A) Bad Debt Expense of $1,000.

B) Allowance for Doubtful Accounts of $(1,050) .

C) Allowance for Doubtful Accounts of $(950) .

D) Bad Debt Expense of $950.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kata Company uses the allowance method.On May 1,Kata wrote off a $22,000 customer account balance when it becomes clear that the particular customer will never pay.The journal entry to record the write-off on May 1 would include which of the following?

A) Debit to Bad Debt Expense and credit to Allowance for Doubtful Accounts.

B) Debit to Accounts Receivable and credit to Allowance for Doubtful Accounts.

C) Debit to Allowance for Doubtful Accounts and credit to Bad Debt Expense.

D) Debit to Allowance for Doubtful Accounts and credit to Accounts Receivable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Subsidiary Account

A) The total amount of money loaned through notes that the lender has not yet collected.

B) A system used by companies to allocate their budgets over the different operating expenses.

C) The interest that a company receives during the year divided by the principal of the loan.

D) Another name for a company's total revenue,which is calculated by multiplying the quantity sold by the average price.

E) The denominator of the receivables turnover ratio.

F) The amount of interest a lender receives during a year.

G) The costs of maintaining accounts with customers who have not made recent purchases.

H) A separate record for each accounts receivable customer.

I) Used by the percentage of credit sales method to estimate bad debts.

J) The rate at which a company pays off its liabilities or debts.

K) The numerator of the receivables turnover ratio.

L) The portion of past credit sales that have not yet been collected.

M) An accounting method which involves estimating bad debts.

N) The average level of net sales revenue the firm earns each month.

P) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Removing an uncollectible account and its corresponding allowance from the accounting records is called:

A) a write-off.

B) a write-up.

C) double entry accounting.

D) elimination accounting.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

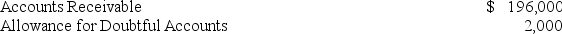

The unadjusted trial balance at the end of the year includes the following:  Both accounts have normal balances.The company uses the aging of accounts receivable method.Its estimate of uncollectible receivables resulting from the aging analysis equals $11,600.What is the amount of Bad Debt Expense to be recorded for the year?

Both accounts have normal balances.The company uses the aging of accounts receivable method.Its estimate of uncollectible receivables resulting from the aging analysis equals $11,600.What is the amount of Bad Debt Expense to be recorded for the year?

A) $11,600

B) $9,600

C) $13,600

D) $15,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When credit card sales occur,the seller may receive cash immediately,or within a few days,depending upon the specific credit card program being used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

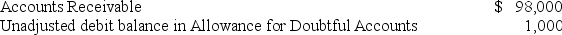

A company's unadjusted trial balance at the end of the year includes the following:  The company uses the aging of accounts receivable method.Its estimate of uncollectible receivables resulting from the aging analysis equals $5,800.What is the amount of Bad Debt Expense to be recorded for the year?

The company uses the aging of accounts receivable method.Its estimate of uncollectible receivables resulting from the aging analysis equals $5,800.What is the amount of Bad Debt Expense to be recorded for the year?

A) $5,800

B) $4,800

C) $6,800

D) $7,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The allowance method for uncollectible accounts is used for both accounts receivable and notes receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Countryside Corporation is owed $11,890 from a customer for landscaping.The account is overdue and the customer is having difficulty paying.Countryside might ask the customer to sign a note for the unpaid amount to:

A) decrease its net income for tax reporting purposes.

B) strengthen Countryside Corporation's legal right to be repaid with interest.

C) reduce its tax liability.

D) eliminate any doubts of collection of the amount due.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Notes Receivable differ from Accounts Receivable in that Notes Receivable:

A) generally charge interest from the day they are signed to the day they are collected.

B) are noncurrent assets.

C) do not have to be created for every new transaction,so they are used more frequently.

D) are generally considered a weaker legal claim.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the maturity date of a $10,000,3-month,8% note,the borrower sends a check that includes the principal and all of the interest due on the note.What is the amount of the borrower's check?

