B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) If revenues are less than expenses, the company has a net loss and retained earnings falls.

B) If revenues are greater than expenses, the company has net income and contributed capital rises.

C) If revenues are less than expenses, the company has a net loss and contributed capital rises to balance off the loss.

D) If revenues are greater than expenses, the company has net income and retained earnings falls.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets had income before income tax of $164,000 last quarter and a 34% tax rate. Its net income should be reported as:

A) $55,760.

B) $108,240.

C) $(55,760) .

D) $248,485.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The insurance policy covers four years and was purchased by Sneetch on 1/1/10. The adjusting entry on December 31 would include

A) a debit to prepaid insurance for $1,200.

B) a credit to prepaid insurance for $1,200.

C) a debit to insurance expense for $3,600.

D) a credit to prepaid insurance for $3,600.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

As a company uses supplies, an adjustment should be made to decrease an asset account and increase an expense account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would appear in the debit column of an adjusted trial balance?

A) Service revenue.

B) Prepaid rent.

C) Accumulated depreciation.

D) Contributed capital.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjusting journal entry that includes an increase to an asset contra-account would include an increase in a(n) :

A) related asset account.

B) liability account.

C) revenue account.

D) expense account.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is done first at the end of each accounting period?

A) Prepare adjusting journal entries.

B) Prepare a post closing trial balance.

C) Prepare closing journal entries.

D) Prepare the statement of retained earnings.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

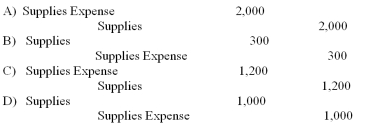

A company started the year with $1,500 of supplies on hand. During the year the company purchased additional supplies of $800 and recorded them as increase to the supplies asset. At the end of the year the company determined that only $300 of supplies are still on hand. What is the adjusting journal entry to be made at the end of the period?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a loan that accrues interest at a rate of $20 a day. The company pays the interest once a quarter. Which of these would be an accurate adjustment for a month in which no payments are made?

A) Debit Interest Payable and credit Interest Expense.

B) Debit Loans Payable and credit Cash.

C) Debit Interest Expense and credit Interest Payable.

D) Debit Cash and credit Loans Payable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June, 30, 2010, a company purchased a two-year insurance policy for $18,000, paying cash and debiting Prepaid Insurance for the entire two-year premium amount. The adjusting entry on December 31, 2010 includes a

A) credit to Prepaid Insurance $4,500.

B) credit to Insurance Expense $4,500.

C) credit to Prepaid Insurance $9,000.

D) debit to Insurance expense $9,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If certain assets are partially used up during the accounting period, then:

A) nothing is recorded on the financial statements until they are completely used up.

B) a liability account is decreased or eliminated and an expense is recorded.

C) an asset account is decreased or eliminated and an expense is recorded.

D) nothing is recorded on the financial statements until they are replaced or replenished.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation is a measure of the decline in market value of an asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount charged for a good or service provided to a customer on account is posted to a revenue account only after the payment is received.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your business purchased a certificate of deposit on April 1 that will pay $90 interest three months from that date. On April 30, which of the following adjusting journal entries would be made?

A) Debit Interest Receivable for $90; credit Interest Revenue for $90.

B) Debit Interest Revenue for $60; credit Interest Receivable for $60.

C) Debit Interest Receivable for $30; credit Interest Revenue for $30.

D) Debit Interest Revenue for $30; credit Interest Receivable for $60.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Asset, Liability, contributed capital and retained earnings accounts are called permanent accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company failed to record depreciation expense on equipment for a period, the financial statements would show total assets overstated and total stockholders' equity understated on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Prepaid expense accounts are reported as assets on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would be classified as a current liability?

A) Service revenue.

B) Wages expense.

C) Accumulated depreciation.

D) Dividends payable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If total debits are not equal to total credits in an adjusted trial balance, which of the following errors may have occurred?

A) Posting Wage Expense to Administrative Expenses.

B) Debiting Interest Payable instead of debiting Interest Expense.

C) Debiting Notes Payable instead of debiting Interest Expense.

D) Posting a credit to Wages Payable as a debit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 138

Related Exams