A) Inventory costing method that uses the weighted average unit cost of the goods available for sale for both cost of goods sold and ending inventory.

B) The inventory that starts the manufacturing process.

C) Inventory costing method that assumes that the costs of the last goods purchased are the costs of the first goods sold.

D) Beginning Inventory + Purchases - Ending Inventory

E) Inventory costing method that identifies the cost of the specific item that was sold.

F) A valuation rule that requires Inventory to be written down when its market value falls below its cost.

G) Goods that are held for sale in the normal course of business or are used to produce other goods for sale.

H) The difference between net sales and cost of goods sold.

I) Inventory that was in process and now is completed and ready for sale.

J) Beginning Inventory + Purchases - Cost of Goods Sold

K) Requires that if LIFO is used on the income tax return,it also must be used in financial statement reporting.

L) Goods that are in the process of being manufactured.

M) The expense that follows directly after Net Sales on a multiple step income statement.

N) Consists of products acquired in a finished condition,ready for sale without further processing.

O) Inventory costing method that assumes that the costs of the first goods purchased are the costs of the first goods sold.

P) A measure of the average number of days from the time inventory is bought to the time it is sold.

Q) Inventory items being transported.

R) Goods a company is holding on behalf of the goods' owner.

S) How many times (on average) that inventory has been bought or sold.

U) D) and R)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alphabet Company,which uses the periodic inventory method,purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February,it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A,D,E,H,J and N in October.There were no additional purchases or sales during the remainder of the year. If Alphabet Company uses the weighted average method,what is the cost of its ending inventory? (Round the per unit cost to two decimal places and then round your answer to the nearest whole dollar. )

A) $38

B) $48

C) $67

D) $75

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most common sources of misstatement in financial statements is the:

A) use of alternating inventory costing methods.

B) failure to write down inventory when the market value is below cost.

C) failure to report stock issues appropriately.

D) incorrectly calculating the inventory turnover ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Lower of cost or market can be applied on an item or total inventory basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sun Concepts sells and installs solar energy products.Information from the financial statements for the last two years revealed the following: The inventory turnover ratio in Year 1 was:

A) 0.18 times

B) 6.37 times

C) 4.84 times

D) 5.50 times

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

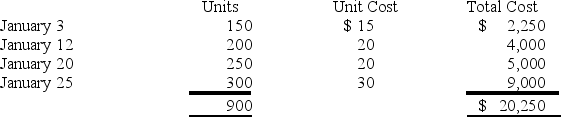

Nordic Industries uses a periodic inventory system.During its first month of operations,Nordic Industries purchased inventory as follows:  There were 100 units in ending inventory on January 31.

Under the FIFO cost method,what is the cost of goods sold for January?

There were 100 units in ending inventory on January 31.

Under the FIFO cost method,what is the cost of goods sold for January?

A) $17,250

B) $16,500

C) $18,750

D) $18,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method will result in the same cost of goods sold amount whether it is computed using the periodic inventory system or the perpetual inventory system?

A) LIFO

B) Weighted average cost

C) FIFO

D) None of the above because periodic and perpetual inventory systems always produce different amounts.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market value of goods in inventory is $26,000 below its cost,the company should:

A) do nothing,because assets are reported at their original purchase price.

B) credit Inventory for $26,000.

C) debit Inventory for $26,000.

D) use the weighted average cost method since that method provides a more accurate indicator of current value.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When costs to purchase inventory are rising,using LIFO leads to reporting a ________ than FIFO.

A) lower value for inventory on the balance sheet

B) higher value for inventory on the balance sheet

C) lower value for inventory on the income statement

D) higher value for inventory on the income statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory shipped FOB destination and in transit on the last day of the year should be included in:

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory shipped FOB shipping point and in transit on the last day of the year should be included in:

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nordic Industries uses a periodic inventory system.During its first month of operations,Nordic Industries purchased inventory as follows:  There were 100 units in ending inventory on January 31.

Under the LIFO cost method,what is the cost of goods sold for January?

There were 100 units in ending inventory on January 31.

Under the LIFO cost method,what is the cost of goods sold for January?

A) $17,250

B) $19,500

C) $18,750

D) $18,000

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Sparks Furniture Company carries three lines of sofas.Information about the sofa inventory as of the end of its most recent fiscal year follows.If LCM/NRV is applied to each separate product line,what is the amount of the adjustment that must be made to the company's inventory?

A) $6,250

B) ($35,750)

C) ($25,500)

D) ($29,500)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about inventory costing methods is correct?

A) A change in inventory method is allowed only if it improves the accuracy of the company's financial results.

B) During a period of rising prices,LIFO results in a higher income tax expense than does FIFO.

C) International Financial Reporting Standards (IFRS) allow the use of LIFO but not FIFO.

D) In the U.S. ,if a company uses LIFO on the income tax return,it may use a different method for financial reporting.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Ball Corp.writes down its inventory,its:

A) cost of goods sold will decrease.

B) net income will increase.

C) current assets will decrease.

D) stockholders' equity will increase.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Acme Company's balance sheet shows three inventory accounts-raw materials,work in process,and finished goods.Acme Company must be a:

A) manufacturer.

B) merchandiser.

C) service business.

D) wholesale distributor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

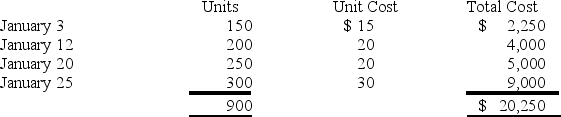

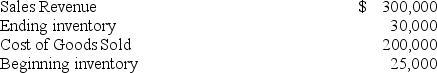

Barron Industries has the following information:  What is Barron's number of days to sell?

What is Barron's number of days to sell?

A) 33.5 days

B) 36.5 days

C) 50.2 days

D) 54.8 days

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The records of Alberta Inc.included the following information: What is the number of days to sell?

A) 91.25 days

B) 94.30 days

C) 88.16 days

D) 182.50 days

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pearl Company has a perpetual inventory system.The company uses the FIFO method to assign costs to inventory and cost of goods sold.Consider the following information: What amounts would be reported as cost of goods sold and ending inventory for April?

A) Cost of goods sold $6,250;Ending inventory $1,750.

B) Cost of goods sold $7,550;Ending inventory $2,250.

C) Cost of goods sold $5,500;Ending inventory $2,500.

D) Cost of goods sold $6,000;Ending inventory $2,000.

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Langston Company updates its inventory periodically.The company's cost of goods sold was $2,700 and purchases were $5,600 during the year.The company's ending inventory count was $5,000.What was the amount of beginning inventory?

A) $3,300

B) $13,300

C) $7,900

D) $2,100

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 218

Related Exams