A) beyond what is needed to replace current property,plant,and equipment and pay cash dividends.

B) across all three activity components of the statement of cash flows.

C) beyond what has been allotted for future property,plant,and equipment replacement and expansion.

D) across both financing and investing activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ski resort with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operating activities in the second and third quarters (April - September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operating activities in the fourth and first quarters (October - March) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A healthy company typically shows positive cash flows in the financing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items below will be subtracted in the financing cash flow portion of the statement of cash flows?

A) Net income earned.

B) Bank loans obtained.

C) Payment of dividends.

D) Disposal of equipment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ABC Company issued 30,000 shares of common stock in January.In August,the company repurchased 5,000 shares for the treasury.When reporting these transactions in the statement of cash flows,ABC Company ________ combine them into one transaction in the ________ activities section.

A) can;financing

B) cannot;financing

C) cannot;investing

D) can;investing

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outdoor water park that has a calendar year-end and is located in an area of the country that has warmer weather during April through September and colder weather during the rest of the year is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operating activities in the second and third quarters (April through September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operating activities in the fourth and first quarters (October through March) .

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Condensed financial data of Monopoly Corporation appear below:

Monopoly Corporation

Comparative Balance Sheet

December 31

Current Year Prior Year

Assets

Cash $44,000 $28,000

Accounts receivable A 32,000

Inventories B 70,000

Prepaid rent 2,500 2,000

Property,plant,and equipment 224,000 200,000

Accumulated depreciation (55,000)(40,000)

Total assets $341,500 $292,000

Liabilities and Stockholders' Equity

Accounts payable $38,000 $34,000

Accrued liabilities 10,000 12,000

Notes payable (long-term)130,000 150,000

Contributed capital 50,000 25,000

Retained earnings 113,500 71,000

Total liabilities and stockholders' equity $341,500 $292,000

Monopoly Corporation

Income Statement

Year Ended December 31

Sales $477,500

Expenses

Cost of goods sold $290,000

Selling,general,and administrative expenses 94,000

Depreciation expense C

Interest expense 9,000

Income taxes ______D 425,000

Net income $ 52,500

Monopoly Corporation

Cash Flow Statement

Year End December 31

Cash Flows from Operating Activities

Net income $52,500

Adjustments to reconcile net income to net cash

provided by operating activities:

Depreciation 15,000

Changes in current assets and current liabilities:

Accounts Receivable (4,000)

Inventories (20,000)

Prepaid Expenses E

Accounts Payable 4,000

Accrued Liabilities F

Net cash provided by (used in)operating activities G

Cash flows from investing activities

Purchase of property,plant,and equipment (24,000)

Net cash provided by (used in)investing activities (24,000)

Financing activities

Additional capital contributed by stockholders H

Payments on long-term debt (20,000)

Payment of cash dividends I

Net cash provided by (used in)financing activities J

Increase in cash and cash equivalents 16,000

Cash and cash equivalents,beginning of period 28,000

Cash and cash equivalents,end of period $44,000

A cash dividend was declared and paid in full to stockholders during the year.

Required:

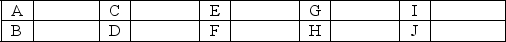

Solve for the missing numbers and summarize your answers in the table below.Be sure to indicate in parentheses ( )if the missing number is negative (that is,a cash outflow).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the calculation of cash flows from operating activities starts with net income,the company:

A) is using the net income method.

B) will remove the effects of all noncash items included in the calculation of net income.

C) is using the direct method.

D) will add all noncash items not included in the calculation of net income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Viviana Co.uses the indirect method to determine its cash flow from operations.Which of the following items will be subtracted from net income to find its cash flow from operations?

A) Decrease in Supplies.

B) Increase in Accounts Payable.

C) Depreciation Expense.

D) Increase in Accounts Receivable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Accrual-based net income can be manipulated because it is based on estimates.

B) Cash flows are easily manipulated because they are based on estimates.

C) Accrual-based net income is not easily manipulated because valuation for such items as bad debts and inventory are precise and based on objectively verifiable information.

D) Cash flows are not easily manipulated because they are generated by internal transactions and do not involve external parties.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the indirect method is used to determine net cash provided by (used in) operating activities and that Accounts Receivable balance decreased by $10 million during the year.That $10 million should be:

A) added to net income.

B) subtracted from net income.

C) added to investing activities.

D) subtracted from investing activities.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used,details from which of the following balance sheet accounts are used in calculating both operating and financing cash flows?

A) Bonds Payable

B) Taxes Payable

C) Retained Earnings

D) Common Stock

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are used to determine cash flows from financing activities?

A) Short-term debt,Accrued Liabilities,Common Stock,and Notes Payable

B) Long-term debt,Common Stock,and Retained Earnings

C) Short-term debt,Accrued Liabilities,Retained Earnings,and Bonds Payable

D) Long-term debt,Notes Payable,Interest Expense,and Bonds Payable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the statements below is correct when comparing the direct and indirect methods of reporting operating cash flows?

A) The direct method starts with net income and makes adjustments to arrive at the net cash provided by or used in operations.

B) The indirect method starts with cash collected from customers and details cash inflows and outflows from operations.

C) The indirect method starts with net income and makes adjustments to arrive at the net cash provided by or used in operations.

D) The net cash provided by or used in operations will be different depending on whether the direct or indirect method is used.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

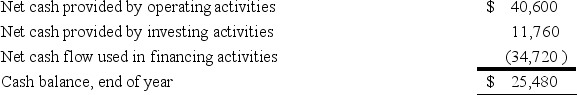

Westmoreland Corporation prepared its statement of cash flows for the year.The following information is taken from that statement:  What is the cash balance at the beginning of the year?

What is the cash balance at the beginning of the year?

A) $15,680

B) $7,840

C) $17,640

D) $43,120

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

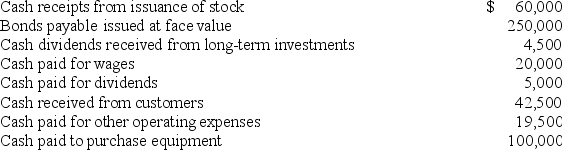

Marion Manufacturing had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.  What is the net cash provided by (used in) investing activities?

What is the net cash provided by (used in) investing activities?

A) ($100,000)

B) $210,000

C) $205,000

D) ($95,000)

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation Expense is not reported on the statement of cash flows when prepared using the direct method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from operating activities?

A) Cash received from customers.

B) Cash received from an issuance of bonds.

C) Cash dividends paid to stockholders.

D) Cash used for purchases of equipment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include:

A) changes in Accounts Receivable.

B) sale of land.

C) paying principal to lenders.

D) cash dividends paid.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not needed to prepare a statement of cash flows?

A) Statement of Retained Earnings

B) Comparative balance sheets

C) Additional data concerning selected accounts that increase and decrease as a result of investing and/or financing activities

D) A complete income statement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 203

Related Exams