A) Revenue for this period is $45,000.

B) Accounts receivable at the end of this period is $5,000.

C) Accounts payable at the end of this period is $5,000.

D) Cash for next period will increase by $50,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a balance sheet using these data.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating activities:

A) involve day to day events related to production and sales.

B) relate to the acquisition or sale of long-term assets.

C) only involve financial exchanges.

D) involve the payment of dividends to owners.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing activities on the Statement of Cash Flows are

A) transactions with lenders, borrowing and repaying cash.

B) transactions with stockholders, selling company stock and paying dividends.

C) activities directly related to running the business to earn profit.

D) buying and selling productive resources with long lives.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company uses $50,000 of its cash to buy an asset then:

A) assets and liabilities will be unchanged.

B) assets will rise $50,000 as will liabilities.

C) assets will rise $50,000 as will stockholders' equity.

D) assets will fall $50,000 and liabilities will rise $50,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

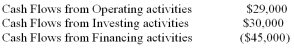

The statement of cash flows for a company contained the following:  What was the change in cash for the period?

What was the change in cash for the period?

A) $14,000 increase

B) $15,000 increase

C) $14,000 decrease

D) $15,000 decrease

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company incurred $5,000 in wages for employees for the year. $4,500 of these wages were paid by the end of the year. Choose the TRUE statement.

A) Wages payable on the income statement will be $4,500.

B) Wages expense on the income statement will be $500.

C) Wages expense on the balance sheet will be $5,000.

D) Wages payable on the balance sheet will be $500.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the missing amount for Total Liabilities?

A) $3,347,700

B) $1,439,200

C) $1,470,700

D) $1,877,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement?

A) The SEC approves the rules used by the auditors in determining whether a public company's financial statements are in conformity with GAAP.

B) The PCAOB and the SEC were both created by the FASB.

C) The SEC was created by the PCAOB.

D) The PCAOB approves the rules used by auditors in determining whether a public company's financial

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of Retained Earnings at the end of the year is

A) $15,000.

B) $11,000.

C) $12,000.

D) $1,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company reports net income on the income statement, then the statement of cash flows must show an increase in cash flows from operating activities for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of total liabilities at the end of 2011?

A) $7,075

B) $10,075

C) $9,075

D) $12,975

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net Income is

A) the amount the company earned after expenses and dividends are subtracted from revenue.

B) the amount by which assets exceed expenses.

C) the amount by which assets exceed liabilities.

D) the amount by which revenues exceed expenses.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expenses are shown

A) on the income statement in the time period in which they are paid.

B) on the income statement in the time period in which they are incurred.

C) on the balance sheet in the time period in which they are paid.

D) on the balance sheet in the time period in which they are incurred.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The separate entity assumption means

A) the financial information depicts the economic substance of the business activities.

B) the financial reports of a business are assumed to include the results of only that business's activities.

C) the results of business activities are reported in an appropriate monetary unit.

D) the financial information can be compared across businesses because similar accounting methods have been applied.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Accounts payable, notes payable and wages payable are examples of liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company began the year with Assets of $100,000, Liabilities of $20,000 and Stockholders' equity of $80,000. During the year Assets increased $55,000 and stockholders' equity increased $20,000. What was the change in Liabilities for the year?

A) Increase of $75,000

B) Increase of $35,000

C) Decrease of $75,000

D) Decrease of $35,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true concerning the notes to the financial statements?

A) Notes to the financial statements explain what policies were used to prepare the financial statements.

B) Notes to the financial statements provide additional information about what is included in the financial statements.

C) Notes to the financial statements provide additional information about financial matters that are not included in the financial statements.

D) Notes to the financial statements provide financial information about the owners of the business.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Each of the following independent companies is missing numerical data. Use your knowledge of the financial statement equations and their interrelationships to fill in the missing amounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of total assets to be reported on the balance sheet at the end of the year?

A) $112,000

B) $102,000

C) $119,000

D) $155,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 135

Related Exams