A) an indication of a contra-equity account.

B) called an Accumulated Deficit.

C) called a net loss.

D) impossible.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct about reissuing treasury stock?

A) If treasury stock is sold at a higher price than the stock's cost when the company reacquired it,a gain will be recognized.

B) If treasury stock is sold at a higher price than the stock's par value,a gain will be recognized.

C) If the treasury stock is sold at a lower price than the amount of the original issuance,a loss will be recognized.

D) A gain or loss on the reissuance of treasury stock is never recognized.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The price-earnings ratio reveals information about the stock market's expectations for a company's future growth in earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has net income of $5.6 million and earnings per share of $2.00.Average common stockholders' equity is $32 million.The company's current stock price is $10 per share.What is its Price/Earnings (P/E) ratio?

A) 0.2

B) 5.0

C) 0.175

D) 5.7

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Income Investment

A) A company that is like a partnership in nature except that it has limited liability.

B) A company that has a separate legal identity from its owners.

C) A company that issues stock on one of the major stock exchanges.

D) When companies are obligated to pay preferred stockholders past dividends not yet distributed before paying dividends to owners of common stock.

E) The nominal value per share of stock set by the company's charter.

F) The current stock price.

G) A stock that is currently selling for its original issue price.

H) Stock of companies that tend to pay relatively high dividends compared to the stock price.

I) Stock of companies that tend to reinvest earnings to provide for greater future sales and profits.

J) When stockholders prefer to receive dividends at the end of the year rather than each quarter.

K) An unincorporated business that is owned by a single individual.

L) When preferred stockholders are paid dividends before other stockholders.

M) An unincorporated business owned by two or more individuals.

O) D) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following events would not require a journal entry on a corporation's books?

A) 2-for-1 stock split

B) 100% stock dividend

C) 2% stock dividend

D) $1 per share cash dividend

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Corporation

A) A company that is like a partnership in nature except that it has limited liability.

B) A company that has a separate legal identity from its owners.

C) A company that issues stock on one of the major stock exchanges.

D) When companies are obligated to pay preferred stockholders past dividends not yet distributed before paying dividends to owners of common stock.

E) The nominal value per share of stock set by the company's charter.

F) The current stock price.

G) A stock that is currently selling for its original issue price.

H) Stock of companies that tend to pay relatively high dividends compared to the stock price.

I) Stock of companies that tend to reinvest earnings to provide for greater future sales and profits.

J) When stockholders prefer to receive dividends at the end of the year rather than each quarter.

K) An unincorporated business that is owned by a single individual.

L) When preferred stockholders are paid dividends before other stockholders.

M) An unincorporated business owned by two or more individuals.

O) G) and M)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the best investment?

A) A company that pays no dividends,but has substantial net income.

B) A company that pays substantial dividends,but whose earnings per share has been declining over the past several years.

C) A company whose stock price has increased steadily,but pays no dividends.

D) It depends on one's investment objectives.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Treasury Stock

A) Stock shares that pay a fixed dividend rate but have no voting rights.

B) The shares of stock held by stockholders.

C) Stock that allows owners to be listed among creditors.

D) This payment raises stockholders' equity.

E) This payment decreases stockholders' equity.

F) The shares of stock held by the issuing company.

G) Earnings per share that reflects treasury and preferred stock.

H) (Net income less preferred dividends) divided by average stockholders' equity.

I) This dividend does not reduce stockholders' equity.

J) Stockholders' entitlement to remaining assets after creditors are repaid.

K) The additional shares of stock a company can issue beyond what are already issued.

L) (Net income less preferred dividends) divided by the average number of outstanding common shares.

M) When a company first starts selling stock to the public.

O) G) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettygrove Company had 600,000 shares of $10 par value common stock outstanding.The amount of additional paid-in capital is $3,000,000,and Retained Earnings is $900,000.The company issues a 2-for-1 stock split.The market price of the stock is $26.What is the balance in the Common Stock account after this issuance?

