amount of cash flow from operating activities that would appear on the Year 2 statement of cash flows?

A) $97,000

B) $104,000

C) $89,520

D) $95,060

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2?

![[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f4e_4261_ace2_7b38772e36ec_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which accounting concept can be used by some companies to justify the use of the direct write-off method?

A) The entity concept

B) The materiality concept

C) The going concern concept

D) The monetary principle

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is a company's operating cycle determined?

A) Adding the inventory turnover ratio to the receivables turnover ratio divided into 365 days.

B) Adding the average days in inventory to the average days in receivables.

C) Dividing cost of goods sold by average inventory.

D) Dividing 365 days by the difference in the inventory turnover and receivable turnover.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a company receives payment from a customer whose account was previously written off,the account is reinstated and the net realizable value of Accounts Receivable increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the accounts receivable turnover ratio measure?

A) How quickly accounts receivable turn into cash

B) How quickly the accounts receivable balance increases

C) Average balance of accounts receivables

D) How quickly inventory turns into accounts receivable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a cost of extending credit to customers?

A) Uncollectible accounts expense

B) Lost sales

C) Fees paid to credit card companies

D) Explicit interest

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the percent of receivables method?

A) Income statement approach

B) Direct write-off approach

C) Credit sales approach

D) Balance sheet approach

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the average number of days to collect accounts receivable computed?

A) Accounts Receivable ÷ Net income

B) 365 ÷ Accounts receivable turnover ratio

C) Accounts Receivable ÷ 365

D) Sales ÷ Net accounts receivable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of accepting credit cards from retail customers?

A) The acceptance of credit cards tends to increase sales.

B) The credit card company performs credit worthiness assessments.

C) There are fees charged for the privilege of accepting credit cards.

D) The credit card company assumes the cost of slow collections and write-offs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false assuming use of the allowance method.

Correct Answer

Multiple Choice

Allegheny Company ended Year 1 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $23,000 and $900,respectively.During Year 2,Allegheny wrote off $1,500 of Uncollectible Accounts.Using the percent of receivables method,Allegheny estimates that the ending Allowance for Doubtful Accounts balance should be $1,600.What amount will Allegheny report as Uncollectible Accounts Expense on its Year 2 income statement?

A) $2,200

B) $1,500

C) $700

D) $1,600

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the percent of receivables method to estimate uncollectible accounts,the company will first determine the required ending balance in Allowance for Doubtful Accounts; the Uncollectible Accounts Expense will be the difference between that amount and the balance in the Allowance for Doubtful Accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rosewood Company made a loan of $16,000 to one of the company's employees on April 1,Year 1.The one-year note carried a 6% rate of interest.What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2,respectively?

A) $960 in Year 1 and $0 in Year 2

B) $0 in Year 1 and $960 in Year 2

C) $240 in Year 1 and $720 in Year 2

D) $720 in Year 1 and $240 in Year 2

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 93

Related Exams