B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's balance sheet reports its financial condition on a specific date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To effectively run a business, it is necessary to:

A) hire a full-time accountant.

B) use a public accounting firm.

C) understand and use accounting information.

D) make certain that you do not spend too much time on your accounting system.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mini-Case Minnie A. Wright-Hoff works as an accountant for Double Entry Doors, Inc. Her company sells and installs oversized garage doors needed by large vehicles. Most of Minnie's work involves helping department heads and other decision makers by measuring and reporting costs for their departments, and by identifying areas where departments are exceeding their budgets. However, as one of only three accountants employed by Double Entry Doors, Minnie is something of a "jill-of-all-trades" in terms of her accounting assignments. For example, she recently spent several hours summarizing all of the financial data in account ledgers to see if the information was correct and balanced. Her efforts revealed no problems, so she is now ready to start working on the firm's financial statements. Minnie is interested in this part of the accounting cycle because she likes to be one of the first to know the "bottom line" her company will report. She knows that she and the other accountants who work on these statements can influence the results by the choices they make about the way they report certain items. -Double Entry Door's suppliers maintained very stable prices for many years, but Minnie has noticed that the cost of doors has been rising steadily for the past few years. She is concerned that, given the company's current accounting methods of basing its cost on the most recent doors purchased, this will result in a much lower net income than in the past. The most likely reason for her concern is that Double Entry has apparently been using:

A) The FIFO inventory valuation method to determine its cost of goods sold.

B) A great deal of equity financing to purchase the doors.

C) The LIFO inventory valuation method to determine its cost of goods sold.

D) A depreciation method based on the average value of inventory.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debts that are due in one year or less are classified on the balance sheet as:

A) current liabilities.

B) bonds payable.

C) callable bonds.

D) immediate expenses.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of the current ratio is to evaluate the firm's ability to:

A) generate sales with a given level of current assets.

B) utilize current assets profitably.

C) pay its bills in the short run.

D) effectively use borrowed funds.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Although accounting has several specific uses, the overall purpose of accounting can be summarized as:

A) to provide financial information that is useful to decision makers.

B) to meet the legal requirements of the Financial Accounting Standards Board (FASB) .

C) to allow the government to track business activity levels.

D) to compute the profit or loss and declared dividend of a business firm.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows shows a firm's revenues, costs of goods sold, expenses, and net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

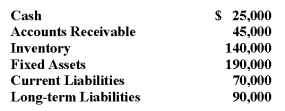

As a bank loan officer, you are considering a loan application by Peak Performance Sporting Goods. The company has provided you with the following information:  Peak Performance's debt to owners' equity ratio (rounded to the nearest tenth of a percent) is:

Peak Performance's debt to owners' equity ratio (rounded to the nearest tenth of a percent) is:

A) 45.4%.

B) 66.7%.

C) 112.5%.

D) 133.3%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mini-Case Minnie A. Wright-Hoff works as an accountant for Double Entry Doors, Inc. Her company sells and installs oversized garage doors needed by large vehicles. Most of Minnie's work involves helping department heads and other decision makers by measuring and reporting costs for their departments, and by identifying areas where departments are exceeding their budgets. However, as one of only three accountants employed by Double Entry Doors, Minnie is something of a "jill-of-all-trades" in terms of her accounting assignments. For example, she recently spent several hours summarizing all of the financial data in account ledgers to see if the information was correct and balanced. Her efforts revealed no problems, so she is now ready to start working on the firm's financial statements. Minnie is interested in this part of the accounting cycle because she likes to be one of the first to know the "bottom line" her company will report. She knows that she and the other accountants who work on these statements can influence the results by the choices they make about the way they report certain items. -The last major task Minnie completed before getting ready to prepare the firm's financial statements was the preparation of the:

A) cash budget.

B) master budget.

C) trial balance.

D) internal audit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Once a trial balance has been prepared, the next step of the accounting cycle involves:

A) posting the information to the correct ledger accounts.

B) completing a balance sheet and ratio analysis.

C) preparing financial statements such as the balance sheet, income statement, and statement of cash flows.

D) classifying the transactions into logical categories.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cindy is concerned because during the past four months her company has experienced difficulty in paying its bills on time. She knows if this continues, the firm will have difficulties in accomplishing its goals. Cindy is concerned with:

A) asset disbursement.

B) cash flow.

C) profit and loss.

D) inventory valuation.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_________ refers to how quickly an asset can be converted into cash.

A) Liquidity

B) Velocity

C) Fundability

D) Accessibility

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenue, minus cost of goods sold =____________.

A) retained earnings.

B) fundamental accounting equation.

C) gross profit.

D) net income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Financial accountants prepare reports for owners, creditors, suppliers, and others outside of the organization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given that measuring a firm's financial health is important to its survival, which of the following strategies is good advice for a person just starting a business?

A) Create a method for keeping your books that makes sense to you. Outside agencies such as creditors and suppliers will not evaluate you by the way you keep books.

B) All transactions are important. Separating transactions only serves to create a perception that some transactions are of lesser importance than others.

C) Accounting systems used by big business are not suitable for small businesses.

D) Select an accounting system that helps you make decisions, and helps you report information to others outside your firm.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Derek has a bachelor's degree in accounting and additional training in tax law. He is responsible for preparing tax returns and developing tax strategies for his employer, and has done so for the past seven years. Derek is a certified government accountant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The return on sales ratio measures a firm's use of leverage.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity refers to how fast an asset can be converted to cash.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Banks are likely to request a firm's balance sheet when determining whether or not to loan money to the firm. However, banks would have little interest in the firm's income statement since it covers a short period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 366

Related Exams