A) Financing activity

B) Operating activity

C) Investing activity

E) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

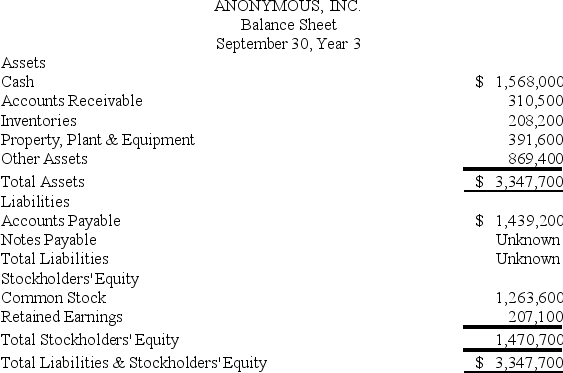

A company's balance sheet contained the following information: Notes Payable is the only other item on the balance sheet.Notes Payable must equal:

A) $400,000.

B) $16,000.

C) $144,000.

D) $688,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of September 30,Year 3,who provided more financing for Anonymous,Inc.?

As of September 30,Year 3,who provided more financing for Anonymous,Inc.?

A) Owners

B) Creditors

C) Both provided equal financing

D) Neither provided any financing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Faithful representation is a characteristic of external financial reporting that means:

A) the financial reports of a business are assumed to include the results of only that business's activities.

B) financial information can be compared across businesses because similar accounting methods are applied.

C) the results of business activities are reported using an appropriate monetary unit.

D) financial information depicts the economic substance of business activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the use of financial statements is not correct?

A) When choosing between a company that pays steady dividends and one that retains its earnings to support future growth,investors will always choose the company that pays steady dividends.

B) Companies can develop reputations for honest financial reporting even when conveying bad news.

C) Trends in a company's net income from year to year can provide clues about its future earnings,which can help investors to decide whether to buy stock in the company.

D) Information in the notes to the financial statements can influence a user's interpretation of balance sheet and income statement information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Blair Industries had $24 million in revenue and net income of $6 million,then its:

A) expenses must have been $30 million.

B) expenses must have been $18 million.

C) assets must have been $24 million.

D) assets must have been $6 million.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's financial records at the end of the year included the following amounts: What is the amount of total assets to be reported on the balance sheet at the end of the year?

A) $112,000

B) $102,000

C) $119,000

D) $155,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Puffin Co.began the year with assets of $120,000 and liabilities of $90,000.During the year assets increased by $14,400 and liabilities decreased by $10,800. What is the amount of the change in Puffin's stockholders' equity during the year?

A) $3,600 increase

B) $25,200 increase

C) $25,200 decrease

D) $3,600 decrease

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction would be reported on the income statement for the current year?

A) The revenue earned from selling sold goods in the current year to customers who have not yet paid for those goods (that is,they have promised to pay for those goods next year) .

B) The amount of cash received from customers this year as payment for goods that were sold to those customers last year.

C) The proceeds from a borrowing from the bank that was to be used to finance business activities during the current year.

D) The proceeds from the issuance of common stock to owners that was to be used to finance business activities during the current year.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income appears on which of the following financial statements?

A) Balance sheet and income statement

B) Balance sheet and statement of retained earnings

C) Balance sheet and statement of cash flows

D) Income statement and statement of retained earnings

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the format of financial statements is correct?

A) A double underline is drawn below the subtotal for Total Liabilities on the balance sheet.

B) Dollar signs are omitted if the heading states that amounts are reported in U.S.dollars.

C) Dividends are shown in parentheses on the statement of retained earnings.

D) The order of the items included in the heading of each financial statement is as follows: the name of the business,the time period covered by the financial statement,and the title of the report.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

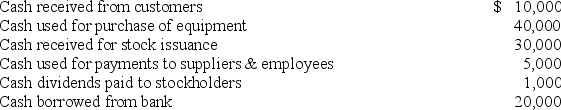

The Statement of Cash Flows for the current year contained the following:  The change in cash for the current year was an increase of $14,000.

What is the amount of cash flows from (used in) financing activities?

The change in cash for the current year was an increase of $14,000.

What is the amount of cash flows from (used in) financing activities?

A) ($40,000)

B) $5,000

C) $49,000

D) $10,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company began the year with assets of $200,000,liabilities of $40,000,and stockholders' equity of $160,000.During the year assets increased $110,000 and stockholders' equity increased $40,000.What was the change in liabilities for the year?

A) Increase of $150,000

B) Increase of $70,000

C) Decrease of $150,000

D) Decrease of $70,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.(There are more definitions than terms. ) -Investors

A) A procedure by which independent evaluators assess the accounting procedures and financial reports of a company.

B) An example of external users of financial statements.

C) Activities directly related to running the business to earn a profit.

D) When a company acquires money from investors.

E) A financial statement that summarizes a company's past and current cash situation.

F) Transactions with lenders (borrowing and repaying cash) and stockholders (selling company stock and paying dividends) .

G) The total amount of profits that are kept by the company.

H) The idea that the financial statements of a company include the results of only that company's business activities.

I) The idea that a company should report its financial data in the relevant currency.

J) Borrowing money from lenders.

K) A financial statement showing a company's assets,liabilities and stockholders' equity.

L) A financial statement that shows a company's revenues and expenses.

M) An example of an internal user of financial statements.

O) F) and L)

Correct Answer

verified

Correct Answer

verified

Essay

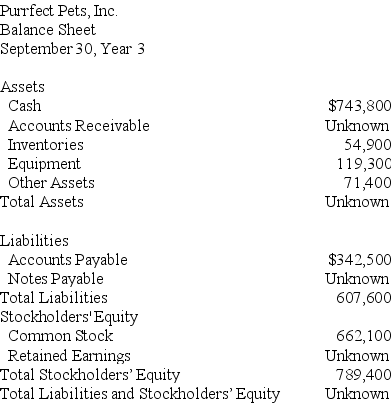

The following partially completed balance sheet is missing numerical data.

Required:

Fill in the missing items in the balance sheet.

Required:

Fill in the missing items in the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S. ,public companies have to be audited by independent auditors using rules approved by the:

A) International Accounting Standards Board (IASB) .

B) Public Company Accounting Oversight Board (PCAOB) .

C) Financial Accounting Standards Board (FASB) .

D) American Institute of Certified Public Accountants (AICPA) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crystal Lodging recorded $330,000 in revenues,$247,500 in expenses,and $45,000 of dividends for the year.The company began the year with total assets of $285,000 and stockholder's equity of $130,500. Suppose that liabilities increased by $90,000 and stockholders' equity increased by $37,500.What would be the change in Crystal Lodging's assets?

A) $168,000 increase

B) $127,500 increase

C) $154,500 increase

D) $52,500 increase

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash activity with stockholders and creditors,such as banks,are reported as cash flows from ________ activities on the statement of cash flows.

A) financing

B) investing

C) operating

D) managing

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost of doing business is referred to as a(n) ________ and is considered necessary to earn ________.

A) revenue;assets

B) expense;revenue

C) liability;expenses

D) dividend;revenue

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a sense,________ is to accountants and auditors what the criminal code is to lawyers and the public.

A) the SEC

B) faithful representation

C) U.S.GAAP

D) the basic accounting equation

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 228

Related Exams