A) $12,000,000

B) $13,800,000

C) $6,000,000

D) $9,000,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically,a profitable company that pays relatively high dividends:

A) is an attractive investment for those seeking a steady income,like retired people.

B) will reinvest more profit which can lead to smaller growth potential.

C) will experience more growth in stock price over time.

D) is a bad investment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buffalo Butter Co.had 40,000 shares of $4 par value common stock outstanding on January 1.On January 20,the company purchased 4,000 of its stock for $16 per share.On July 3,the company reissued 2,000 of the shares at $20 per share.Buffalo Butter uses the cost method to account for its treasury stock. What journal entry will record the purchase of the stock on January 20?

A) Debit Treasury Stock for $16,000,debit Additional Paid-in Capital for $48,000,and credit Cash for $64,000.

B) Debit Treasury Stock and credit Cash for $64,000.

C) Debit Treasury Stock for $16,000,debit Common Stock for $48,000,and credit Cash for $64,000.

D) Debit Common Stock and credit Cash for $64,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation's board of directors could prefer a stock split to a stock dividend because a stock split:

A) increases the market price of the stock.

B) reduces Retained Earnings,so the company pays less taxes.

C) does not reduce Retained Earnings,so it does not reduce the ability to declare a cash dividend in the future.

D) increases total stockholders' equity and allows the corporation more flexibility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ROE relates:

A) net income after subtracting preferred dividends to the average common stockholders' equity.

B) total assets to the average common stockholders' equity.

C) EPS to the average common stockholders' equity.

D) net income after subtracting preferred dividends to the price per share.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

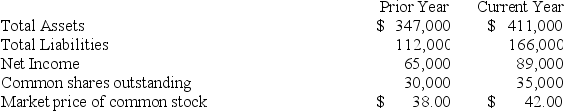

The information below was extracted from the most recent financial statements of Milton Technologies (in millions,except for stock price) :  What is the EPS for the company's stock for the current year?

What is the EPS for the company's stock for the current year?

A) $2.74

B) $2.37

C) $2.54

D) $2.97

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Outstanding Shares

A) The total number of shares currently owned by stockholders.

B) The amount above the par value of the stock that owners paid the issuer for the stock.

C) When employees of a company have the opportunity to buy a company's stock in the future at a fixed price.

D) The date on which a company determines who receives a dividend.

E) The date on which a liability is recorded for a dividend.

F) When a company sells issues of stock after its IPO.

G) When owners of the company contribute additional capital beyond what they paid for their stock.

H) When cash or stock dividends are issued according to the proportion of stock owned.

I) The date on which a company authorizes a dividend payment.

J) The date on which a company debits dividends payable and credits cash.

K) Dividends that have not had income tax withheld from them.

L) The total number of shares the company has sold,whether held by stockholders or by the company.

M) The accumulation of all the past dividends the company has not paid.

N) When cash or stock dividends are issued in an equal dollar or share amount per stockholder.

P) F) and I)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company issues 12 million shares to investors and later repurchases 3 million shares.The number of issued shares after these transactions have been accounted for is:

A) 12 million shares.

B) 11 million shares.

C) 9 million shares.

D) 5 million shares.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

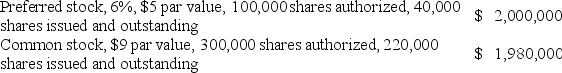

Brazee Company has the following paid-in capital:  If the company pays a $30,000 dividend and the preferred stock is noncumulative,what is the amount the common stockholders will receive?

If the company pays a $30,000 dividend and the preferred stock is noncumulative,what is the amount the common stockholders will receive?

A) $30,000

B) $18,000

C) $19,800

D) $0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When should a corporation record a liability for dividends in arrears on its cumulative preferred stock?

A) When the dividends have been declared.

B) When the corporation knows it will not be paying dividends.

C) When recording year-end adjusting entries.

D) Never.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ownership structure can vary from one company to another,but the most basic form of corporation offers:

A) preferred stock.

B) net income.

C) treasury stock.

D) common stock.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 278

Related Exams