B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is more useful to compare a company's inventory turnover with its own results from prior periods than with the results of other companies:

A) because companies may use different accounting methods which may cause the turnovers to vary significantly.

B) because larger companies' ratios are not comparable with smaller companies' ratios.

C) on extremely rare occasions.Little information can be gleaned from comparing a company's current and prior period results.

D) because knowing the results of other companies does not help you manage or evaluate the company in which you are interested.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If companies are required to adopt IFRS,companies will:

A) no longer be able to use FIFO.

B) have to switch to FIFO.

C) have to switch to weighted average cost.

D) no longer be able to use LIFO.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lux Company uses a periodic inventory system.The company started the month with 20 lamps in its beginning inventory that cost $30 each.During the month,Lux purchased 80 additional lamps for $31 each.At the end of the month,Lux counted its inventory and found that 25 lamps remained unsold.If Lux uses the weighted average cost method,its cost of goods sold for the month is:

A) $2,287.50.

B) $770.00.

C) $2,305.00.

D) $2,310.00.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inventory is updated periodically,which of the equations is correct?

A) Cost of goods sold = Beginning inventory + Purchases − Ending inventory

B) Cost of goods sold = Beginning inventory + Purchases + Ending inventory

C) Beginning inventory + Purchases = Ending inventory

D) Ending inventory = Beginning inventory + Purchases + Cost of goods sold

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company has inventory which is subject to gradually increasing prices,the use of the LIFO method of valuing inventory will result in the:

A) highest amount of assets and the lowest amount of net income.

B) highest amount of assets and the highest amount of net income.

C) lowest amount of assets and the highest amount of net income.

D) lowest amount of assets and the lowest amount of net income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

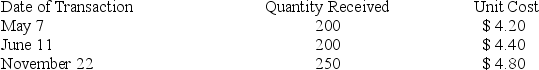

Windrose,Inc.uses a periodic inventory system and its inventory records contain the following information: The company sold 2,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 1,000 units were in its ending inventory at the end of the year. If Windrose uses the weighted average inventory costing method,what is the cost of its ending inventory? (Round the per unit cost to 2 decimal places and then round your answer to the nearest whole dollar. )

A) $8,400

B) $5,400

C) $2,800

D) $2,730

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because LIFO uses older costs for inventory,in times of rising units costs:

A) LIFO results in a higher book value of inventory and lower inventory turnover ratio than FIFO.

B) LIFO results in a lower book value of inventory and lower inventory turnover ratio than FIFO.

C) LIFO results in a higher book value of inventory and higher inventory turnover ratio than FIFO.

D) LIFO results in a lower book value of inventory and higher inventory turnover ratio than FIFO.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about an auto manufacturer's inventory is not correct?

A) Tires,batteries,glass,paint,headlamp bulbs,and electric wiring would be included in raw materials inventory.

B) Incomplete cars that are still being processed would be included in work in process inventory.

C) Finished cars ready to be shipped to dealers would be included in finished goods inventory.

D) Cars that have been sold to dealers would be included in finished goods inventory.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Days to sell measures the average number of:

A) times per year inventory is purchased.

B) days' sales in accounts payable.

C) times per year receivables are collected.

D) days from the time inventory is purchased to the time it is sold.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about inventory measures is not correct?

A) If the inventory turnover ratio increases,the days to sell measure decreases.

B) The days to sell measure can help managers make ordering decisions for inventory.

C) A higher inventory turnover ratio indicates that inventory is moving more quickly from purchase to sale.

D) It is rare for a company with a lower gross profit percentage to have a faster inventory turnover.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Valuing inventory under LIFO may produce different results depending on whether a perpetual or periodic inventory system is used.

B) Valuing inventory under the weighted average cost method always produces the same results using either a perpetual or periodic inventory system.

C) Valuing inventory under FIFO may produce different results depending on whether a perpetual or periodic inventory system is used.

D) Using the specific identification method will produce different results depending on whether perpetual or periodic inventory system is used.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will occur when inventory costs are decreasing?

A) FIFO will result in a lower net income but a higher ending inventory than will LIFO.

B) FIFO will result in a higher net income but a lower ending inventory than will LIFO.

C) FIFO will result in a lower net income and a lower ending inventory than will LIFO.

D) FIFO will result in a higher net income and a higher ending inventory than will LIFO.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FIFO uses the ________ cost for cost of goods sold on the income statement and the ________ cost for inventory on the balance sheet.

A) newest;newest

B) newest;oldest

C) oldest;oldest

D) oldest;newest

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Laurel Corporation starts the year with a beginning inventory of 600 units at $5 per unit.The company purchases 1,000 units at $4 each in February and 400 units at $6 each in October.Laurel sells 300 units during the year.Laurel has a periodic inventory system and uses the FIFO inventory costing method.What is the amount of cost of goods sold?

A) $1,200

B) $1,868

C) $1,500

D) $1,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company can use different methods for inventories that differ in nature or use.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally accepted accounting principles (GAAP) require that the inventory be reported at:

A) market value.

B) historical cost.

C) lower of cost or market/net realizable value.

D) retail value.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alphabet Company,which uses the periodic inventory method,purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February,it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A,D,E,H,J and N in October.There were no additional purchases or sales during the remainder of the year. If Alphabet Company uses the FIFO method,what is the cost of its ending inventory?

A) $24

B) $42

C) $58

D) $76

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardware Inc.has a periodic inventory system and uses the weighted average method.The company began the year with 150 large brass switch plates on hand at a cost of $4.00 each.Purchases of switch plates during the year were as follows:  The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

A) $3,990

B) $2,508

C) $2,480

D) $2,560

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If inventory is sold with terms of FOB shipping point,the goods belong to the seller while in transit.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 218

Related Exams