A) $17,500

B) $12,500

C) $14,250

D) $15,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements regarding the effective interest method is true or false.

Correct Answer

Multiple Choice

Which of the following statements about installment notes is correct?

A) With each subsequent payment on an installment note, the amount of interest expense decreases.

B) With each subsequent payment on an installment note, the amount of interest expense increases.

C) With each subsequent payment on an installment note, the amount of the principal paid decreases.

D) With each subsequent payment on an installment note, the amount of the principal paid remains unchanged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements about lines of credit is true or false.

Correct Answer

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. -What is the amount of interest expense shown on Jones' income statement for the year ending December 31,Year 1?

A) $16,200

B) $21,000

C) $15,000

D) $13,800

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

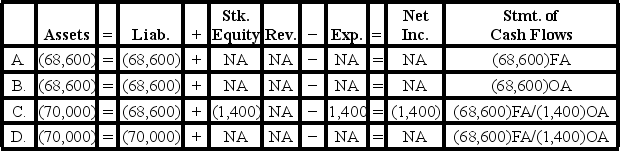

[The following information applies to the questions displayed below.]

On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal.

-Which of the following shows the effect of the December 31,Year 1 payment?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal. -Which of the following shows the effect of the December 31,Year 1 payment? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f25_3667_ace2_eb2aee7863c5_TB1323_00_TB1323_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Serial bonds are issued based on the overall strength of the borrower's credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Victor Company issued bonds with a $250,000 face value, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds sold at 95. Interest is payable in cash on December 31 of each year. Victor uses the straight-line method to amortize bond discounts and premiums. -What is the carrying value of the bond liability at December 31,Year 3?

A) $241,000

B) $242,500

C) $237,500

D) $245,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jacobs Company issued bonds with a $300,000 face value on January 1,Year 1.The bonds were issued at 102 and carried a 5-year term to maturity.They had a 9% stated rate of interest that was payable in cash on December 31st of each year.Jacobs uses the straight-line method to amortize bond discounts and premiums.Based on this information alone,how does the recognition of interest expense during Year 1 affect the company's accounting equation?

A) Decreases stockholders' equity by $25,800, decreases liabilities by $1,200, and decreases assets by $27,000

B) Decreases both assets and stockholders' equity by $2,700

C) Decreases both assets and stockholders' equity by $25,800

D) Increases liabilities by $1,200, decreases assets by $25,800, and decreases stockholders' equity by $27,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pace Company issued bonds with a face value of $200,000 at 97.How does the issuance affect the company's accounting equation?

A) Assets and liabilities would both increase by $200,000.

B) Assets and liabilities would both increase by $194,000.

C) Assets would increase by $194,000 and liabilities would increase by $200,000.

D) Assets would increase by $200,000, and liabilities would increase by $194,000.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

The after-tax interest cost of debt equals total interest expense multiplied by the tax rate.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, The Palms borrowed $200,000 to purchase a warehouse by agreeing to an 8%, 5-year note with the bank. Payments of $50,091.29 are due at the end of each year. The first payment will be made on December 31, Year 1. -How much will the company still owe on the loan at the end of Year 2? (Round your final answer to the nearest dollar.)

A) $186,727

B) $184,000

C) $129,090

D) $165,910

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

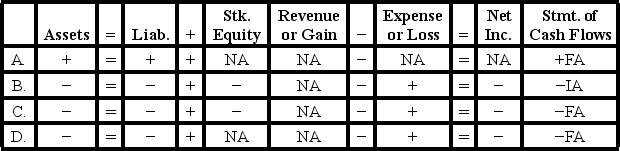

On December 31,Year 5,Gordon Corporation records interest and amortization.Immediately after that,Gordon pays off the bonds as scheduled.Which of the following shows the effect of the bond payoff on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Denver Co.issued bonds with a face value of $100,000,a stated rate of interest of 8%,and a 5-year term to maturity.The bonds were sold at 102.5.Denver uses the straight-line method to amortize bond discounts and premiums.What is the amount of interest expense during Year 1?

A) $7,500

B) $8,500

C) $8,000

D) $8,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spokane Company called in bonds at a price that was above the carrying value of the bond liability.Which of the following shows how this event will affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thrasher Company reported income before taxes of $180,000.The company is in a 30% income tax bracket.Also,Thrasher's income statement contained a charge for interest expense amounting to $60,000.Based on this information alone,what is the company's times-interest-earned ratio?

A) 2.1

B) 3.0

C) 3.1

D) 4.0

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currie Company borrowed $20,000 from Sierra Bank by issuing a 10% three-year note.Currie agreed to repay the principal and interest by making annual payments in the amount of $8,042.Based on this information,what is the amount of the interest expense associated with the second payment? (Round your answer to the nearest dollar.)

A) $730

B) $1,396

C) $2,000

D) $8,042

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Weller Company issued bonds with a $400,000 face value, a stated rate of interest of 10%, and a 10-year term to maturity. Weller uses the effective interest method to amortize bond discounts and premiums. The market rate of interest on the date of issuance was 8%. Interest is paid annually on December 31. -Assuming Weller issued the bonds for $431,940,what is the carrying value of the bonds on the December 31,Year 3?

A) $420,615

B) $426,495

C) $414,264

D) $404,800

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Which of the following is the term used to describe bonds that mature at specified intervals throughout the life of the issuance?

A) Term bonds

B) Registered bonds

C) Coupon bonds

D) Serial bonds

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Sheffield Co.issued bonds with a face value of $200,000,a term of ten years,and a stated interest rate of 6%.The bonds were issued at 105,and interest is payable each December 31.Sheffield uses the straight-line method to amortize bond discounts and premiums.What is the carrying value of the bonds at December 31,Year 4?

A) $204,000

B) $200,000

C) $205,000

D) $206,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 112

Related Exams