A) report Dividends Payable.

B) report Dividends Arrears Payable.

C) not report any Dividends Payable.

D) report Dividends Expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barbur,Inc.reported net income of $12 million.During the year the average number of common shares outstanding was 3 million.The price of a share of common stock at the end of the year was $5.There were 400,000 shares of preferred stock outstanding on average and no dividends were declared and the preferred stock is noncumulative. The EPS is approximately:

A) $0.80.

B) $3.52.

C) $3.72.

D) $4.00.

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Advantages of the corporate form include all of the following except:

A) easy to raise capital.

B) shares can be purchased in small amounts.

C) ownership interests are transferrable.

D) legal liability of its owners is unlimited.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -ROE

A) Stock shares that pay a fixed dividend rate but have no voting rights.

B) The shares of stock held by stockholders.

C) Stock that allows owners to be listed among creditors.

D) This payment raises stockholders' equity.

E) This payment decreases stockholders' equity.

F) The shares of stock held by the issuing company.

G) Earnings per share that reflects treasury and preferred stock.

H) (Net income less preferred dividends) divided by average stockholders' equity.

I) This dividend does not reduce stockholders' equity.

J) Stockholders' entitlement to remaining assets after creditors are repaid.

K) The additional shares of stock a company can issue beyond what are already issued.

L) (Net income less preferred dividends) divided by the average number of outstanding common shares.

M) When a company first starts selling stock to the public.

O) F) and K)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Crystal Spring Company's P/E ratio is 24 and the company's EPS is $.75,then the company's stock price is:

A) $18.00.

B) $12.75.

C) $8.00.

D) $3.13.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation had 10,000 shares of $10 par value common stock outstanding.The board of directors declared and issued a 10% stock dividend.The market value of the stock was $20 per share.What is the journal entry to record this stock dividend?

A) Debit Retained Earnings and credit Common Stock for $20,000.

B) Debit Retained Earnings and credit Common Stock for $10,000.

C) Debit Retained Earnings for $20,000,credit Common Stock for $10,000,and credit Additional Paid-in Capital for $10,000.

D) No entry is made to record the stock dividend.

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Seasoned New Issues

A) The total number of shares currently owned by stockholders.

B) The amount above the par value of the stock that owners paid the issuer for the stock.

C) When employees of a company have the opportunity to buy a company's stock in the future at a fixed price.

D) The date on which a company determines who receives a dividend.

E) The date on which a liability is recorded for a dividend.

F) When a company sells issues of stock after its IPO.

G) When owners of the company contribute additional capital beyond what they paid for their stock.

H) When cash or stock dividends are issued according to the proportion of stock owned.

I) The date on which a company authorizes a dividend payment.

J) The date on which a company debits dividends payable and credits cash.

K) Dividends that have not had income tax withheld from them.

L) The total number of shares the company has sold,whether held by stockholders or by the company.

M) The accumulation of all the past dividends the company has not paid.

N) When cash or stock dividends are issued in an equal dollar or share amount per stockholder.

P) A) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells 1 million shares of common stock with no par value for $15 a share.In recording the transaction,it would debit:

A) Cash and credit Additional Paid-in Capital for $15 million.

B) Cash and credit Common Stock for $15 million.

C) Common Stock and credit Cash for $15 million.

D) Common Stock and credit Additional Paid-in Capital for $15 million.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do stock splits and stock dividends impact Retained Earnings?

A) Stock splits increase Retained Earnings and stock dividends have no effect on Retained Earnings.

B) Stock splits have no effect on Retained Earnings and stock dividends decrease Retained Earnings.

C) Stock splits and stock dividends both decrease Retained Earnings.

D) Stock splits and stock dividends have no effect on Retained Earnings.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The journal entry to record a large stock dividend includes a:

A) debit to Retained Earnings.

B) credit to Cash.

C) debit to Common Stock.

D) credit to Additional Paid-in Capital.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock.The preferred stock has an 8% dividend rate.The board of directors declares $300,000 in total dividends for the year.Which of the following is correct if the preferred stockholders have a cumulative dividend preference?

A) Preferred stockholders will receive the entire $300,000 and they must also be paid $20,000 before the end of the current accounting period;common stockholders will receive nothing.

B) Preferred stockholders will receive $24,000 (or 8% of the total dividends) ;common stockholders will receive the remaining $276,000 (or $300,000 − $24,000) .

C) Preferred stockholders will receive the entire $300,000 and they must also be paid the remaining $20,000 sometime in the future before common stockholders will receive any dividends.

D) Preferred stockholders will receive the entire $300,000,but will receive nothing more in the future relating to this dividend declaration;common stockholders will receive nothing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically,a profitable company that pays little or no dividends:

A) is a bad investment.

B) will reinvest profits which can lead to greater growth potential.

C) will experience relatively stable stock prices over time.

D) will appeal to investors who desire distributions of profit.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -EPS

A) Stock shares that pay a fixed dividend rate but have no voting rights.

B) The shares of stock held by stockholders.

C) Stock that allows owners to be listed among creditors.

D) This payment raises stockholders' equity.

E) This payment decreases stockholders' equity.

F) The shares of stock held by the issuing company.

G) Earnings per share that reflects treasury and preferred stock.

H) (Net income less preferred dividends) divided by average stockholders' equity.

I) This dividend does not reduce stockholders' equity.

J) Stockholders' entitlement to remaining assets after creditors are repaid.

K) The additional shares of stock a company can issue beyond what are already issued.

L) (Net income less preferred dividends) divided by the average number of outstanding common shares.

M) When a company first starts selling stock to the public.

O) E) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barbur,Inc.reported net income of $12 million.During the year the average number of common shares outstanding was 3 million.The price of a share of common stock at the end of the year was $5.There were 400,000 shares of preferred stock outstanding on average and no dividends were declared and the preferred stock is noncumulative. The Price/Earnings ratio is approximately:

A) 1.00.

B) 1.25.

C) 1.42.

D) 6.25.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Income tax expense would be found on the income statement of a sole proprietorship,but not on the income statement of a corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

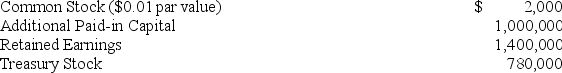

At the end of the prior year,Atoka Industries reported the following account balances:  The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in the current year,what journal entry must be prepared to record the transaction?

The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in the current year,what journal entry must be prepared to record the transaction?

A) Debit Cash for $500,000,debit Other Losses for $280,000,and credit Treasury Stock for 780,000.

B) Debit Cash for $500,000,credit Common Stock for $100,and credit Additional Paid-in Capital for $499,900.

C) Debit Cash for $500,000,debit Additional Paid-in Capital for $280,000,and credit Treasury Stock for $780,000.

D) Debit Cash and credit Treasury Stock for $500,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock:

A) does not appear on the balance sheet.

B) is a contra-equity account.

C) is an asset account.

D) is recorded as additional paid-in capital.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rights of current stockholders to purchase additional shares of newly issued stock in order to maintain the same percentage ownership is called:

A) liquidation.

B) preemptive rights.

C) cumulative preference.

D) voting rights.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is generally classified as stockholders' equity under both GAAP and IFRS.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A liability for dividends is recorded on the declaration date.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 278

Related Exams