A) When making comparisons across companies,it's far easier to express the relationship as a ratio.

B) The current ratio is used to evaluate a company's ability to pay current obligations.

C) Having more current assets than current liabilities will yield a current ratio less than 1.0.

D) A high current ratio suggests good liquidity.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shaylee,Inc.borrowed $62,000 from a bank,depositing those funds in its bank account and signing a formal agreement to repay the loan in two years.What is the correct journal entry for this transaction?

A) Debit notes payable and credit cash for $62,000

B) Debit notes payable and debit cash for $62,000

C) Credit notes payable and credit cash for $62,000

D) Debit cash and credit notes payable for $62,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirby,Inc.borrows $16 million from its bank.It then uses this money to buy equipment.How do these two transactions affect the company's accounting equation?

A) Assets and liabilities both increase by $16 million.

B) Assets increase by $8 million and liabilities decrease by $8 million.

C) Assets increase by $16 million,liabilities increase by $8 million,and stockholders' equity increases by $8 million.

D) Assets remain unchanged and liabilities increase by $16 million.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term with its definition.(There are more definitions than terms. ) -Transaction

A) The abbreviation for an item posted on the left side of a T-account.

B) A balance sheet that has not yet been publicly released.

C) A transaction that is triggered automatically merely by the passage of time.

D) When a company becomes included in the Fortune 500.

E) The account credited when cash is received in exchange for stock issued.

F) The value of a company's public relations campaign.

G) An event that has no effect on the balance sheet and is not recorded in the financial statements.

H) A balance sheet that has assets and liabilities categorized as current vs.noncurrent.

I) Amounts owed to suppliers for goods or services bought on credit.

J) The abbreviation for an item posted on the right side of a T-account.

K) An exchange or event that has a direct impact on a company's financial statements.

L) Liabilities divided by assets.

M) Another name for stockholders' equity or shareholders' equity.

N) A method of recording a transaction in debit/credit format.

O) The expression that assets must equal liabilities plus stockholders' equity.

Q) A) and M)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A noncurrent liability is one that the company:

A) has owed for over one year.

B) has owed for over five years.

C) will not pay within 12 months.

D) will not pay within five years.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spin Co.has $52,000 in its Cash account,$20,000 in its Inventory account,and $12,000 in its Notes Payable (short-term) account.If Spin's only other account is Common Stock,what is the balance of that account?

A) $20,000.

B) $84,000.

C) $60,000.

D) $44,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Year 2,the Denim Company bought an acre of land that cost $15,000.In Year 5,another company purchased a nearby acre of land for $28,000 and a different company purchased another nearby acre of land for $26,000.As a result,an appraiser estimated that the acre owned by Denim had increased in value to $27,000.If Denim prepares a balance sheet at the end of Year 5,the acre of land that it owns should be reported at:

A) $15,000.

B) $28,000.

C) $27,000.

D) the average of all of the amounts.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term with its definition.(There are more definitions than terms. ) -T-Account

A) A summary of account names and numbers.

B) A simplified version of an account in the General Ledger.

C) Compares balance sheet items from two different time periods.

D) When a dollar value is assigned to an item recorded in the accounting system.

E) A journal entry that lowers the balance of the account.

F) An amount that is posted on the left side of a T-account or ledger.

G) The concept that a company must keep separate accounts by time period.

H) An amount that is posted on the right side of a T-account or ledger.

I) Assets are initially recorded at the amount paid to acquire them.

J) When journal entries are recorded in the appropriate T-account or ledger.

K) When a company's balance sheet has been verified by an outside auditor.

L) The principle that a company should use the least optimistic measure,when uncertainty exists.

M) The concept that any transaction must have at least two effects on the accounting equation.

N) The mechanism used to record each transaction in the General Journal.

P) F) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Listed below are components of several transactions.Indicate whether a debit (dr) or credit (cr) would be required to record the component of the transaction. -Increase in Common Stock.

A) cr

B) dr

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does the current ratio measure?

A) The relative proportion of current versus noncurrent assets

B) Whether current assets are sufficient to pay current liabilities

C) The speed which current assets can be converted to cash

D) Whether cash is sufficient to pay current liabilities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which account is affected by recording the buying of goods on credit?

A) Cash

B) Retained Earnings

C) Common Stock

D) Accounts Payable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The classified balance sheet for a company reported current assets of $811,925,total liabilities of $399,770,Common Stock of $500,000,and Retained Earnings of $65,130.The current ratio was 2.5. What is the total amount of noncurrent assets?

A) $246,795

B) $412,155

C) $324,770

D) $152,975.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amounts invested and reinvested by a company's owners is called:

A) stockholders' equity in a corporation.

B) assets,or the resources presently owned by a business that generate future economic benefits.

C) a trial balance,proving that all amounts are accounted for.

D) liabilities,or the amounts presently owed by a business.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

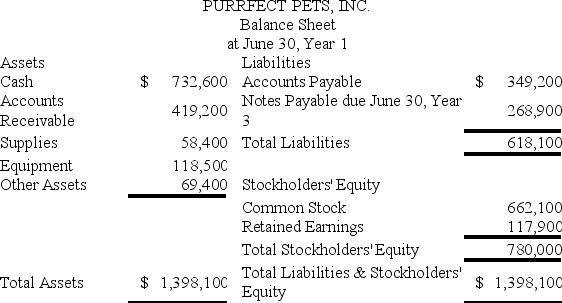

How much financing did the stockholders of Purrfect Pets,Inc. ,directly contribute to the company?

How much financing did the stockholders of Purrfect Pets,Inc. ,directly contribute to the company?

A) $117,900

B) $662,100

C) $780,000

D) $1,398,100

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company borrows money from a bank and signs an agreement to repay the loan several years from now,in which account would the company report the amount borrowed?

A) Common Stock

B) Accounts Payable

C) Notes Payable (long-term)

D) Retained Earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Baldwin Company purchased equipment for $420,000 and planned to use it when the company expanded one of its product lines.However,six months later,the company changed its plans and sold the equipment to Stick,Inc.for $420,000.Stick signed a note for $420,000 that is due in 60 days.The journal entry prepared by Baldwin Company to record the sale of the equipment would include which of the following?

A) Credit to Note Receivable

B) Debit to Cash

C) Credit to Equipment

D) Debit to Accounts Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Listed below are components of several transactions.Indicate whether a debit (dr) or credit (cr) would be required to record the component of the transaction. -Increase in Cash.

A) cr

B) dr

D) undefined

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts Payable had a balance of $9,100 at the beginning of the month.During the month,three debits in the amounts of $2,350,$5,650,and $7,400 were posted to Accounts Payable,and three credits in the amounts of $1,800,$4,750,and $6,350 were posted to Accounts Payable.What is the ending balance of the Accounts Payable account?

A) $6,600

B) $2,500

C) $11,600

D) $24,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A business is obliged to repay both debt and equity financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amounts owed to suppliers for goods purchased on credit are called:

A) Common Stock.

B) Retained Earnings.

C) Accounts Payable.

D) Inventory.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 223

Related Exams