A) When making an adjustment to recognize supplies used in a period,total assets will not change.

B) Accrued wages are wages owed but not yet paid to employees and will need to be recorded with an adjusting entry that will increase expenses.

C) Deferrals are created by reflecting a transaction so that it delays or defers the recognition of an expense or a revenue.

D) Depreciation is an example of a deferred expense.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

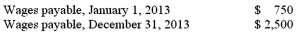

A company reported the following amounts of wages payable at the beginning and the end of the year 2013:  The income statement for 2013 reported Wages Expense of $56,200. How much cash was paid for wages during 2013?

The income statement for 2013 reported Wages Expense of $56,200. How much cash was paid for wages during 2013?

A) $52,950

B) $56,200

C) $54,450

D) $53,700

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

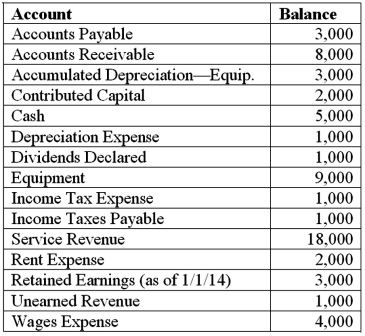

Below is an alphabetical listing of all of the accounts for T.O.'s Dance Studio on 12/31/14.Assume all adjustments have been made and all balances are "normal".  A)Prepare closing entries for T.O.'s Dance Studio.

B)Prepare the post-closing trial balance for T.O.'s Dance Studio.

C)Prepare the classified balance sheet for T.O.'s Dance Studio.

A)Prepare closing entries for T.O.'s Dance Studio.

B)Prepare the post-closing trial balance for T.O.'s Dance Studio.

C)Prepare the classified balance sheet for T.O.'s Dance Studio.

Correct Answer

verified

Correct Answer

verified

True/False

The amounts of all the accounts reported on the balance sheet can be taken from the adjusted trial balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation is a measure of the decline in market value of an asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If certain assets are partially used up during the accounting period,then:

A) nothing is recorded on the financial statements until they are completely used up.

B) a liability account is decreased or eliminated and an expense is recorded.

C) an asset account is decreased or eliminated and an expense is recorded.

D) nothing is recorded on the financial statements until they are replaced or replenished.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the month,the adjusting journal entry to record the use of supplies would include:

A) A debit to supplies and a credit to supplies expense.

B) A debit to supplies expense and a credit to supplies.

C) A debit to supplies and a credit to revenue.

D) A debit to supplies and a credit to cash.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the effect of a net loss on the closing process is true?

A) If a company has a net loss during the current accounting period,then the ending retained earnings will be smaller than the beginning retained earnings.

B) When closing entries are prepared,contributed capital is debited if a company has a net loss.

C) If a company has a net loss,the closing entry will include debits to the revenue accounts,credits to the expense accounts,and a credit to Retained earnings.

D) If a company has a net loss,the amount of revenues to be closed will be greater than the amount of expenses to be closed in the closing process.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A post-closing trial balance should include only permanent accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company billed a client for services rendered in January.The payment was received partially in January,and the balance in February.When should the entry be made to record the service revenue?

A) January.

B) February.

C) Split between January and February.

D) At the end of the year with an adjusting entry.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total of the credit column of the adjusted trial balance?

A) $24,700

B) $37,050

C) $74,900

D) $37,450

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries:

A) are prepared before financial statements are prepared.

B) reduce the number of permanent accounts.

C) cause the revenue and expense accounts to have zero balances.

D) summarize the activity in every account.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

All asset accounts,all liability accounts,contributed capital,and retained earnings accounts are called permanent accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would aid the CEO in making 2014 net income results look more impressive?

A) Overstating the cost of machinery purchased in 2014.

B) Prepaying 2014 expenses in 2013.

C) Deferring 2014 expenses to 2015 and accruing revenues in 2014 that don't exist.

D) Recording 2014 revenue as unearned revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purrfect Pets had $6,000 of supplies at the end of October.During November,the company bought $2,000 of supplies.At the end of November,the company had $1,000 of supplies remaining.Which of the following statements is not true?

A) During November,the company used $7,000 of supplies.

B) Supplies should be reported at $1,000 on the balance sheet.

C) An expense should be debited for $7,000 in November.

D) An asset should be debited for $1,000 in November.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A count of supplies revealed $400 worth on hand at 12/31/13.The adjusting entry would include

A) a debit to supplies expense for $400.

B) a debit to supplies expense for $600.

C) a debit to supplies for $400.

D) a debit to supplies for $600.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following trial balances are used as a source for preparing the income statement?

A) Unadjusted trial balance.

B) Pre-adjusted trial balance.

C) Adjusted trial balance.

D) Post-closing trial balance.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of an accrued revenue is

A) accumulated interest on a note receivable.

B) accumulated interest on a note payable.

C) unearned revenue.

D) accounts receivable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjusted trial balance should be prepared immediately:

A) after the financial statements,but before closing.

B) before posting adjusting entries.

C) after posting adjusting entries.

D) after journalizing adjusting entries.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrued revenues recorded at the end of the current year:

A) often result in cash receipts from customers in the next period.

B) often result in cash payments in the next period.

C) are also called Unearned Revenues.

D) are recorded in the current year when cash is received.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 147

Related Exams