A) $54,000

B) $50,000

C) $46,000

D) $52,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

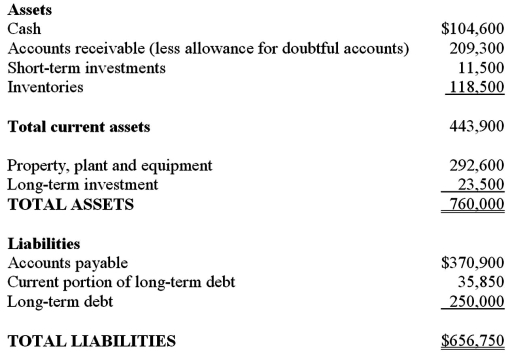

A company's total assets and total liabilities at the end of the year are as follows:  The quick ratio for this company is approximately:

The quick ratio for this company is approximately:

A) 1.09.

B) 0.80.

C) 1.16.

D) 0.50.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered a contingent liability?

A) Products sold with a warranty.

B) Pending lawsuits.

C) Frequent flyer miles earned by passengers.

D) Advance ticket sales.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three key pieces of information that are stated on a bond certificate are:

A) the interest payment,the face value of the bond,and the credit rating of the company.

B) the market interest rate,the price of the bond,and the maturity date.

C) the stated interest rate,the face value of the bond,and the maturity date.

D) the interest payment,the issue price of the bond,and the credit rating of the company.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has liquid assets of $600,000 and current liabilities of $500,000.What is the effect on the quick ratio if the company records an accrual adjustment for salaries of $100,000 and pays accounts payable in the amount of $50,000?

A) The quick ratio will not change as a result of either of these transactions.

B) The accrual adjustment will cause the quick ratio to decrease and the payment of accounts payable will cause an increase in the quick ratio.

C) The accrual adjustment will cause the quick ratio to increase and the payment of accounts payable will not affect the quick ratio.

D) The accrual adjustment and the payment of accounts payable will both cause the quick ratio to decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

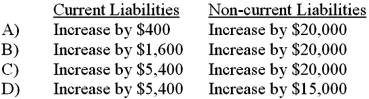

At the beginning of the quarter,your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year.Interest is paid at the end of the second and fourth quarters,whereas principal payments are due at the end of each year.How does this new promissory note affect the current and non-current liability amounts reported on the balance sheet at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%.The market interest rate is 5%.The issue price of the bond is calculated as:

A) the present value of $10,000 to be received in 5 years plus the present value of $700 per year for 5 years.

B) the face value of the bonds,$10,000.

C) the amount investors would have to pay to earn 7% interest.

D) the amount investors would have to pay to earn an average of the stated interest rate and the market interest rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following accounts would not necessarily be classified as a current liability?

A) Accounts payable

B) Accrued liabilities

C) Contingent liabilities

D) Current portion of long-term debt

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.If the Simplified Approach (Effective-interest Method) of amortization is used,how much total interest expense would be recorded in 2013?

A) $1,000

B) $1,080

C) $800

D) $864

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

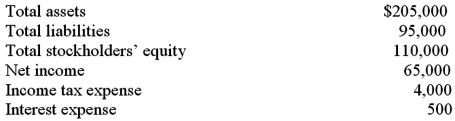

The following data came from the financial statements of a company:  What is the company's times interest earned ratio?

What is the company's times interest earned ratio?

A) 130

B) 129

C) 122

D) 139

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Payroll deductions are an expense of the company.

B) When the payroll is recorded,the total wages expense is equal to the sum of all the deductions.

C) The net pay is debited to wages expense when the payroll is recorded.

D) Gross pay is equal to the hours worked x the hourly pay rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An entertainment company received $6 million in cash for advance season ticket sales.Prior to the beginning of the season,these sales should be recorded as a liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company issued bonds at a premium.Which of the following statements is not true?

A) The contra account,premium on bonds payable,is amortized each year by shifting part of its balance to interest expense.

B) On the date of issuance,the stated interest rate was greater than the market interest rate.

C) As the current date approaches the maturity date,the carrying value of the bond approaches the face value of the bond.

D) The account used to record the premium has a normal debit balance.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding bond terminology is true?

A) The face value of a bond is what it is currently worth in the market.

B) The stated interest rate is expressed as an annual interest rate even if the bonds pay semiannual interest payments.

C) The stated rate of interest always presents the amount that investors are willing to pay for the bond on the issue date.

D) The carrying value of the bond is always equal to the face value of the bond.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When interest expense is calculated using the effective-interest amortization method,interest expense on a bond that pays interest annually is equal to:

A) the actual amount of interest paid.

B) the carrying value of the bonds payable multiplied by the effective interest rate.

C) the maturity value of the bonds payable multiplied by the effective interest rate.

D) the carrying value of the bonds payable multiplied by the stated interest rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company sells $50,000 of bonds for an issue price of $48,000.Which of the following statements is correct?

A) The bond sold at a price of 96,implying a discount of $4,000.

B) The bond sold at a price of 48,implying a premium of $2,000.

C) The bond sold at a price of 48,implying a premium of $4,000.

D) The bond sold at a price of 96,implying a discount of $2,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company encounters a contingent liability that is remote in likelihood,the company should:

A) include a description in the notes to the financial statements.

B) record the amount of the liability times the probability of its occurrence.

C) record the amount of the liability as a long-term liability on the balance sheet.

D) exclude the information about the contingent liability from its financial statements and notes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding bond discounts or premiums is true?

A) A discount on a bond reduces the amount that the issuer has to repay to the lenders.

B) A premium on a bond increases the interest expense of the loan to the issuer.

C) A premium on a bond increases the amount that the issuer has to repay to the lenders.

D) A discount on a bond increases the interest expense of the loan to the issuer.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issued $100,000 5-year,7% bonds and received $101,137 in cash.The market rate of interest when the bonds were issued was 6.5%.What is the amount of interest expense to be recorded for the first annual interest period if the company uses the effective-interest method of amortization?

A) $6,573.91

B) $7,000.00

C) $6,500.00

D) $7,079.59

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues a 5-year bond with a $7,500 discount.Using straight-line amortization,the company should:

A) debit discount on bonds payable for $1,500 per year.

B) credit discount on bonds payable for $1,500 per year.

C) debit interest payable for $1,500 per year.

D) credit interest expense for $1,500 per year.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 145

Related Exams