A) 39.3%

B) 21.7%

C) 37.1%

D) 36.3%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported net income of $5.6 million.At the beginning of the year,3.4 million shares of common stock were outstanding and at the end of the year,3.6 million shares were outstanding.No dividends were declared.The EPS is approximately:

A) $1.60.

B) $1.56.

C) $1.65.

D) $1.40.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

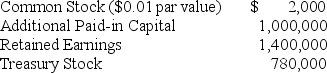

At the end of the prior year,Atoka Industries reported the following account balances:

The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in in the current year,what journal entry must be prepared to record the transaction?

The treasury stock arose from a purchase of 10,000 shares of common stock for $78 per share.If the 10,000 treasury shares are issued for $50 per share in in the current year,what journal entry must be prepared to record the transaction?

A) Debit Cash for $500,000, debit Other Losses for $280,000, and credit Treasury Stock for 780,000

B) Debit Cash for $500,000, credit Common Stock for $100, and credit Additional Paid-in Capital for $499,900

C) Debit Cash for $500,000, debit Additional Paid-in Capital for $280,000, and credit Treasury Stock for $780,000

D) Debit Cash and credit Treasury Stock for $500,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nova,Inc.is considering declaring a $100,000 cash dividend.Nova has a cash balance of $20,000 and Retained Earnings balance of $100,000.Nova should:

A) declare a cash dividend because it has enough Retained Earnings and cash.

B) declare a cash dividend because it has enough Retained Earnings.

C) not declare a cash dividend because it does not have enough Retained Earnings.

D) not declare a cash dividend because it does not have enough cash.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has 110,000 shares authorized,50,000 shares issued,and 5,000 shares of treasury stock.How many shares are outstanding?

A) 45,000

B) 155,000

C) 55,000

D) 145,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is a corporation's own stock that has been issued and subsequently repurchased by the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in Retained Earnings is:

A) an indication of a contra-equity account.

B) called an Accumulated Deficit.

C) called a net loss.

D) impossible.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock has some distinctly different characteristics from common stock.Which of the characteristics below is not related to preferred stock?

A) Its dividends may be paid at a fixed rate.

B) It has a higher priority for the distribution of assets than common stock.

C) It has a higher priority for the payment of dividends than common stock.

D) It generally has voting rights.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What journal entry will record the reissuance on July 3?

A) Debit Cash and credit Treasury Stock for $20,000

B) Debit Cash for $20,000, credit Treasury Stock for $16,000, and credit Additional Paid-in Capital for $4,000

C) Debit Cash for $20,000, credit Common Stock for $6,000, and credit Additional Paid-in Capital for $14,000

D) Debit Cash for $20,000, credit Common Stock for $16,000, and credit Gain on Reissuance of Stock for $4,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the par value of a stock represent?

A) The average market value of a stock for the year to date

B) It is a legal concept not related to the market value of a stock

C) The amount that would be paid if a stock was purchased by the issuing company

D) The current market value of a stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company does not have any accumulated other comprehensive income (loss) ,stockholders' equity is the:

A) amount the company received in exchange for all stock issued plus the amount of Retained Earnings minus the cost of treasury stock.

B) amount the company received for all stock authorized plus the amount of Retained Earnings and treasury stock.

C) par value the company received for all stock issued plus the amount of Retained Earnings minus treasury stock.

D) amount the company received for all stock when issued minus the amount of Retained Earnings and treasury stock.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend transfers:

A) contributed capital to Retained Earnings.

B) Retained Earnings to assets.

C) contributed capital to assets.

D) Retained Earnings to contributed capital.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Stock splits and stock dividends both reduce the market price of a share, but only stock splits reduce the par value of a share.

B) Stock splits and stock dividends both reduce the market price of a share and the par value of a share.

C) Stock splits and stock dividends both reduce the market price of a share, but only stock dividends reduce the par value of a share.

D) Stock splits and stock dividends both reduce the market price of a share and reduce Retained Earnings.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A stock split increases total stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock dividends and stock splits are similar in all of the following ways except:

A) they both involve a pro rata distribution of shares to existing stockholders.

B) they both reduce the stock price.

C) they both decrease Retained Earnings.

D) have no effect on cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements about earnings per share (EPS) is correct?

A) The EPS ratio is important because it signals the ability of the company to pay future dividends, which investors factor into the stock price.

B) Earnings per share (EPS) is generally reported in the balance sheet under stockholders' equity.

C) Earnings per share (EPS) is the best way to compare the performance of different companies.

D) EPS, in its basic form, is calculated by dividing net income by the average number of common shares issued.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A dividend date of record is the date on which the corporation:

A) makes no entry.

B) records an increase in Dividends Payable.

C) records a decrease in Dividends Payable.

D) records an increase in Dividends.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An LLC is different from a corporation in that an LLC has:

A) a "distribution of net income" section in its financial statements.

B) Retained Earnings in its financial statements.

C) Income Tax Expense in its financial statements.

D) Dividends in its financial statements.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cumulative dividend preference means that:

A) preferred stockholders are paid dividends before common stockholders are paid dividends for the current year only.

B) unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C) preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D) unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current period.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the advantages of a partnership is:

A) limited liability.

B) the salaries of the partners can be written off as an expense.

C) ease of formation.

D) income tax is paid by the business.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 253

Related Exams