A) Debt to assets is usually greater than debt to equity.

B) Debt to assets is usually less than debt to equity

C) Debt to assets is usually equal to debt to equity.

D) There is no constant relationship between these two ratios.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has $72,500 of inventory at the beginning of the year and $65,500 at the end of the year.Sales revenue is $986,400,cost of goods sold is $572,700,and net income is $124,200 for the year.The inventory turnover ratio is closest to:

A) 1.8.

B) 8.3.

C) 6.0.

D) 14.3.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Trend analysis is a form of horizontal analysis.Horizontal analysis is a comparison of the trends in a company's financial information over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wanted to examine a company's long-run ability to survive,which of the following would best be considered?

A) Liquidity.

B) Market share.

C) Profitability.

D) Solvency.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the P/E ratio is not true?

A) The P/E ratio indicates how much investors are willing to pay for a share of a company's stock as a multiple of current earnings.

B) A high P/E ratio may mean that investors have pushed the price of the stock up in anticipation of higher future net income.

C) If EPS decreases and there is no change in the market price of the stock,the P/E ratio will decrease.

D) If the market price of the stock increases and there is no change in EPS,the P/E ratio will increase.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The gross profit percentage is closest to:

A) 32%.

B) 56%.

C) 86%.

D) 14%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Debt-to-assets ratio.

B) Fixed asset turnover ratio.

C) Receivables turnover ratio.

D) Current ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The asset turnover ratio is a profitability ratio.The asset turnover ratio is a profitability ratio that indicates the amount of sales revenue generated for each dollar invested in assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

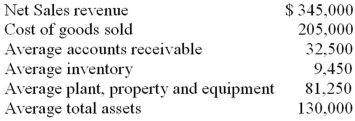

The following information is available for a company for the current year: Which of the following is closest to the company's days to collect ratio for the current year?

A) 91.25

B) 84.88

C) 57.84

D) 34.37

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary objective of external financial reporting is:

A) to enhance the ability of the company to acquire financial capital from external sources.

B) to accurately provide financial results for tax purposes.

C) to comply with external regulations and requirements of government and professional associations.

D) to provide useful information to decision makers,especially investors and creditors.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the liquidity of a company?

A) Return on equity.

B) Fixed asset turnover ratio.

C) Receivables turnover ratio.

D) Times interest earned ratio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency ratio data are primarily concerned with the ability of a company to:

A) produce profits.

B) handle its debt.

C) manage its cash flow.

D) provide income for stockholders.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The net profit margin is closest to:

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Common size financial statements are not useful in analyzing companies of different size.Common size analysis provides information by expressing each financial statement amount as a percent of another amount on the same statement.These percentages allow for the comparison of financial statement items between companies of different size.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is generally the most useful in analyzing companies of different size?

A) Comparative financial statements.

B) Horizontal analysis.

C) Common size financial statements.

D) Trend analysis.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net sales by average accounts receivable?

A) Days to sell ratio.

B) Current ratio.

C) Profit margin.

D) Accounts receivable turnover ratio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating its net profit margin for 2015,Coca Cola would most likely use all of the following benchmarks except:

A) Anheuser Busch's net profit margin for 2015.

B) Coca Cola's net profit margin for 2014.

C) Pepsico's net profit margin for 2015.

D) The average net profit margin for the soft drink manufacturing industry for 2015.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the percentage of financing from creditors is the:

A) Current ratio.

B) Times interest earned ratio.

C) Debt to assets ratio.

D) Price/earnings ratio.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If EPS (earnings per share)decreases,it must mean that the company's net income has fallen.A decrease in EPS could result from a decrease in net income,an increase in the average number of shares outstanding,or an increase in the average shares proportionally larger than an increase in net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

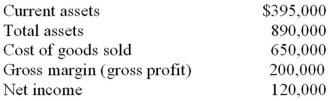

The following information is taken from the financial statements of a company for the current year: Use the information above to answer the following question.The gross profit percentage for the current year rounded to the nearest whole percent is closest to

A) 24%.

B) 76%.

C) 60%.

D) 31%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 110

Related Exams