A) Companies can choose to end their fiscal year on any date they feel is most relevant.

B) Companies must end their fiscal year on March 31, June 30, September 30, or December 31.

C) Companies can select any date except a holiday to end their fiscal year.

D) Companies must end their fiscal year on December 31.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors are often interested in the amount of net income distributed as dividends. In which section of the financial statements would investors look to find this amount?

A) Statement of retained earnings.

B) Balance sheet.

C) Notes to the financial statements.

D) Income statement.

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Liabilities on the balance sheet would include which of the following?

A) Accounts payable, notes payable and contributed capital

B) Accounts receivable, supplies expense and retained earnings

C) Accounts payable, notes payable and wages payable

D) Contributed capital, retained earnings and notes payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on this information, what was the amount of retained earnings at the beginning of the year?

A) $150,000

B) $0

C) $550,000

D) $350,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of retained earnings at the end of 2011?

A) $37,000

B) $240,000

C) $29,000

D) $269,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A company owes $200,000 on a bank loan. If this loan is documented using a formal written debt contract, it will be reported as a liability called Notes Payable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true?

A) Assets = Liabilities + Stockholders' Equity

B) Liabilities = Assets - Stockholders' Equity

C) Stockholders' Equity + Liabilities - Assets = 0

D) Liabilities - Stockholders' Equity = Assets

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounting information systems:

A) are summarized by reports that are published to the public.

B) capture and report the results of a business's operating, investing, and financing activities.

C) monitor business activities only in financial terms.

D) capture only the information that is needed by the owners of the company.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The amount of Assets at the end of the year is

A) $105,000.

B) $108,000.

C) $104,000.

D) $107,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assets:

A) represent the amounts earned by a company.

B) must equal the liabilities of a company.

C) must equal the stockholders' equity of the company.

D) represent the resources owned by a company.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Revenue is reported on the income statement only if cash was received at the point of sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What was the amount of the change in liabilities during the year?

A) Increase of $100,000

B) Increase of $40,000

C) Increase of $70,000

D) Increase of $170,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine whether generally accepted accounting principles (GAAP) were followed in the preparation of financial statements, an examination of:

A) tax documents would be performed by the IRS.

B) the annual report would be performed by the SEC.

C) the financial statements and related documents would be performed by an independent auditor.

D) the financial statements and related documents would be performed by the FASB.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

For a new business, the beginning balance of Retained Earnings is zero.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accounts payable and accounts receivable are reported on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What was the amount of retained earnings at the end of 2010?

A) $20,000

B) $8,000

C) $150,000

D) $155,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

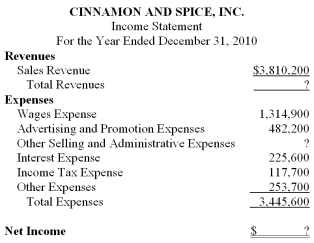

Find the missing data.

A) Total revenues are $3,810,200, other selling and administrative expenses are $1,051,500, and net income is $364,600.

B) Total revenues are $2,495,300, other selling and administrative expenses are $1,051,500, and net income is ($950,300) .

C) Total revenues are $364,600, other selling and administrative expenses are $3,081,000, and net income is $7,255,800.

D) Total revenues are $3,810,200, other selling and administrative expenses are $364,600, and net income is

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A company issued stock to investors for cash of $50,000. Choose the TRUE statement.

A) Cash will increase $50,000 and contributed capital will increase $50,000.

B) Cash will decrease $50,000 and retained earnings will decrease $50,000.

C) Cash will increase $50,000 and retained earnings will increase $50,000.

D) Cash will decrease $50,000 and contributed capital will increase $50,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would affect stockholders' equity?

A) A company borrows $100 million and buys $100 million in equipment.

B) A company pays $100 million to stockholders as a dividend.

C) A company sells $100 million in assets for $100 million cash.

D) A company receives payment for $100 million in accounts receivable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Expenses are the costs incurred in doing business which are necessary to earn revenue.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 135

Related Exams