A) preferred stockholders are paid dividends before common stockholders are paid dividends for the current year only.

B) unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C) preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D) unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On February 16, a company declares a 34 dividend to be paid on April 5. There are 2 million shares of common stock issued and 100,000 shares of treasury stock. What does the company record on April 5?

A) A debit to Dividends Payable and a credit to Cash for $680,000.

B) A debit to Dividends Declared and a credit to Dividends Payable for $646,000.

C) A debit to Dividends Payable and a credit to Cash for $646,000.

D) A debit to Dividends Declared and a credit to Dividends Payable for $680,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The incorporation of companies in the U.S. is controlled by:

A) state governments.

B) local governments.

C) the federal government.

D) the courts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is generally classified as stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All other things equal, the higher the Return on Equity ratio the better the financial performance of the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else equal, when a company uses excess cash to buy back some of its outstanding common stock, which of the following ratios will be affected directly in the manner described below?

A) The return on equity (ROE) will decrease.

B) Earnings per share (EPS) will increase.

C) The inventory turnover ratio will increase.

D) The receivables turnover ratio will increase.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Issuing stock to obtain financing is called equity financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

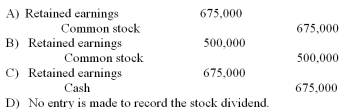

A corporation had 50,000 shares of $20 par value common stock outstanding. The board of directors declared and issued a 50% stock dividend. The market value of the stock was $27 per share. What is the journal entry to record this stock dividend?

A) Option: A

B) Option: B

C) Option: C

D) Option: D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT true?

A) The legal capital of a corporation represents an amount that cannot be returned to the owners while the corporation still exists.

B) Investors in a corporation are called stockholders.

C) The right to receive a dividend is one of the basic rights of preferred stockholders.

D) Compared with preferred stock, common stock usually has a favorable preference in terms of dividends.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One reason why a company may choose a stock split over a stock dividend is that the stock split does not reduce retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ROE ratio measures:

A) the return stockholders receive in dividends for each dollar of their investment.

B) the return stockholders receive in dividends and stock price growth for each dollar of their investment.

C) the amount earned by the company on each dollar contributed by stockholders and earnings reinvested in the company.

D) the amount earned by the company on each dollar obtained from equity and debt financing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is an asset account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following events would not require a journal entry on a corporation's books?

A) 2-for-1 stock split

B) 100% stock dividend

C) 2% stock dividend

D) $1 per share cash dividend

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GE buys back 300,000 shares of its stock from investors at $45 a share. Two years later it reissues this sto ck for $65 a share. The stock reissue would be recorded as:

A) a debit to Cash of $19.5 million and a credit to Treasury Stock of $19.5 million.

B) a debit to Cash of $13.5 million, a debit to Additional Paid-in Capital of $6 million, a credit to Treasury Stock of $13.5 million, and a credit to Stockholders' Equity of $6 million.

C) a debit to Cash of $19.5 million, a credit to Treasury Stock of $13.5 million, and a credit to Additional Paid-in Capital of $6 million

D) a debit to Cash of $13.5 million, and a debit to Stockholders' Equity of $6 million, a credit to Treasury Stock

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation declares and distributes a 10% stock dividend on its common shares, the account debited is:

A) Dividends Payable.

B) Common Stock.

C) Share Capital.

D) Retained Earnings.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holders of common stock receive certain benefits, such as a residual claim, which:

A) is the right of stockholders to be paid back their investment before anyone else if the company ceases operation.

B) is the right to oversee management of the company.

C) is the right to share in any remaining assets after creditors have been paid off, should the company cease operations.

D) is the continuing right to receive a share of the company's profits in the form of dividends.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson and O'Neill open a partnership that produces gates. Jackson provides $30,000 of capital while O'Neill contributes $90,000 of capital; they agree to split net income by the same proportion. The partnership's net income is $80,000 for the first year. They did not draw any income out of the business or add any additional capital during the first year. At the end of the year, the partners' equity is:

A) $70,000 for Jackson and $130,000 for O'Neill for a total of $200,000.

B) $200,000 minus income tax expense for the partnership.

C) $200,000 minus the income tax paid by each partner.

D) $50,000 for Jackson and $150,000 for O'Neill for a total of $200,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the accounting period, but before closing entries are made, Harry, the proprietor of Harry's Bar and Grill, has a debit of $24,500 in his drawing account and a credit of $126,800 in his capital account. If his capital account has a credit balance of $137,900 after the closing, what was his net income?

A) $11,100

B) $35,600

C) $113,400

D) $13,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you own 200,000 shares of stock in a company with 8 million shares outstanding and the company issues an additional 2 million shares to its employees through a stock purchase plan, your ownership percentage:

A) remains the same because the company now has more assets.

B) falls from 2.5% to 2%.

C) remains the same because the company now has fewer liabilities.

D) increases because the company now has more stock outstanding.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An additional paid-in capital account could be used with all of the following transactions EXCEPT:

A) The issuance of par value stock at a price greater than the par value.

B) The reissuance of treasury stock at a price less than the price paid when the stock was reacquired.

C) The reissuance of treasury stock at a price greater than the price paid when the stock was reacquired.

D) The issuance of no par stock.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 142

Related Exams