B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is calculated as total current assets divided by total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

True/False

If a company is in a region in which floods or earthquakes are deemed to be possible,the company should record a contingent liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's classified balance sheet shows current assets of $8,650 and current liabilities of $6,000.What is the company's current ratio?

A) 0.69 to 1

B) 1.44 to 1

C) 1.16 to 1

D) 3.26 to 1

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.

Correct Answer

Multiple Choice

Greer Company pays Jamal Perry a salary of $3,000 per week.How much FICA tax must Greer pay with regards to this employee (including both the employee and employer portions) ? (Assume a Social Security rate of 6 percent on the first $110,000 of income and a Medicare rate of 1.5 percent on all earnings.)

A) $225

B) $360

C) $-0-

D) $450

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Indicate whether each of the following statements is true or false. -A warranty obligation only occurs if a buyer purchases an extended warranty.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A company with a high current ratio should be concerned that it is not maximizing its earnings potential.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

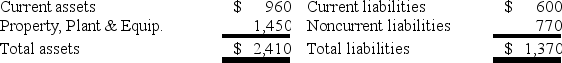

The following information is taken from the balance sheet of Atlanta Company:

What is Atlanta Company's current ratio?

What is Atlanta Company's current ratio?

A) 2.5 to 1

B) 1.6 to 1

C) 1.76 to 1

D) 0.66 to 1

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Contingent liabilities are only recognized if they arise from past events.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a claims exchange transaction?

A) Accrual of interest on a note payable

B) Issued a note to purchase equipment

C) Repaid principal on a note payable

D) Paid interest on a note payable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Riley Company borrowed $36,000 on April 1, Year 1 from Titan Bank. The note issued by Riley carried a one-year term and a 7% annual interest rate. Riley earned cash revenues of $1,700 during Year 1 and $1,400 during Year 2. Assume no other transactions. -Based on this information alone,what amount of cash flow from operating activities would appear on the Year 2 statement of cash flows?

A) $770 inflow

B) $1,400 inflow

C) $38,520 outflow

D) $1,120 outflow

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,West Company borrowed $10,000 from Valley Bank.West agreed to pay interest annually at the rate of 6% per year.The note issued by West carried an 18-month term.West Company has a calendar year-end.What is the amount of interest expense that will be reported on West's income statement for Year 1?

A) $-0-

B) $150

C) $60

D) $200

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the current ratio used to evaluate?

A) Solvency

B) Liquidity

C) Equity

D) Profitability

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the going concern assumption affect accounting for notes payable?

A) It dictates that notes payable be reported at their face value.

B) It dictates that interest expense be accrued at the end of the accounting period.

C) It dictates that notes payable be reported at their net realizable value.

D) It dictates that interest expense be paid when the note matures.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following is true or false.Perez Company borrowed money from its bank in July Year 1.The accrual of interest on the loan at the end of Year 1:

Correct Answer

Showing 61 - 77 of 77

Related Exams