A) $10,200

B) $10,600

C) $10,800

D) $10,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Allowance for Doubtful Accounts on January 1 equals $10,000 and during the year $9,000 of specific customers' accounts were written off,then its Allowance for Doubtful Accounts will have an unadjusted balance of:

A) $1,000 credit.

B) $1,000 debit.

C) $10,000 credit.

D) $9,000 debit.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Net Sales Revenue

A) The total amount of money loaned through notes that the lender has not yet collected.

B) A system used by companies to allocate their budgets over the different operating expenses.

C) The interest that a company receives during the year divided by the principal of the loan.

D) Another name for a company's total revenue,which is calculated by multiplying the quantity sold by the average price.

E) The denominator of the receivables turnover ratio.

F) The amount of interest a lender receives during a year.

G) The costs of maintaining accounts with customers who have not made recent purchases.

H) A separate record for each accounts receivable customer.

I) Used by the percentage of credit sales method to estimate bad debts.

J) The rate at which a company pays off its liabilities or debts.

K) The numerator of the receivables turnover ratio.

L) The portion of past credit sales that have not yet been collected.

M) An accounting method which involves estimating bad debts.

N) The average level of net sales revenue the firm earns each month.

P) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjusting entry to record the estimated bad debts in the period credit sales occur includes a debit to an:

A) asset account and a credit to a liability account.

B) expense account and a credit to an asset account.

C) expense account and a credit to a revenue account.

D) expense account and a credit to a contra-asset account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the adjusting entry to accrue interest of $1,000 on a note receivable is omitted,then:

A) assets,net income,and stockholders' equity are overstated by $1,000.

B) assets,net income,and stockholders' equity are understated by $1,000.

C) liabilities are understated by $1,000,net income is overstated by $1000,and stockholders' equity is overstated by $1,000.

D) assets are overstated,net income is understated,and stockholders' equity is understated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marconi Co.has the following information available for the current year: What was the amount of write-offs during the year?

A) $93,000

B) $67,500

C) $82,500

D) $60,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the allowance method is used,the entry to record the write-off of specific uncollectible accounts would decrease:

A) the Allowance for Doubtful Accounts account.

B) Net Income.

C) Accounts Receivable,Net.

D) Bad Debt Expense.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the interpretation of the receivables turnover ratio is not correct?

A) Analysts often interpret a sudden increase in the receivables turnover ratio as a signal of a developing problem.

B) The smaller the receivables turnover ratio the larger the days to collect.

C) A change in the receivables turnover ratio may indicate a change in the company's credit granting policies.

D) A change in the receivables turnover ratio may indicate a change in economic conditions.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of uncollectible accounts at the end of the year is estimated to be $25,000,using the aging of accounts receivable method.The balance in the Allowance of Doubtful Accounts account is an $8,000 credit before adjustment.What is the adjusted balance of the Allowance for Doubtful Accounts at the end of the year?

A) $8,000

B) $17,000

C) $25,000

D) $33,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and its definition.There are more definitions than terms. -Allowance for Doubtful Accounts

A) The process of removing specific customers' accounts deemed uncollectible.

B) When a company increases the amount of accounts receivable by adding the interest earned as accounts age without being collected.

C) How much money you can expect to earn over a period of time selling your goods.

D) Selling accounts receivable to another company for immediate cash.

E) Credit that a company receives when one good is exchanged for another.

F) Also known as net accounts receivable.

G) The length of the credit period and any discounts offered for prompt payment.

H) The amount of money lent.

I) A method of estimating uncollectible debts by forecasting the probability of not collecting late accounts.

J) The interest earned by money over a period of time.

K) A method of estimating uncollectible debts by looking at the historical average of credit sales not collected.

L) The account in which the estimated amount of accounts receivable expected to be uncollectible is recorded.

N) C) and L)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 240

Related Exams