A) dividends paid divided by the average book value of stockholders' equity.

B) net income divided by the average number of outstanding common shares.

C) dividends divided by the average number of total shares.

D) net income divided by average stockholders' equity.

F) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following statements is true concerning the declaration and payment of cash dividends?

A) Declaration and payment of cash dividends will reduce the amount of net income.

B) Declaration and payment of cash dividends will not reduce the retained earnings balance.

C) Declaration and payment of cash dividends will reduce the amount of resources available to invest in assets.

D) Declaration and payment of cash dividends is calculated on the amount of shares of stock issued,not the amount of shares outstanding.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation declares and distributes a 10% stock dividend on its common shares,the account debited is:

A) Dividends Payable.

B) Common Stock.

C) Additional Paid-in Capital.

D) Retained Earnings.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically,a profitable company that pays relatively high dividends:

A) is an attractive investment for those seeking a steady income,like retired people.

B) will reinvest more profit which can lead to smaller growth potential.

C) will experience more growth in stock price over time.

D) is a bad investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In its most basic form,the earnings per share ratio is calculated as:

A) dividends paid on common stock divided by the average number of outstanding common shares.

B) net income divided by the average number of outstanding common shares.

C) total dividends paid divided by the average number of total stock shares.

D) net income divided by average stockholders' equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported net income of $5.6 million.At the beginning of the year,3.4 million shares of common stock were outstanding and at the end of the year,3.6 million shares were outstanding.No dividends were declared.The EPS is approximately:

A) $1.60.

B) $1.56.

C) $1.65.

D) $1.40.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Typically,a profitable company that pays little or no dividends:

A) is a bad investment.

B) will reinvest profits which can lead to greater growth potential.

C) will experience relatively stable stock prices over time.

D) will appeal to investors who desire distributions of profit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

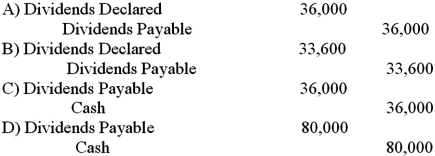

A company declared a $0.80 per share cash dividend.The company has 100,000 shares authorized,45,000 shares issued,and 42,000 shares of common stock outstanding.What is the journal entry to record the dividend declaration?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.Assume the company paid a dividend of $5 per share on August 3.What is the total amount of the dividends that would be paid to the common stockholders?

A) $95,000

B) $100,000

C) $90,000

D) $76,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

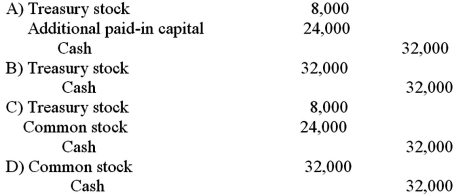

Use the information above to answer the following question.What is the journal entry to record the purchase of the stock on January 20?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A stock split increases total stockholders' equity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Corporations are governed by federal law.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements accurately explains why the board of directors of a company whose financial future contains some uncertainties might issue a 2-for-1 stock split rather than declare a 100% stock dividend?

A) A stock split would not reduce the market price per share,whereas a stock dividend would.

B) A stock split would reduce the market price per share,whereas a stock dividend would not.

C) A stock split would increase total stockholders' equity,whereas a stock dividend would not.

D) A stock split would not reduce retained earnings,whereas a stock dividend would.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The retained earnings balance was $22,900 on January 1.Net income for the year was $18,100.If retained earnings had a credit balance of $23,800 after closing entries were made for the year,and if additional stock of $5,200 was issued during the year,what was the amount of dividends declared during the year?

A) $17,200

B) $23,700

C) $23,300

D) $13,000

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A company originally issues 180,000 shares of stock at a price of $22;one year later the stock price is $40 per share,the number of outstanding shares is unchanged,and the company's net income for the year is $230,400.The P/E ratio at the end of the recent year is:

A) 0.0002.

B) 24.22.

C) 31.25.

D) 0.0001.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock.The preferred stock has an 8% dividend rate.The company declares $300,000 in total dividends for the year.Which of the following is true if the preferred stockholders have a cumulative dividend preference?

A) Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B) Preferred stockholders will receive $24,000 (8% of the total dividends) .Common stockholders will receive the remaining $276,000.

C) Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D) Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All other things being equal,when companies make stock repurchases:

A) EPS falls and ROE rises.

B) EPS rises and ROE stays the same.

C) EPS rises and ROE falls.

D) EPS and ROE both rise.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

State laws often restrict dividends to the amount of retained earnings.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

A company that pays no dividends is always a poor investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about stock options is false?

A) Stock options are intended to give upper management the same goals as stockholders.

B) When stock options are exercised by upper management,existing stockholders lose voting power.

C) Stock options may create an incentive for upper management to overstate net income.

D) An expense is reported by the company when stock options are exercised.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 146

Related Exams