A) Debits should equal credits both before and after adjustments are made.

B) Debits will equal credits after adjustments are made but not necessarily before.

C) Debits will equal credits before adjustments are made but not necessarily after.

D) Debits do not have to equal credits in the adjusted trial balance but they must be equal in the post-closing trial balance.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets had income before income tax of $164,000 last quarter and a 34% tax rate.Its net income should be reported as:

A) $55,760.

B) $108,240.

C) $219,760.

D) $482,353.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will happen if the accrual adjusting entry is not made for revenue earned but not yet recorded?

A) Assets will be understated and revenues will be overstated.

B) Revenues will be understated and assets will be overstated.

C) Both revenues and assets will be overstated.

D) Both revenues and assets will be understated.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

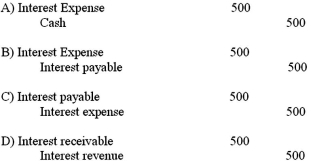

On December 31,2013,interest of $500 is owed on a bank loan that will not be paid until June 30,2014.What is the necessary adjusting journal entry on December 31,2013?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

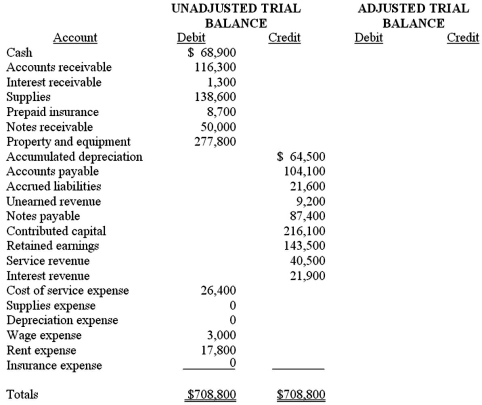

The company's unadjusted trial balance includes the following account balances:  The following data are available to determine adjusting entries:

A)$4,350 of prepaid insurance expired during the period.

B)The company estimates depreciation expense of $8,150 for the period.

C)A count showed $85,700 of supplies on hand.

D)Interest earned and receivable on the outstanding notes receivable is $260 for the period.

E)Performed services,$5,600,for which customers had previously paid in advance.

F)Performed services,$2,000,not yet billed or recorded.

Prepare the adjusting entries that should be recorded.Then,prepare an adjusted trial balance using the blank columns to the right of the unadjusted trial balance.

The following data are available to determine adjusting entries:

A)$4,350 of prepaid insurance expired during the period.

B)The company estimates depreciation expense of $8,150 for the period.

C)A count showed $85,700 of supplies on hand.

D)Interest earned and receivable on the outstanding notes receivable is $260 for the period.

E)Performed services,$5,600,for which customers had previously paid in advance.

F)Performed services,$2,000,not yet billed or recorded.

Prepare the adjusting entries that should be recorded.Then,prepare an adjusted trial balance using the blank columns to the right of the unadjusted trial balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After adjusting entries are prepared and posted,but before closing entries are prepared and posted,the balance in retained earnings is equal to

A) zero.

B) the difference between total assets and total liabilities.

C) the amount that is to be reported in the current year's balance sheet.

D) the amount that was reported on the previous year's balance sheet.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

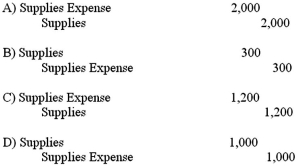

A company started the year with $1,500 of supplies on hand.During the year the company purchased additional supplies of $800 and recorded them as increase to the supplies asset.At the end of the year the company determined that only $300 of supplies are still on hand.What is the adjusting journal entry to be made at the end of the period?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company makes a deferral adjustment that reduces a liability.This must mean:

A) an expense account is decreasing by the same amount.

B) an expense account is increasing by the same amount.

C) a revenue account is increasing by the same amount.

D) a revenue account is decreasing.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an expense has been incurred but will be paid later,then:

A) nothing is recorded on the financial statements.

B) a liability account is created or increased and an expense is recorded.

C) an asset account is decreased or eliminated and an expense is recorded.

D) a revenue and an expense are accrued.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) Net income implies that revenues are greater than expenses.

B) A net loss causes retained earnings to decrease.

C) Net income causes stockholders' equity to increase.

D) A net loss prevents a company from declaring dividends.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As a company uses supplies,an adjustment should be made to decrease an asset account and increase an expense account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these accounts would normally not be affected by an adjustment?

A) Supplies.

B) Revenues.

C) Expenses.

D) Cash.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had calculated net income to be $77,550 based on the unadjusted trial balance.The following adjusting entries were then made: Salaries payable of $790 was recorded;Interest earned but not received from investments $750;Prepaid insurance decreased by $550 for insurance used up during the period;$750 of Unearned revenue has now been earned.After recording these adjustments,net income would be:

A) $77,710.

B) $74,710.

C) $77,310.

D) $79,600.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets has made all the year-end adjustments.Its expense accounts total $130,000,and its revenue accounts total $190,000.The closing entry to close the income statement accounts for the year will:

A) debit its various expense accounts for a total of $130,000,debit retained earnings for $60,000,and credit its various revenue accounts for a total of $190,000.

B) debit its various revenue accounts for a total of $190,000,credit its various expense accounts for a total of $130,000,and credit retained earnings for $60,000.

C) debit its various expense accounts for a total of $130,000,credit its various revenue accounts for a total of $190,000,and credit retained earnings for $60,000.

D) debit its various revenue accounts for a total of $190,000,debit retained earnings for $60,000,and credit its various expense accounts for a total of $130,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The adjusted trial balance is completed to check that debits still equal credits after the income statement is prepared.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

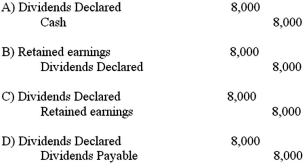

A company declared and paid a dividend of $8,000 this year.The entry to close the dividend account at the end of the year is:

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An error is indicated if the following account appears on the post-closing trial balance with a positive balance.

A) Office equipment.

B) Contributed capital.

C) Accumulated depreciation.

D) Depreciation expense.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

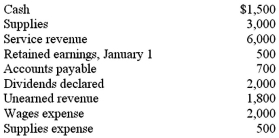

The December 31,2013,adjusted trial balance of a company,where all accounts have normal balances is:  Given this information,after all closing entries are made,the balance in the retained earnings account is:

Given this information,after all closing entries are made,the balance in the retained earnings account is:

A) $2,000.

B) $4,000.

C) $0.

D) $1,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the balance sheet,accumulated depreciation is:

A) added to property and equipment.

B) subtracted from property and equipment.

C) added to total liabilities.

D) subtracted from total liabilities.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding adjusting entries is not true?

A) Adjustments are needed to ensure that the accounting system includes all of the revenues and expenses of the period.

B) Adjustments help to ensure the related accounts on the balance sheet and income statement are up to date and complete.

C) Adjusting entries often affect the cash account.

D) Adjusting entries generally include one balance sheet and one income statement account.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 147

Related Exams