Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public corporations are businesses:

A) owned by two or more people,each of whom is personally liable for the debts of the business.

B) whose stock is bought and sold on a stock exchange.

C) whose stock is bought and sold privately.

D) where stock is not used as evidence of ownership.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Investing Activities

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

O) A) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first year of operations for a company was Year 1.The net income for Year 1 was $20,000 and dividends of $12,000 were paid.In Year 2,the company reported net income of $34,000 and paid dividends of $5,000.At the end of Year 1,the company had total assets of $150,000.At the end of Year 2,the company had total assets of $240,000. What is the amount of retained earnings at the end of Year 2?

A) $37,000

B) $240,000

C) $29,000

D) $269,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Information that always makes a difference in a decision is:

A) cash based.

B) audited.

C) provided by GAAP.

D) relevant.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amounts earned by selling goods or services to customers are called:

A) revenues.

B) expenses.

C) dividends.

D) common stocks.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

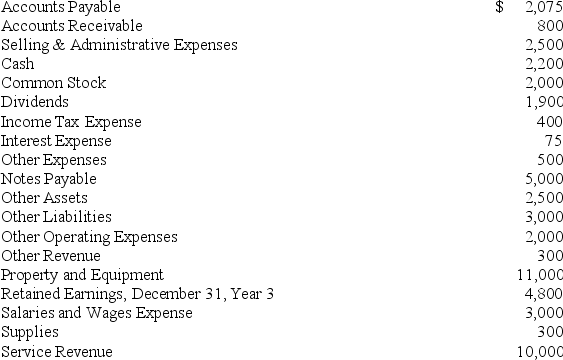

The following accounts are taken from the December 31,Year 4 financial statements of a company.  What is the amount of net income for Year 4?

What is the amount of net income for Year 4?

A) $3,825

B) $1,825

C) $10,300

D) $5,625

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Revenue is reported on the income statement only if cash was received at the point of sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sole proprietorship is:

A) a separate legal and accounting entity from its owner(s) .

B) owned and operated by one individual.

C) considered a public company.

D) can easily raise large amounts of capital for growth.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about a company's fiscal year is correct?

A) All companies have a December 31 year end.

B) It usually corresponds to a company's slow period.

C) It always corresponds to the calendar year.

D) The Financial Accounting Standards Board assigns a year-end to each company.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an expense?

A) Wages of employees

B) Interest incurred on a note payable

C) Dividends

D) Corporate income tax

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be reported on the income statement for Year 2?

A) Supplies that were purchased and used in Year 1 but paid for in Year 2.

B) Supplies that were purchased in Year 1,but used in Year 2.

C) Dividends that were paid in Year 2.

D) Accounts Receivable as of December 31,Year 2.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of beginning retained earnings is equal to the:

A) beginning retained earnings of the prior year.

B) ending retained earnings of the prior year.

C) beginning retained earnings of the next year.

D) ending retained earnings of the next year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Common Stock is reported as an asset on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The separate entity assumption assumes:

A) the financial reports of a business include only the results of that business's activities.

B) assets equal liabilities plus stockholder's equity.

C) revenues and expenses are reported in separate sections of a company's income statement.

D) assets are reported in a separate financial statement from liabilities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Directors of a corporation:

A) want to ensure they will be paid for the goods and services they deliver.

B) oversee managers to ensure their decisions are in the best interests of its stockholders.

C) assess the financial strength of a business and attempt to estimate its value.

D) are responsible for the functioning of stock markets and ensuring that taxes are correctly computed.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

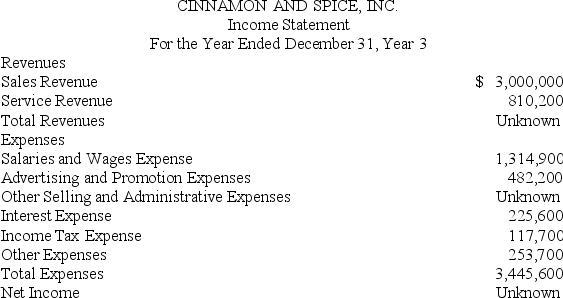

Find the missing data.

A) Total revenues are $3,810,200,other selling and administrative expenses are $1,051,500,and net income is $364,600.

B) Total revenues are $2,495,300,other selling and administrative expenses are $1,051,500,and net income is ($950,300) .

C) Total revenues are $364,600,other selling and administrative expenses are $3,081,000,and net income is $7,255,800.

D) Total revenues are $3,810,200,other selling and administrative expenses are $364,600,and net income is $7,255,800.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An economic resource that is owned by a company and will provide future benefits is referred to as:

A) revenue.

B) an asset.

C) retained earnings.

D) net income.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main goal of both U.S.GAAP and IFRS is to:

A) ensure that companies produce useful information for capital providers.

B) reduce the number of required financial statements.

C) prevent all fraud and ensure the amounts reported are precise to the penny.

D) ensure that companies become more profitable.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial statements is not correct?

A) Cash flows from financing activities would appear on the Statement of Cash Flows.

B) Dividends would appear on the Statement of Retained Earnings.

C) Assets would appear on the Income Statement.

D) Revenues would appear on the Income Statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 228

Related Exams