A) is a preliminary financial statement for external and internal users.

B) generally lists account names in alphabetical order.

C) is created to determine that total debits equal total credits.

D) indicates whether or not errors were made in recording transactions.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Rainbow House Painting Company has been contracted to paint a house for $3,600.One-half of that amount will be paid up front;the rest will be paid upon satisfactory completion.Rainbow should recognize the revenue when:

A) the performance obligation is identified.

B) the first payment is received.

C) the contract is identified.

D) the performance obligation is satisfied.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company decides to record an expenditure made this period as an expense,when it should have been recorded as an asset,net income will be overstated in the current period as a result.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would increase the net profit margin in the current year?

A) Postpone routine maintenance work that was to be done this year.

B) Increase the amount of research and development in the last month of the year.

C) Postpone the purchase of supplies to the first month of the following year.

D) Postpone dividends to stockholders.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 30,Sugar Co.received a bill for $4,200 for running a newspaper ad in June.The bill will be paid in July.Which of the following statements is correct for June?

A) Liabilities are decreased by $4,200.

B) Assets are increased by $4,200.

C) Expenses are increased by $4,200.

D) Revenues are decreased by $4,200.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be reported on the income statement?

A) Utilities expense in the amount of a bill received for utilities used during the current period but unpaid as of the end of the period.

B) Rent expense in the amount of rent paid during the period for use of a storage facility in the current period.

C) Revenue for services provided to customers who promise to pay in the next period.

D) Cost of land purchased with cash for future use.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wave Company receives $18,000 in advance this month for work to be performed next month.This month,the company should record a journal entry that includes a debit to:

A) Cash and a credit to Service Revenue for $18,000.

B) Cash and a credit to Deferred Revenue for $18,000.

C) Cash and a credit to Accounts Receivable for $18,000.

D) Prepaid Services and a credit to Cash for $18,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will have no effect on total assets?

A) Billing a customer for work performed during the current month

B) Receiving cash from a customer to pay for a previously recorded account receivable

C) Receiving cash from a customer for work to be performed next month

D) Receiving cash from a customer for work performed today

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During March,Perpetual Envy Inc.provides $46,000 in consulting services for a customer.The customer paid $24,000;the other $22,000 was on account.Which of the following statements about these transactions is correct?

A) Cash increases by $24,000,Consulting Revenue increases by $22,000,and Accounts Receivable increases by $46,000.

B) Cash increases by $24,000,Accounts Receivable increases by $22,000,and Consulting Revenue increases by $46,000.

C) Accounts Receivable increases by $22,000,Liabilities decrease by $24,000,and Stockholders' Equity increases by $2,000.

D) Revenues increase by $24,000,liabilities decrease by $24,000,and Stockholders' Equity is unchanged.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

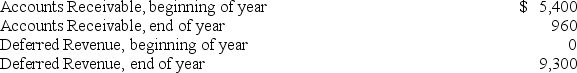

A company reported sales revenue,all of which arose from credit sales,of $48,000 on the income statement.Balance sheet information includes the following:  How much cash was collected from customers during the year?

How much cash was collected from customers during the year?

A) $13,740.

B) $61,740.

C) $52,440.

D) $45,840.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about revenues and expenses is correct?

A) Credits increase both revenues and expenses.

B) Credits increase expenses and decrease revenues.

C) Credits increase revenues and decrease expenses.

D) Credits decrease both revenues and expenses.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following line items appear on an income statement?

A) Accounts Payable

B) Equipment

C) Utilities Expense

D) Retained Earnings

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expense recognition principle ("matching") matches:

A) cash receipts with cash disbursements.

B) expenses with the revenues to which they relate.

C) assets with liabilities.

D) prepaid expenses with deferred revenues.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An unadjusted trial balance:

A) cannot be used to prepare financial statements.

B) is prepared after end-of-period adjustments have been made.

C) will not reflect up-to-date information for income taxes.

D) contains final amounts for assets and liabilities,but not for revenues and expenses.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term and the explanation.There are more definitions than terms. -Net Profit Margin

A) The concept that expenses should be reported at the same time as the related revenue.

B) Reported when a company sells goods or services in the ordinary course of business for more than it costs to produce.

C) A company's policy on when to report revenue in the financial statements.

D) A ratio that indicates the percent of each revenue dollar that is left over after covering costs and expenses.

E) Reporting expenses and revenue according to the time the underlying activities occur.

F) A liability account indicating customers have already paid for services not yet rendered.

G) The principle that changes in assets must be matched by changes in liabilities and equity.

H) An indication that a company has already paid a cost not yet incurred.

I) A list of account balances when the accounts do not yet include all revenues and expenses.

J) Also known as net assets,this is the value of assets minus liabilities.

K) Reporting expenses and revenues according to the time the money is paid or received.

M) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenues are increased with:

A) debits because they decrease stockholder's equity.

B) credits because they decrease stockholder's equity.

C) credits because they increase stockholder's equity.

D) debits because they increase stockholder's equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume accrual basis accounting is used.Which of the following statements about income statement accounts is correct?

A) Costs incurred to help generate revenue are only reported as expenses on the income statement if they are paid in cash in the same period as the revenue received.

B) Revenue accounts are shown after the amount of expense accounts on the income statement.

C) Revenue accounts include Cash,Accounts Receivable,and Deferred Revenue.

D) There is no Net Income account.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about net income is correct?

A) Net income equals the amount of cash generated by the business during the reporting period.

B) Net income represents the change in the market value of the company's stock during the period.

C) Measurement of net income involves only counting.

D) Measurement of net income involves estimations.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would eventually cause Retained Earnings to increase?

A) Receiving cash for services provided in a prior month

B) Incurring utilities that will be paid for next month

C) Receiving cash for services to be provided next month

D) Performing services for which cash will be received next month

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents an account rather than a subtotal?

A) Net Income

B) Total Revenues

C) Total Expenses

D) Service Revenue

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 233

Related Exams