A) Financing activity

B) Investing activity

C) Operating activity

D) Noncash financing and investing activity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Corporation's balance sheet reports equipment that originally cost $65,000.The accumulated depreciation for the equipment is $25,000.Warren sells the equipment for $37,000.What would the effect be on its income statement and statement of cash flows? Income Statement Cash Flows

A)

B)

C)

D)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Companies report significant noncash investing and financing activities on a schedule that accompanies the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If cash from operating activities was $48,000,cash used for investing activities was ($88,000) and the net change in cash was $96,000,what was cash from/used for financing activities?

A) ($144,000)

B) $48,000

C) $136,000

D) $96,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an incorrect statement of one of the rules for converting net income to the cash flow from operating activities using the indirect method?

A) Increases in current assets are subtracted from net income.

B) Decreases in current assets are added to net income.

C) Gains are added to net income.

D) Increases in current liabilities are added to net income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A cash payment to purchase treasury stock is reported on the statement of cash flows as a financing activity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anton Company reported a beginning balance of $13,200 and an ending balance of $14,400 in its Unearned Revenue account for the current year.During the year,$36,000 of revenue (previously unearned) was recognized.Considering only this information,how much cash was received in advance from customers during the year?

A) $36,000

B) $37,200

C) $36,800

D) $27,600

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the cash paid to purchase land reported in the statement of cash flows?

A) Cash outflow from financing activities

B) Schedule of noncash investing and financing activities

C) Cash outflow from investing activities

D) Cash inflow from operating activities

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pittsburgh Company pays cash for all inventory purchases.The company had a beginning inventory of $18,500 and an ending inventory of $16,900.Their cost of goods sold amounted to $75,000.Based on this information,what was the amount of cash paid for inventory purchases?

A) $76,600

B) $73,400

C) $75,000

D) $81,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions affects cash flows?

A) Accrual of interest receivable

B) Issuance of a stock dividend

C) Recognition of depreciation expense

D) Payment of dividends declared in a previous year

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the name given to the sum of the subtotals of the three sections (operating activities,investing activities,and financing activities) of the statement of cash flows?

A) Net income for the period

B) The change in the cash account balance between the beginning and ending of the period

C) The ending cash balance

D) The amount of cash inflow for the period

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company sells equipment at a loss,the loss from selling the equipment is reported in the investing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following cash flows would be included in the operating activities section of the statement of cash flows if the direct method is used?

A) Cash received from a bond issue

B) Cash paid to purchase equipment

C) Cash receipts from dividends

D) Cash gains and losses from the sale of operational assets

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

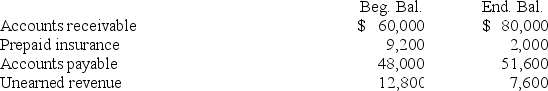

Chisholm Associates uses the indirect method to prepare the operating activities section of the statement of cash flows.The following accounts and balances were drawn from the company's accounting records:

Net income for the period was $80,000.What is the net cash flows from operating activities?

Net income for the period was $80,000.What is the net cash flows from operating activities?

A) $70,400

B) $65,600

C) $76,000

D) $94,400

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bristol Corporation reported a beginning balance of $6,200 in accounts receivable.During the year,sales on account totaled $49,600.If the ending balance of accounts receivable amounts to $25,000,what was the amount of cash received from customers?

A) $24,600

B) $25,000

C) $30,800

D) $68,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Gregg Co.reported wages expense of $160,000 during Year 2,wages payable of $16,000 at the beginning of Year 2,and wages payable of $22,000 at the end of Year 2.What amount of cash was paid for wages during Year 2?

A) $176,000

B) $160,000

C) $154,000

D) $144,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Mayer Corporation signed a contract to perform $25,000 worth of services for Phips Company over the next three years.Which of the following indicates the effects of this event on the Year 1 income statement and statement of cash flows of Mayer Corporation? Cash Flows Net Income Operating Investing Financing

A)

B)

C)

D) NA NA NA NA

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash flow from operating activities is often less stable from year to year than the amount of net income reported on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the operating activities section of the statement of cash flows by the indirect method,decreases in noncash current liabilities are added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the operating activities section of the statement of cash flows shows increases and decreases in noncash current assets and current liabilities to arrive at cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 85

Related Exams