A) controls;opportunity

B) audits;rationalization

C) financial statements;opportunity

D) loan covenants;incentive

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a significant objective of the Sarbanes-Oxley (SOX) Act?

A) Counteract incentives

B) Increase opportunities

C) Discourage honesty

D) Reduce internal controls

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research has found that three factors exist when fraud occurs.Which of the following is one of the three factors of the fraud triangle?

A) Assessments

B) Covenants

C) Monitoring

D) Rationalization

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements relating to restricted cash is not correct?

A) Restricted cash is not available for general use but rather restricted for a specific purpose.

B) Restricted cash must be reported separately on the balance sheet.

C) By including restricted cash as part of the amount reported as cash and cash equivalents,the company more clearly conveys to financial statement users the actual amount of cash available to pay liabilities.

D) Companies are sometimes legally or contractually required to set aside cash for a specific purpose and are not allowed to use it for day-to-day operations.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account Cash Overage is which type of account?

A) An asset account

B) A liability account

C) A miscellaneous revenue account

D) A miscellaneous expense account

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

A company established a $400 petty cash.On October 15,there was $16 remaining in the petty cash fund on that date and there were petty cash receipts for travel expense,$39,delivery expense,$138,and office expenses,$214.The petty cash fund was replenished and increased to $1,000 in total. Required: Prepare the journal entry,if any,required,to record the replenishment of the petty cash fund and the increase in its amount on October 15.(If no entry is required for a transaction/event,select "No Journal Entry Required" in the first account field. )

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a correct statement regarding the Cash Shortage account?

A) The account normally has a credit balance.

B) If the recorded cash exceeds the cash counted,a shortage exists.

C) It is reported as a miscellaneous revenue.

D) It is reported on the balance sheet.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company made a bank deposit on September 30 that did not appear on the bank statement dated September 30.In preparing the September 30 bank reconciliation,the company should:

A) deduct the deposit from the bank statement balance.

B) send the bank a debit memorandum.

C) deduct the deposit from the September 30 book balance and add it to the October 1 book balance.

D) add the deposit to the end cash balance per bank statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following was not a change introduced by the Sarbanes-Oxley Act?

A) Limits on executive compensation for most companies.

B) Stiffer fines and maximum jail sentences for willful misrepresentation of financial results.

C) An external audit of the effectiveness of internal controls.

D) Anonymous tip lines and legal protection to whistle-blowers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning electronic funds transfers is not correct?

A) Businesses sometimes receive payments from customers via EFT.

B) An EFT occurs when a customer electronically transfers funds from his or her bank account to the company's bank account.

C) Because electronic funds transfers are deposited directly into the company's bank account,they require additional internal control procedures.

D) To process an EFT,the accounting department merely records journal entries to debit Cash and credit Accounts Receivable from each customer.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

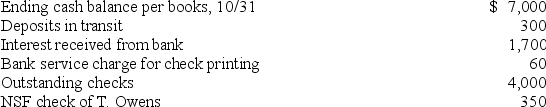

Lenore,Inc.gathered the following information from its accounting records and the October bank statement to prepare the October bank reconciliation:  The up-to-date ending cash balance on October 31 is:

The up-to-date ending cash balance on October 31 is:

A) $7,940

B) $8,290

C) $5,290

D) $4,590

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash equivalents would include:

A) a 30-day bank certificate of deposit.

B) the amount in the petty cash fund.

C) a 6-month U.S.treasury bill.

D) the balance in the company's savings account.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

A petty cash fund was originally established with a check for $180.On December 31,the petty cash fund was replenished when there was $5.10 remaining and there were petty cash receipts for postage,$52.20;supplies,$62.22;and equipment repair,$58.80. Required: Prepare the journal entry,if any,required,to record the replenishment of the petty cash fund on December 31.(If no entry is required for a transaction/event,select "No Journal Entry Required" in the first account field.Round your final answer to two decimal places. )

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In comparing the canceled checks on the bank statement with the entries in the accounting records,it is found that check number 2889 for December's utilities was correctly written and drawn for $970 but was erroneously entered into the accounting records as $790.The journal entry to adjust the books for the bank reconciliation would include a debit to:

A) Cash and a credit to Utility Expense for $180.

B) Utility Expense and a credit to Cash for $180.

C) Utility Expense and a credit to Cash for $790.

D) Cash and a credit to Utility Expense for $790.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company's accountant mistakenly recorded an $85 deposit as $58,the error would be shown on the bank reconciliation as a(n) :

A) $27 deduction from the book balance.

B) $85 deduction from the book balance.

C) $27 addition to the book balance.

D) $85 addition to the book balance.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.There are more definitions than terms. -Segregation of Duties

A) A set of regulations passed by Congress in 2002 in an attempt to improve financial reporting and restore investor confidence.

B) A process for approving and documenting all purchases and payments on account.

C) An attempt to deceive others for personal gain.

D) Terms of a loan agreement that if broken,entitle the lender to renegotiate loan terms or force repayment.

E) Short-term,highly liquid investments purchased within three months of maturity.

F) Another name for bounced checks.They arise when the check writer (your customer) does not have sufficient funds to cover the amount of the check.

G) An internal report prepared to verify the accuracy of both the bank statement and the cash accounts of a business or individual.

H) Actions taken to promote efficient and effective operations,protect assets,enhance accounting information,and adhere to laws and regulations.

I) An internal control designed into the accounting system to prevent an employee from making a mistake or committing a dishonest act as part of one assigned duty and then also covering it up through another assigned duty.

J) Not available for general use but rather restricted for a specific purpose.

K) A process that controls the amount paid to others by limiting the total amount of money available for making payments to others.

L) Money or any instrument that banks will accept for deposit and immediately credit to a company's account.

N) B) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The control components used by companies as a framework when analyzing their internal control systems include:

A) compliance.

B) control environment.

C) covenants.

D) corruption.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following bank reconciliation items would not result in a journal entry on a company's books?

A) Service charge

B) Outstanding checks

C) A customer's check returned NSF

D) Interest earned on deposits

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fraud triangle contains three elements that must exist for accounting fraud to occur.The elements are:

A) fear,greed,and satisfaction.

B) greed,larceny,and access.

C) motive,opportunity,and means.

D) incentive,opportunity,and rationalization.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A petty cash fund is a separate checking account used to reimburse employees for expenditures they have made on behalf of the organization.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 187

Related Exams