B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A(n) ________ is an evaluation and unbiased opinion about the accuracy of a firm's financial statements.

A) internal audit

B) annual report

C) independent audit

D) certified audit

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Once a trial balance has been prepared, the next step of the accounting cycle involves

A) posting the information to the correct ledger accounts.

B) completing a balance sheet and ratio analysis.

C) preparing financial statements such as the balance sheet, income statement, and statement of cash flows.

D) classifying the transactions into logical categories.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When reviewing the balance sheet for Portable Pet Care, Inc., a mobile small animal care business, Ricky noted the following information: Company assets totaling $3.5 million, and liabilities totaling $1.3 million. On paper, the net worth (owners' equity) for this business =

A) $2.2 million.

B) $4.8 million.

C) $3.5 million.

D) $0.2 million.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a certified public accountant, you would be working in the area of managerial accounting.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After recording a business's transactions, bookkeepers usually classify the recorded transactions into groups with common characteristics.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is used to evaluate a firm's ability to pay its short-term debts.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

As mentioned in the Adapting to Change box, accountants that search for fraudulent activities are called forensic accountants.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gross profit represents profit after the deduction of cost of goods sold, and before the deduction of all other selling expenses, general expenses, and tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Green Goddess Lawn Services will refer to its income statements to determine whether it was profitable, or whether it lost money over the past year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an effort to maintain a competitive advantage, firms do not share accounting information with people outside of the firm.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

During periods of rising prices, firms that want to report more attractive profits would tend to favor the FIFO technique of inventory valuation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrea is preparing her homework for her accounting class. She is uncertain as to the proper handling of patents and copyrights on a firm's financial statements. Which of the following is correct?

A) Patents and copyrights are included with the firm's intangible assets on the balance sheet.

B) Patents and copyrights are included with the firm's long-term liabilities on the balance sheet.

C) Patents and copyrights are included with the firm's cost of goods sold on the income statement.

D) Patents and copyrights are included with the firm's fixed assets on the balance sheet.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quinn is an accountant employed by CCDL Enterprises. Recently, she has spent much of her time working on defining measures of costs for the production department and checking to ensure that various departments are staying within their budgets. Quinn is a

A) public accountant whose work is mainly concerned with auditing.

B) public accountant whose work is mainly concerned with financial accounting.

C) private accountant whose work is mainly concerned with managerial accounting.

D) private accountant whose work is mainly concerned with financial accounting.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Managers who are concerned about keeping costs under control should be very interested in the information and advice provided by their company's managerial accountants.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet for Greeley Contracting shows assets totaling $207,000 and liabilities totaling $95,000. Which of the following statements is correct?

A) Owners' equity equals $182,000.

B) Current assets are worth $92,000.

C) Net income for the period is $112,000.

D) Owners' equity equals $112,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

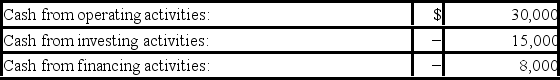

Day-by-Day Calendar Company's statement of cash flows showed the following activities for the year ended December 31, 2019:  The year-end cash balance for this firm is:

The year-end cash balance for this firm is:

A) $7,000.00

B) $53,000.00

C) $23,000.00

D) $30,000.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company controller asked Jade to determine if it could borrow more money for an expansion project. When she calculated a leverage ratio, she determined that the company already had 1.5 times as much debt as equity. Do you agree with her assessment that the company should back off with borrowing more funds at this time?

A) Yes, but if the company would increase sales, it could go ahead with borrowing more funds.

B) Not necessarily. She should investigate the debt to equity ratios of other firms in the same industry.

C) Yes, but the firm should pursue equity investment until the ratio equals 1:1.

D) Not necessarily. In poor economic times, it is good financial strategy for a firm to be highly leveraged.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet, the statement of cash flows, and the ________ are three key financial statements prepared by accountants.

A) income statement

B) statement of retained earnings

C) statement of changes in financial position

D) trial balance

F) A) and D)

Correct Answer

verified

A

Correct Answer

verified

True/False

Jeremy thinks his business will be successful as long as he just keeps his customers satisfied. He does NOT need to have a great deal of knowledge about accounting practices.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 362

Related Exams